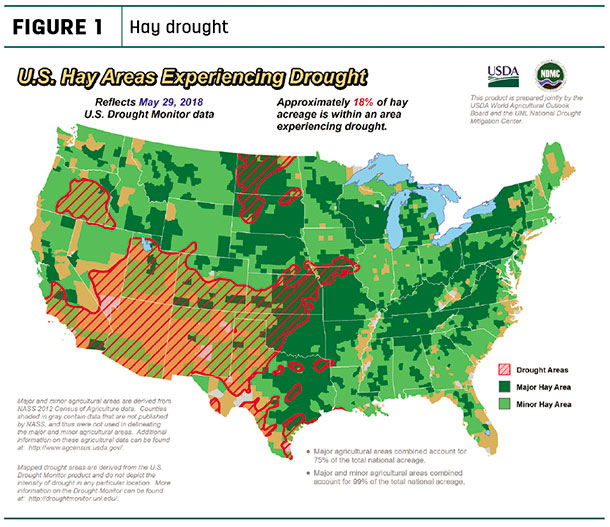

Drought areas mostly concentrated in the Southwest

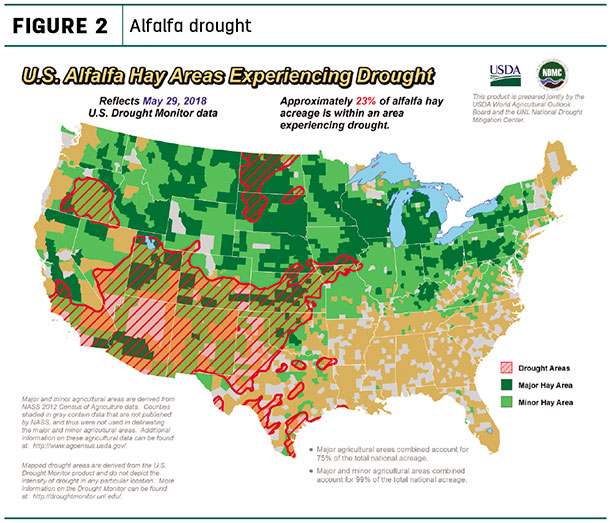

The percentage of U.S. hay acreage located in areas experiencing drought improved again from last month, but the same was not true for alfalfa hay.

The USDA’s World Agricultural Outlook Board estimated 23 percent of U.S. hay-producing acreage was located in areas experiencing drought as of May 29 (Figure 1), a 5 percent improvement from May 1. In contrast, about 23 percent of alfalfa hay acreage remained under drought conditions to end May, just 1 percent better than when the month started (Figure 2).

Drought areas stretch from southern Iowa and northwest Missouri into southeast Nebraska, Kansas, central Oklahoma, western Texas, Colorado, New Mexico, Arizona, Utah and California in the Southwest, with Oregon and western North Dakota and South Dakota still under dry conditions. Heavy rain associated with Subtropical Storm Alberto doused previously dry areas in the Southeast. Check out the hay areas under drought conditions by clicking here.

As of June 3, about 50 percent of U.S. pasture and range conditions were rated good to excellent, with 18 percent rated poor or very poor. As in the drought map, poorest quality pasture and range conditions were in Arizona, Colorado, New Mexico and Texas.

Hay prices

The latest available USDA monthly Ag Prices report summarized April 2018 prices.

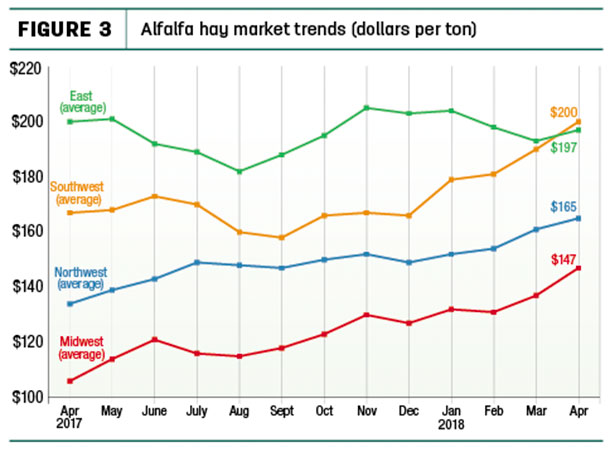

Alfalfa

With sharp increases in a few major states, the April 2018 U.S. average alfalfa hay price pushed to $183 per ton, its highest level since May 2015. As of April, alfalfa prices had topped $200 per ton in seven states. April’s average price was up $17 from March and $33 more than April 2017. Average prices were up across all regions (Figure 3).

