The report, released during the first week of September, shows that monthly exports of “other hay” totaled 101,138 metric tons (MT). Not only is that the lowest monthly volume of the year, but it’s one of the lowest totals for any month in the 21st century.

Prior to July, monthly exports of other hay have been below 102,000 MT only seven times dating back to January 2000, a period of 235 months. (If you’re curious, those times were January 2001, October 2002, June-August 2004 and July-August 2007.) July 2020 sales to three of the leading markets – Japan, South Korea and the United Arab Emirates – were at or near lows for the year.

Christy Mastin, sales representative with Eckenberg Farms in Mattawa, Washington, said the low export volumes are due to several factors.

First, the overall acreage harvested of other hay (primarily timothy) dropped in 2019. Compared to a year earlier, acreage harvested in her home state alone was down 100,000 acres. Less production meant higher prices for other hay in 2019, and that has carried over into 2020.

Other hay has competition from Chinese rice straw and, most directly, Australian oaten hay, which had a good harvest last year, so prices for those alternatives are more appealing.

“The ‘other hay’ will continue to struggle if pricing stays strong,” Mastin said. “If there is some decrease of pricing, then purchases may increase.”

Meanwhile, at 226,625 MT, July exports of alfalfa hay were down about 64,000 MT from April’s peak and the lowest volume since February.

China remained the biggest alfalfa customer, purchasing 103,240 MT in July, about 66% of all alfalfa hay exports for the month. Elsewhere, increased sales to Saudi Arabia and the United Arab Emirates were offset by declines to Japan, South Korea and Taiwan. Sales to Japan were the lowest since January 2018, while sales to South Korea were the lowest since August 2018.

The overall softening of all hay exports is related to reoccurring themes:

- Heavy purchases of the 2019 hay crop earlier this year have left potential buyers with adequate inventories.

- With COVID-19 travel restrictions, there have been fewer marketing trips to check out new hay offerings. There’s less buyer confidence when they can’t see, feel and smell what they’re buying.

- Related in part to COVID-19, ocean vessel delays remain a problem. Having worked through many of the cancelled export shipments earlier this year due to lack of incoming ships, there are now reports that some crew members are testing positive for the coronavirus, placing crews (and vessels) in quarantine.

Due to those factors, look for August hay export numbers to be similar to July’s.

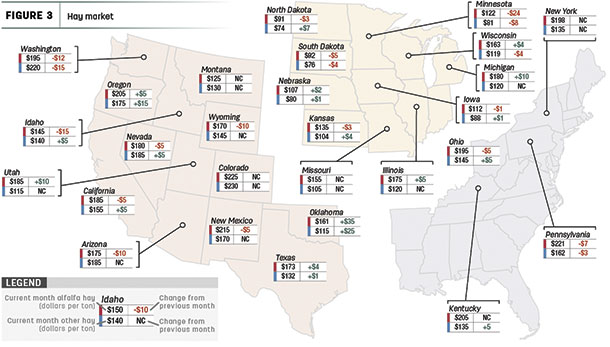

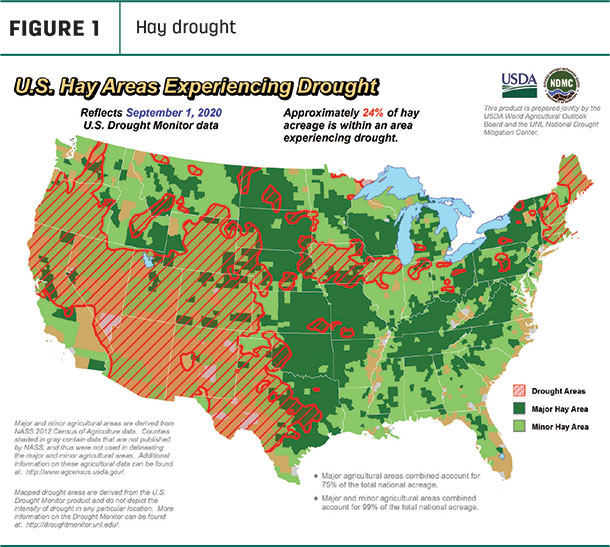

Drought areas grow

Early September weather maps showed hay-producing areas impacted by drought continued to spread in the West, parts of the Midwest and New England. About 24% of U.S. hay-producing acreage (Figure 1) was considered under drought conditions as of Sept. 1, a 5% increase from the first week in August. At 35%, alfalfa-producing areas affected by drought increased 6% over the same period (Figure 2).

