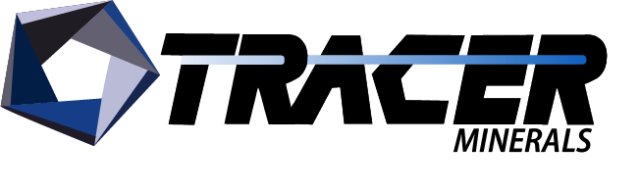

The USDA’s World Agricultural Outlook Board reported little change in hay production areas under drought conditions. About 28 percent of U.S. hay-producing acreage was located in areas experiencing drought as of Sept. 4, a 1 percent decline from a month earlier (Figure 1).

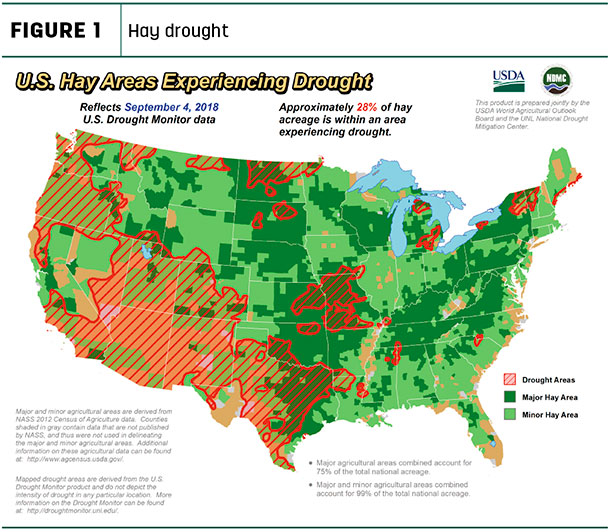

In contrast, about 24 percent of alfalfa hay acreage was in the same condition (Figure 2), up 2 percent. Conditions improved in Kansas but worsened in parts of Oregon, Washington, and North Dakota and South Dakota.

Local hay market reports provided a wide range of conditions in major hay-growing areas of the country as of early September.

Midwest

In eastern and central Kansas, moisture conditions improved enough to add hope for extending the hay harvest. Western Kansas continued to struggle getting hay put up due to high moisture and humid conditions.

This year continues to be tough on growers in Iowa, as portions of the state have recorded record heat while other sections have seen record rainfall. Hay prices continued to drift lower as hay quality decreased. Both goat and cow dairies are looking out of state for the quality of hay they need.

Moisture conditions across Nebraska varied widely. Some areas of the southeast continued to be very dry, with the central, northeast and west regions above normal on precipitation. Alfalfa hay producers were struggling as high humidity, low sunshine and very little wind slowed hay drydown.

Hay without rain damage was in short supply. Top-of-the-line dairy-quality hay was being brought in from out of state.

A large supply of lower-quality alfalfa and grass hay remained readily available in South Dakota; supplies of high-quality alfalfa and grass were more limited. High dew points and rain prevented fourth-cutting alfalfa hay from drying down.

Drought conditions showed slight improvement in Missouri, with heavy rains falling in many areas over the last few days of August. With about six weeks until average first frost dates, many farmers were more optimistic concerning fall pasture.

That optimism resulted in at least a temporary decrease in the number of calls to the state’s hay directory in search of hay. Some corn silage was being chopped as yields were too low to be harvested for grain.

Drenching rains in the Upper Midwest, with new record 24-hour rainfalls in Wisconsin, sparked widespread flooding, slowing fourth cutting and supporting prices for all classes of hay at local auctions.

Northwest

Montana’s third cutting was in full swing across much of the eastern half of the state, but rain in many locations made it difficult to put up high-quality hay. Many producers were busy with harvest and didn’t have time to market hay. Demand for wheat and barley straw was mostly moderate as ranchers sought bedding for calving season.

In Oregon, demand for export hay had increased, but rains created a large supply of rain-damaged hay. In Washington, dissipating smoke from wildfires improved the outlook for fourth-cutting alfalfa.

Colorado’s haying season entered its final stretch with fourth cutting of alfalfa. Meadow hay producers in drought-stricken areas reported yields are averaging 20 percent or less of what they produced last year. These factors have driven the above-normal hay prices for the retail/stable markets and increased prices to a lesser extent in dairy and feedlot markets.

Isolated thunderstorms improved drought conditions in some spots, but stored feed supplies were rated 25 percent short or very short, 71 percent adequate and 4 percent surplus. End users have been forced to use alternative feedstuffs this year, increasing demand for oat hay, wheat hay and rye hay and grasses off Conservation Reserve Program acreage.