Compared to a month earlier, April average alfalfa hay prices jumped $40 per ton in Michigan, $38 in Oklahoma, $30 in Wisconsin and $26 in Minnesota. Only a handful of states (Illinois, Missouri, Nebraska, Nevada, Pennsylvania and South Dakota) posted small declines compared to March.

Compared to a year earlier, alfalfa prices were up $25 per ton or more in 18 of 27 major hay states. Largest year-over-year increases were in Minnesota ($80 per ton), Wisconsin ($72 per ton), Oklahoma ($63 per ton) and Michigan ($60 per ton). Only Missouri, New York and Pennsylvania posted declines from the year before, with New York’s average down $50 per ton.

Other hay

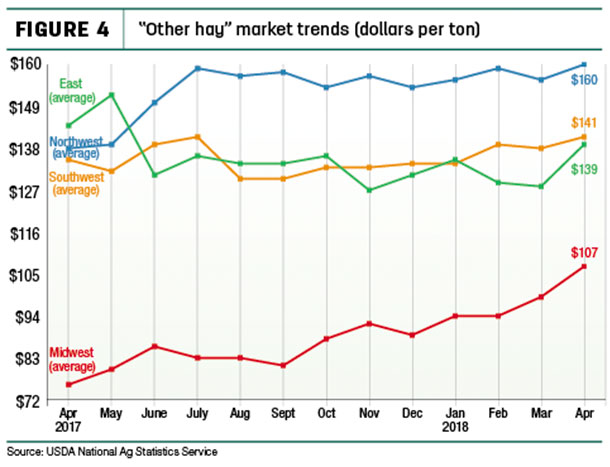

The market for other hay was less dynamic. The April 2018 U.S. average price for other hay was estimated at $124 per ton, up just $1 from March, and $7 less than April 2017.

Despite the smoothing impact of averaging across the U.S., prices were higher across all four regions analyzed by Progressive Forage (Figure 4).

Among individual states, Ohio, Michigan, Wisconsin and Minnesota saw the largest price increases from March, up $25 to $35 per ton. Just four states (Oklahoma, North Dakota, Nebraska and Illinois) saw small declines.

Price changes from a year earlier were more notable. April 2018 prices for other hay were up $40 to $71 per ton in seven states, led by Minnesota. In contrast, the average price for other hay declined $73 per ton in New York.

Deviating from the U.S. average, highest other hay prices were in Arizona, Colorado and Washington (each $190 or more per ton). Lowest prices were in Nebraska and North Dakota ($74 and $75 per ton, respectively).

Figures and charts

The prices and information in Figure 3 (alfalfa hay market trends) and Figure 4 (“other hay” market trends) are provided by NASS and reflect general price trends and movements. Hay quality, however, was not provided in the NASS reports. For purposes of this report, states that provided data to NASS were divided into the following regions:

- Southwest – Arizona, California, Nevada, New Mexico, Oklahoma, Texas

- East – Kentucky, New York, Ohio, Pennsylvania

- Northwest – Colorado, Idaho, Montana, Oregon, Utah, Washington, Wyoming

- Midwest – Illinois, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, South Dakota, Wisconsin

Organic hay

The USDA’s bimonthly National Organic Grain and Feedstuffs report did not list any prices for organic hay.

Regional auction and market summaries

Here’s a peek at early June auction market conditions and summaries:

• East: Some mid-Atlantic market participants report wet weather conditions have had an effect on crops and there are some dairy producers concerned about the feed quality.

Alabama hay prices were fully steady, with moderate supply and demand.