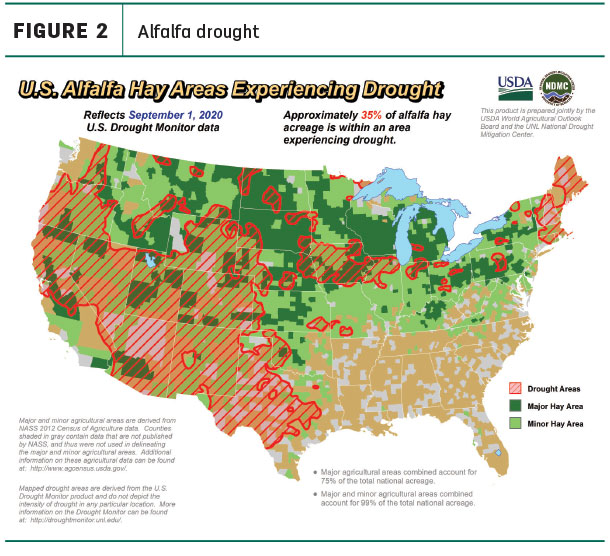

Hay prices mapped

The USDA’s Ag Prices report indicates the national average price for all alfalfa hay fell to a six-month low in July – at $174 per ton, it was down $5 from June. The U.S. average for other hay jumped $9 per ton – at $137 per ton, it equaled a 12-month high set last November.

The price data for 27 major hay-producing states is mapped in Figure 3, illustrating the most recent monthly average price and one-month change. The lag in USDA price reports and price averaging across several quality grades of hay may not always capture current markets, so check individual market reports elsewhere in Progressive Forage.

Click here or on the map above to view it at full size in a new window.

Alfalfa

Among the 27 states reporting alfalfa prices, just eight saw price increases in July. Biggest changes from the previous month were in Oklahoma (+$35 per ton) and Minnesota (-$24 per ton). Prices averaged more than $200 per ton in Colorado, Pennsylvania, New Mexico, Oregon and Kentucky, but less than $100 per ton in North and South Dakota.

Other hay

Month-to-month price trends for other hay were almost opposite those of alfalfa hay: July prices increased in a dozen states and declined in only five.

As with alfalfa hay, however, the list of states seeing the largest price increases included Oklahoma and Oregon, while states exhibiting the largest decreases included Washington and Minnesota. July prices averaged $175 per ton or more in five states, led by Colorado, and less than $100 per ton in five states, led by North Dakota and South Dakota.

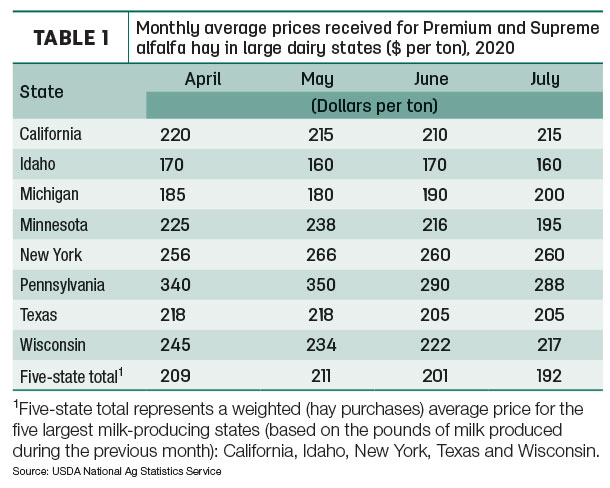

Dairy hay

The average price for Premium and Supreme alfalfa hay in the top milk-producing states averaged $192 per ton in July, down $9 from June (Table 1) and the lowest since the USDA began compiling “dairy hay” price data to start 2019.