Southwest

The eastern region of New Mexico was beginning fourth cutting of alfalfa; southern and southwestern areas were between fourth and fifth cuttings.

In Oklahoma, alfalfa supplies and offerings were lighter, even though third cutting was wrapping up and fourth cutting was well underway. Grass hay baling activities also remained active in central and eastern counties.

Hay delivered into the Texas Panhandle sold steady to $10 lower; coastal bermuda in north and eastern Texas traded steady. Most hay has been contracted and buyers were busy hauling purchased hay, preparing for winter months.

Hay prices moderate

The latest available USDA monthly Ag Prices report summarized July 2018 prices.

Alfalfa

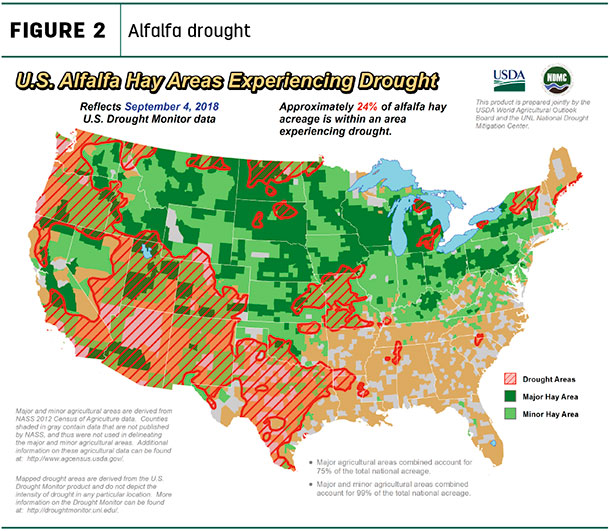

National average alfalfa hay prices continued to decline from the May peak. At $179 per ton, the July 2018 U.S. average price was down $2 from June and $10 from May but still $26 more than July 2017. Regionally, prices declined in the Southwest and Midwest, were steady in the Northwest and rose in the East (Figure 3).

Compared to a month earlier, July average alfalfa hay prices rose $27 per ton in New York and between $10 and $15 per ton in Michigan, Pennsylvania and Colorado. Prices declined $17 to $24 per ton in North Dakota, Wisconsin, Nebraska and Texas.

Compared to a month earlier, July average alfalfa hay prices rose $27 per ton in New York and between $10 and $15 per ton in Michigan, Pennsylvania and Colorado. Prices declined $17 to $24 per ton in North Dakota, Wisconsin, Nebraska and Texas.

Highest average alfalfa hay prices topped $240 in New Mexico and $210 to $220 in Colorado, Kentucky and Arizona. The low prices for the month, under $100 per ton, could be found in South Dakota, North Dakota and Nebraska.

Other hay

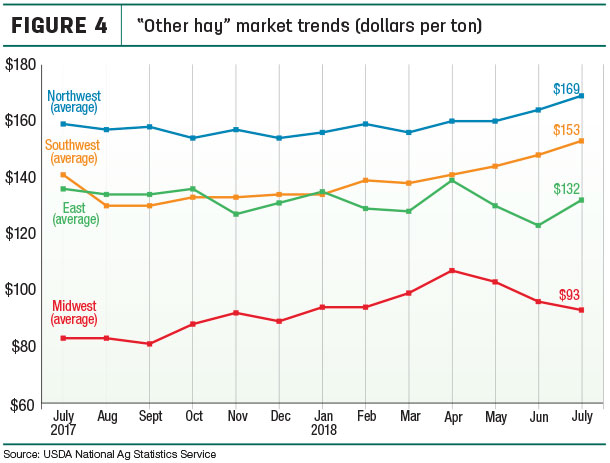

The U.S. average price for other hay was estimated at $126 per ton, up $5 from June and the highest since May 2017. Regionally, July 2018 average prices dipped lower in the Midwest but were higher elsewhere (Figure 4).

Among individual states, New York and Nevada saw the largest price increases from June, up $28 and $20 per ton, respectively. Small price declines ($4 to $8 per ton) were in Indiana, Iowa, Minnesota, North Dakota, Virginia and Washington and Minnesota.

Compared to a year earlier, prices were $35 to $40 higher in Colorado and Kentucky; biggest decliners were New York (-$37) and Washington (-$25).

Highest average prices for other hay hit $200 or more per ton in Washington, Arizona and Colorado. Nebraska and North Dakota saw monthly lows of $67 and $70 per ton, respectively.