In Pennsylvania’s Lancaster area, market information on alfalfa and alfalfa-grass blended hays was limited on a light test. Grass hay sold steady to firm; straw sold $10 to $20 higher. At New Holland, Pennsylvania, alfalfa sold with a steady undertone on a very light test; grass and alfalfa-grass mixed hay sold mostly steady to $10 higher.

• Southwest: All classes of California hay traded steady with good demand. Retail hay was in high demand due to lack of hay in barns this year.

Oklahoma alfalfa trade was moderate to active, with demand very good early, moderate to good late. First cutting continues to progress, and both quality and yields have varied greatly. Overall quality has been mostly good. Western and northern Oklahoma received much needed rain that delayed haying but will benefit new growth.

In Texas, all hay classes traded fully steady on moderate to good demand. As new-crop hay trickled onto the market, buyers were eager to stock up as most of the state is still in need of rain. Coastal bermuda producers in the east have finished baling their first cutting but are in need of rain for another cutting. Producers expect to see an increase in hay prices if rain does not come.

In New Mexico, alfalfa hay prices were steady and demand was good. Southern and southwestern areas are 30 to 50 percent into second cuttings; the southeastern region is 10 to 30 percent into its second cutting. First-crop harvest was just getting underway in Utah. Prices were mostly firm, with trading slow. Lower quality hay demand is light with good supplies.

• Northwest: In Idaho, hay trade was slow with good demand, especially for export and stable hay going to Eastern interests. Rain continued to plague the area, providing large supplies of rain-damaged hay.

In Oregon, prices trended generally steady in an extremely limited test. Retail/stable type hay remains the most demanded hay. Most hay producers are sold out for the growing year. In the Washington-Oregon Columbia Basin, new-crop export and dairy alfalfa hay sold steady; demand was very good.

In Wyoming, growers were gearing up to start cutting hay. Some areas reported heavy infestations of weevils and aphids. In Montana, prices were generally steady. New hay sales are very limited. Ranchers were still moving cattle to summer pasture and range, and producers were busy with planting season. Demand remains light on light supplies. New-crop contracts are starting to show up. Hay fields across the state continue to look good. It was getting close to first cutting in many eastern locations.

In Colorado, trade activity was light on moderate demand. Plains growers were starting to put up first-cutting alfalfa. The Colorado USDA National Ag Statistics office said stored feed supplies were rated 8 percent very short, 19 percent short, 71 percent adequate and 2 percent surplus.

• Midwest: In Iowa, both hay and straw offerings were scarce. Small square bales were noticeably absent. Prices remained steady for both top- and bottom-quality hay, but were uneven for the middle-quality hay. First-cutting alfalfa, which had been delayed more than two weeks behind normal, was successfully baled across most of Iowa. However, the northeast quadrant of the state continued to receive excess rain, pushing hay producers to wait even longer. Most of the first crop was baled as large rounds due to the wet crop and wet ground.

In Missouri, producers were making good progress on hay harvest. In stark contrast to April, which in many areas was recorded as the coolest on record, May will be recorded as the hottest on record. Rains continue to be spotty; northwest Missouri remains the area most in need of moisture. Farmers cutting grass hay have reported lower-than-average yields. Hay supplies are light to moderate; demand is moderate and prices are steady.

Across Kansas, cutting of new-crop alfalfa was underway, and with that the hay market saw more trade activity in the past week than it has seen in the last several months. Prices for all hay types were mostly steady. Southern Kansas saw another week with moderate to locally heavy showers, leading to widespread reductions of drought intensity and coverage. North central Kansas also saw some heavy rains that yielded a corresponding reduction of the abnormally dry category.

In Nebraska, old-crop alfalfa, grass hay and dehydrated pellets and ground hay sold steady. Many producers were just starting on the first cutting of alfalfa, and sales on big square bales of new-crop alfalfa were limited, as both buyers and sellers seek to establish a price point.

In South Dakota, very few sales were reported as many farmers and brokers are sold out until the new crop is harvested. Rain has helped reduce drought concerns in some areas.

In southwest Minnesota, little dairy-quality hay was available; prices were steady.

In Wisconsin, prime hay sold for a premium price. Warm weather allowed the alfalfa crop to advance, and first cutting was underway.

Other factors

Other factors impacting forage producers as we move into June include:

• Exports: U.S. hay exports were mostly steady in April. Alfalfa hay shipments totaled 211,855 metric tons (MT), the third-highest monthly volume since June 2017. The month’s exports were valued at $63.4 million. China’s total of 96,027 MT was the highest of the year.

Sales of other hay totaled 107,853 MT in April, an 11,500 MT decline from March. Those shipments were valued at $35.3 million. Sales to Japan, South Korea, Taiwan and Canada were all down from March; the only increase among major customers was to the United Arab Emirates.

Foreign sales of alfalfa cubes and meal were mixed to mostly lower.

With first cutting underway in the Pacific Northwest, foreign customers are arriving to view the quality of the new crop and compare it to hay in the Pacific Southwest, according to Christy Mastin, international sales manager at Eckenberg Farms of Mattawa, Washington. Less-than-excellent weather during harvest has many customers looking for the higher testing hay. Price negotiations will be heavily dependent on quality.

USDA’s Foreign Ag Service lumps hay under “feeds and fodders” for export purposes. Based on the latest outlook report, exports in that category were raised to $7.6 billion for fiscal year 2018, about $422 million more than fiscal year 2017. Higher prices will offset a small decline in volume.

• Dairy outlook: With alfalfa hay, corn and soybean meal prices all moving higher, U.S. dairy farmers saw April 2018 income-over-feed-cost margins shrink further, hitting a 22-month low. Total feed costs hit a 40-month high. The good news is that the federal Margin Protection Program for Dairy (MPP-Dairy) payments, retroactive to February, should arrive in dairy farmer mailboxes by mid-June.

The negative economic conditions are impacting milk production. At just 0.6 percent, April 2018 U.S. milk production posted its smallest year-over-year increase dating back to January 2015-16. The USDA estimated April 2018 U.S. cow numbers at 9.4 million head, down 2,000 head from March and 8,000 fewer than February. Producers in nine states had fewer cows than a year earlier, led by California (-19,000 head) and Minnesota, Ohio and Wisconsin (each -5,000 head).

• Beef outlook: May 1 cattle feedlot inventories were up 5 percent compared to a year earlier, the second-highest inventory for that date since the USDA began tracking inventories in 1996. However, April 2018 placements into feedlots were down 8 percent compared to April 2017. The USDA lowered its 2018 beef production forecast, but left price projections unchanged. Cattle slaughter in the second quarter was slower than anticipated, and the pace of marketings in the second half of the year is also expected to be slower. However, carcass weights are expected to increase in the second half of the year, partly offsetting the reduction in the slaughter forecast. Highest cattle prices for the year are already behind us.

• Fuel prices: The U.S. average regular gasoline retail price increased 4 cents to $2.96 per gallon on May 28, up 56 cents from the same time last year. The U.S. Energy Information Administration (EIA) forecasts U.S. regular gasoline retail prices to average $2.90 per gallon for the 2018 April-September period, up from an average of $2.41 per gallon last summer. The higher forecast gasoline prices are primarily the result of higher forecast crude oil prices. Monthly average gasoline prices are forecast to reach a summer peak of $2.97 per gallon in June, before falling to $2.86 per gallon in September.

The U.S. average diesel fuel price increased a penny to $3.29 per gallon on May 28, 72 cents higher than a year ago.

• Interest rates: Quarterly Federal Reserve district reports were released, and first-quarter 2018 interest rates on variable- and fixed-rate loans were higher. In most cases, average interest rates on all loan types were the highest since mid-2011 to early 2012.

Coming up

Will the higher hay prices affect 2018 acreage totals? With spring planting delays and some growers needing to reseed, we’ll get an estimate of potential hay acreage for 2018 when the USDA releases its annual Crop Acreage report on June 29. ![]()

-

Dave Natzke

- Editor

- Progressive Forage

- Email Dave Natzke