Organic hay

In the USDA’s organic hay price report, FOB farm gate prices for the two-week period ending Aug. 26 were as follows: Premium alfalfa in large squares sold in a range of $200-$250 per ton, with the average at the low end of the scale, and Premium-Supreme and Good large squares all averaged $200 per ton.

Regional markets

Here’s a regional summary of conditions and markets during the first week of September:

-

Midwest: In Missouri, September brought some much-needed rain, but not much had changed as far as hay business goes. Supplies were heavy, and demand and movement were light.

In Iowa, quality of hay was a little better, but the market for alfalfa wasn’t. Markets for grass hay were steady to weaker; bedding was steady.

In Kansas, demand had picked up a bit, with an increase in inquiries both from within- and out-of-state buyers. Later cuttings provided better yields and quality.

In Nebraska, there were increased buyer inquiries seeking information on prices and availability, with best demand in the western part of the state.

In Michigan, producers who got rain reported good yields and quality for alfalfa and corn silage, whereas others saw little forage to cut.

In South Dakota, there was good demand for dairy-quality hay; best demand was from out of state. Dry weather allowed high-quality alfalfa hay to be made, but tonnage was reduced.

-

Southwest: Texas A&M AgriLife Extension Service experts reported below-average yields for most hay producers in eastern and central regions. Many hay producers missed out on multiple cuttings due to weather conditions or lower yields due to pasture conditions or pest infestations. As a result, hay demand had increased, firming up prices.

In California, hay prices were steady with a moderate demand. August ended with what might be one of the biggest invasions of alfalfa butterflies in years. While the adult butterflies feed on flowers and don't do damage, the larvae feed on the foliage, causing significant yield and quality losses.

In Oklahoma, trade was extremely slow. Heavy rains and cooler-than-average temperatures had producers preparing for a second cutting of bermudagrass. Alfalfa was getting cheaper as many dairies looked for alternative feedstuffs. Stock cow producers were hoping for an extended grazing season, leaving less need to stockpile hay.

In New Mexico, alfalfa hay prices were steady with demand good.

-

Northwest: In Wyoming, all reported hay sold fully steady. Most of the state remains dry, and pastures were getting short. Quite a lot of the hay has been staying within the state this year.

In Montana, hay movement was light, while demand continued to be moderate to good. Hay was being sold out of the state.

In Idaho, all grades of alfalfa, as well as timothy for export and for pellets, sold steady to firm.

In Colorado, there was moderate to good demand for feedlot and dairy hay, and good demand for stable and ranch hay.

In the Washington-Oregon Columbia Basin, there was a lack of test for domestic and export alfalfa. Second-cutting timothy was firm, with moderate demand. Exporters and dairies remain cautious. A fire at one area export facility was reported.

-

East: In Pennsylvania, reports were mixed. At New Holland, alfalfa and alfalfa blend hay sold steady to sharply higher. Large bales of grass hay sold in a tiered market, with orchard and timothy grass hays selling higher, but blends selling steady to lower.

In Alabama, early September hay prices were steady, with trade, supply and demand all moderate.

Other things we’re seeing

-

Dairy: Getting a clear picture of dairy’s economic situation is tricky. The lower alfalfa prices contributed to cheaper overall feed costs in July, while milk prices continued to improve. Combined with direct financial assistance payments under the Coronavirus Food Assistance Program (CFAP), some producers said it was the most gross income for a quarter that they had seen in quite some time.

However, as in June, the dynamics of negative producer price differentials and depooling within the Federal Milk Marketing Order system weighed on actual milk prices received by farmers in July.

The improved milk prices this summer were incentive for some producers to add cows and boost production in July, reversing a downtrend started in April. However, the prospect of more milk has put a dent in the price outlook.

-

Dave Natzke

- Editor

- Progressive Dairy

- Email Dave Natzke