Figures and charts

The prices and information in Figure 3 (alfalfa hay market trends) and Figure 4 (“other hay” market trends) are provided by NASS and reflect general price trends and movements. Hay quality, however, was not provided in the NASS reports. For purposes of this report, states that provided data to NASS were divided into the following regions:

- Southwest – Arizona, California, Nevada, New Mexico, Oklahoma, Texas

- East – Kentucky, New York, Ohio, Pennsylvania, Tennessee, Virginia

- Northwest – Colorado, Idaho, Montana, Oregon, Utah, Washington, Wyoming

- Midwest – Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, South Dakota, Wisconsin

Organic hay

According to the USDA’s organic hay report, FOB farm gate organic hay prices at the end of August were as follows: Supreme alfalfa small square bales – $250 per ton; Premium-Supreme alfalfa large square bales – $220 per ton; Good alfalfa small square bales – $200 per ton; Good alfalfa-grass mix small square bales – $205 per ton; and Premium orchardgrass large square bales – $190 per ton.

Hay exports down slightly

The USDA’s monthly report showed U.S. hay exports were down only slightly in July. Despite the elevation in tensions over tariffs, hay sales to China have not completely evaporated, although many transactions completed during July were likely booked before higher tariffs were imposed.

Alfalfa hay shipments totaled 225,567 metric tons (MT), the third-highest monthly total in more than a year and the fifth straight month export volumes topped 200,000 MT. Based on year-to-date totals, 2018 remains on track to be the second-highest year ever for alfalfa hay exports. The month’s exports were valued at $69 million.

China’s July total of 78,259 MT was the lowest since January and down about 18,000 MT from April’s peak of 96,027 MT.

Depending on trade negotiations, things could get worse. Christy Mastin with Eckenberg Farms Inc., Mattawa, Washington, said she’s heard from her customers Spanish hay is now arriving in Chinese ports.

There’s growing interest in shipping hay to Taiwan in an effort to circumvent the Chinese tariffs on U.S. hay, she added.

Elsewhere, Japan’s purchases of alfalfa hay remained strong in July at 51,441 MT. A downturn in shipments to Saudi Arabia was offset by an increase in sales to the United Arab Emirates.

Sales of other hay totaled 109,843 MT in July, steady with 2018 monthly trends. Those shipments were valued at $36 million. Year-to-date exports of other hay are on pace to yield the lowest total in well over a decade.

The domestic harvest was very wet for most parts of Japan and South Korea, but U.S. shipments there declined somewhat. Those declines were partially offset by increased shipments to Taiwan and China. Japanese buyers are struggling with acceptance of higher prices for U.S. timothy.

Export sales of dehydrated alfalfa meal and cubes were mixed.

Dairy remains weak

The dairy situation remained bleak, with July milk income over feed costs margins returning to the low levels seen earlier in the year. The good news is: Milk prices have likely bottomed out, and corn and soybean meal prices moved lower in concert with alfalfa hay to reduce feed costs.

The sour economics may be impacting the U.S. dairy herd. July U.S. dairy cow numbers dipped below 9.4 million for the first time since last November. Among the 23 major dairy states, 13 states had fewer cows than a year earlier, led by California, Minnesota, Pennsylvania and Ohio.

The USDA stepped in to provide some support, although many in dairy were disappointed. Most U.S. dairy farmers suffering economic losses from the ongoing tariff wars will receive about 12 cents per hundredweight on half of their annual production. A 500-cow dairy herd averaging 22,000 pounds of milk per cow per year would see a payment of about $6,600.

Also under the tariff mitigation program, the USDA said it would spend $84.9 million on dairy products for federal feeding programs and, in a separate announcement, said it would purchase $50 million in fluid milk – estimated at between 12 million and 15 million gallons – by early next year.

Other market factors

- Beef outlook: Federally inspected beef cow slaughter was estimated at 258,000 head in July, 3,500 head less than June but 38,200 more than July 2017, according to the USDA Livestock Slaughter report, released Aug. 23. Through the first seven months of 2018, beef cow culling totaled 1.75 million head, about 187,000 head more than the same period a year ago.

Dry conditions and cheaper corn are pushing more feeder cattle off pasture and into feedlots earlier and at lighter weights. July 2018 placements were 8 percent more than a year earlier, with August inventories now up about 5 percent from a year ago.

-

Fuel prices: At $2.82 per gallon, the national average regular gasoline retail price started September nearly 15 cents higher than a year earlier; the average was 30 to 40 cents higher west of the Rocky Mountains. At $3.25 per gallon, the U.S. average diesel fuel price was up almost 50 cents – and 54 to 82 cents higher west of the Rockies – compared to a year ago.

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke