Livestock conditions

The USDA (PDF, 100KB) reports that the live-weight average steer price is up 8.8 percent over last year at $159.18 per hundredweight. Estimated year-to-date cattle slaughter dropped 7.5 percent over this time last year, with an estimated 8.7 million head.

Weather

Agriculture’s Natural Resources Conservation Service (NRCS) released the April 2015 snowpack report (PDF, 1.2MB), which reveals precipitation well below normal over most of the West, with the exception of some higher elevations in the Rocky Mountains and coastal Alaska. As of April 1, 76 percent of Oregon’s long-term snow monitoring sites were at the lowest snowpack levels on record. The report states snowmelt began early this year throughout the West. Streamflow forecasts remain moderately to extremely low for most of the West.

The national drought monitor report shows that although widespread rain fell across the eastern half of the U.S. in April, significant rain was mainly confined to the Atlantic Coast states and mid-South. Dry, cold weather persisted across the northern Plains and far Upper Midwest, limiting planting. While parts of the West received rain and snow showers, the moisture arrived too late in the year to alter bleak expectations for spring and summer runoff. The drought monitor map for the western states still shows large swaths of exceptional, extreme, severe or moderate drought, extending into Oklahoma, Texas and southern Nebraska.

Fertilizer

The price for DAP declined by 6 percent, and urea declined by 11 percent since February.

Exports

Hapag-Lloyd, the second-largest container carrier to Portland, Oregon, has stopped scheduling trips to the Port of Portland, as reported by Molly Harbarger in The Oregonian. Hapag-Lloyd is a German company that connects shipping trade with European customers. Hapag-Lloyd was reported to have carried 20 percent of Portland’s container business, but also 90 percent of the Port of Lewiston’s container business upriver in Idaho.

In February, Hanjin Shipping Co. also pulled shipping services to Port of Portland. At the time of that pullout, Hanjin was supplying nearly 80 percent of that port’s container business. Exporters who used the Port of Portland are now scrambling to send containers by truck and rail south to California ports or north to the Puget Sound, which will increase demand for container shipping at those ports, which may drive up shipping costs for exporters.

Longstanding disputes between port operators and the International Longshore and Warehouse Union has crippled exports for the past several months. While an agreement was finally reached, the slowdown at the docks has prevented exporters from meeting buyer demand in the international marketplace. The impact is expected to be felt for many months yet as a backlog of containers awaits clearing.

The USDA Foreign Agricultural Service reported hay exports totals in January and February 2015 fell by $12,606,000 over exports for the same period in 2014. The top three countries receiving U.S. hay exports went to Japan, South Korea and China, respectively, with United Arab Emirates and Taiwan pulling distant fourth and fifth spots.

Industry news

On April 28, 2015, the Federal Register published a proposed rule clarifying the manner in which producers can transition dairy animals into organic milk production. The rule is intended to level the playing field and promote consumer confidence in organically labeled products. Producers, consumers and stakeholders can submit written comments until July 27, 2015, by visiting www.regulations.gov.

Dairy market

The National Milk Producers Federation reports the federal order class prices for March indicate that the steep slide in milk prices during the last quarter of 2014 and early 2015 may have come to an end. The USDA has announced that the two-month average margin under the Margin Protection Program for Dairy during January and February was $7.99554 per hundredweight. U.S. dairy exports will likely remain below year-ago levels until the second half of 2015; however, moderate increases in U.S. milk production, coupled with domestic consumption growth, are counterbalancing declining exports, keeping domestic markets relatively balanced.

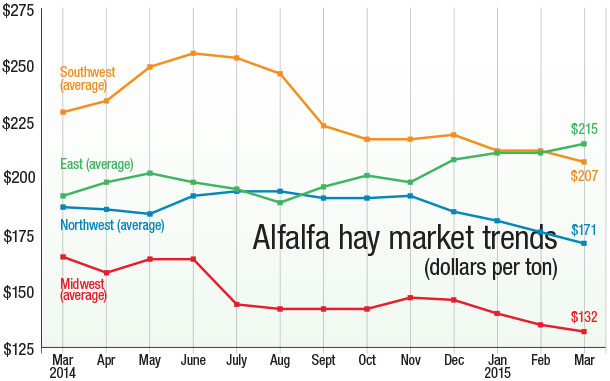

Charting hay market trends

Hay markets vary widely by region and by product: alfalfa hay versus “other hay.” This chart reflects monthly alfalfa hay market prices and information since March 2014, based on NASS data. FG

View a similar chart for "other hay."

References omitted but are available upon request. Click here to email an editor.