Forage cropping plans for 2022 are moving from paper to application and Mother Nature will have a lot to say about how those intentions progress. Some things are clear:

- Last year’s hay output was substantially hampered by the Western drought: Eight states west of the Mississippi River (Idaho, Minnesota, Montana, North Dakota, Oregon, South Dakota, Washington and Wyoming) accounted for a 9.3 million ton decline in dry hay production compared to a year earlier.

- The decline in production resulted in U.S. growers ending 2021 with the third smallest on-farm hay inventories since 1977.

- The USDA estimated the area newly seeded to alfalfa in 2021 at 1.65 million acres, the lowest acreage since records started two decades ago.

Looking forward, it’s still too early to evaluate winterkill levels in many Northern states. High grain and cotton prices are adding competition for new-crop acreage. With the USDA 2022 Prospective Planting report, it’s anticipated growers will harvest the lowest total hay acreage in the past 115 years.

Read: 2022 hay acreage could be smallest since 1907.

Drought conditions linger

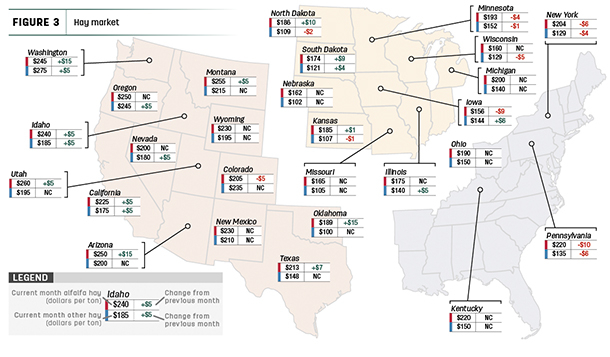

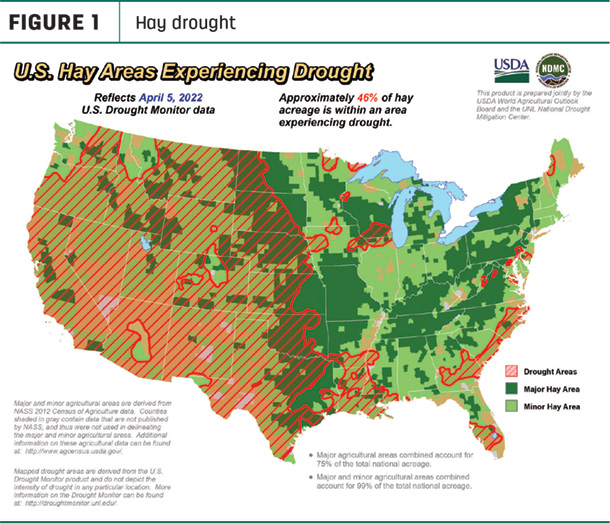

U.S. Drought Monitor maps indicate moisture conditions did not improve substantially in March. As of April 5, about 46% of U.S. hay-producing acreage (Figure 1) was considered under drought conditions, down 4% from a month earlier. The area of drought-impacted alfalfa acreage (Figure 2) decreased 3% to 63%. Most of the improvement was seen in Wisconsin.

Hay prices mostly higher

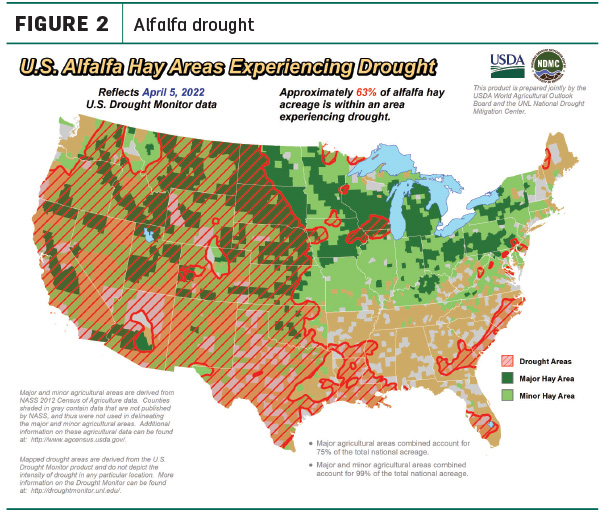

Price data for 27 major hay-producing states is mapped in Figure 3, illustrating the most recent monthly average price and one-month change. The lag in USDA price reports and price averaging across several quality grades of hay may not always capture current markets, so check individual market reports elsewhere in Progressive Forage.

Click here or on the map above to view it at full size in a new window.

Dairy hay

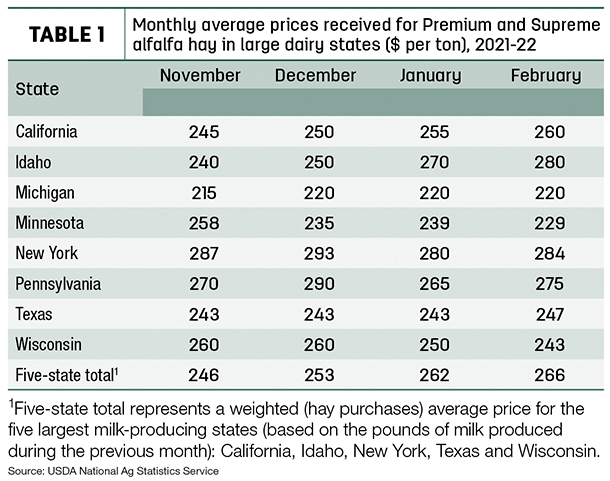

February’s average price for Premium and Supreme alfalfa hay in the top milk-producing states rose another $4 from January to $266 per ton (Table 1), up $55 per ton from a year ago. Largest month-to-month increases were in Idaho and Pennsylvania. Elsewhere, prices were up moderately in California, New York and Texas, steady in Michigan and lower in Minnesota and Wisconsin.

Alfalfa

The average price for all alfalfa hay increased $3 in February to $214 per ton. Prices increased in 11 of 27 major forage states, up $10-$15 in Arizona, Oklahoma, North Dakota and Washington. Average prices decreased in just five states, led by $9-$10 declines in Pennsylvania and Iowa.

Year-over-year price changes were again noteworthy in a couple of states: Montana alfalfa hay prices were up $120 per ton compared to February 2021, while Pennsylvania average prices were down $66 per ton.

Other hay

The U.S. average price for other hay rose $2 in February to $146 per ton, moving higher in eight of 27 major hay-producing states but declining in six others, led by Pennsylvania, New York and Wisconsin.

Year-over-year average prices for other hay were substantially higher in Northern tier and Western states, up $95 and $90 per ton in Washington and Montana, respectively, and $60-$68 In Utah, Oregon and Minnesota. Pennsylvania and New York led decliners, down $63 and $39 per ton, respectively.

Hay exports rebound somewhat

The outlook for U.S. hay exports is improving, although struggles with logistics remain and concerns over currency exchange rate are growing, according to Christy Mastin, sales representative with Eckenberg Farms, Mattawa, Washington. On the horizon, contract negotiations between the Pacific Maritime Association and the International Longshore and Warehouse Union are scheduled for May.

After slumping to a 12-month low in January, February exports of alfalfa hay hit a four-month high at 232,170 metric tons (MT). Most of the rebound was attributed to China and Japan, each up about 14,000 MT from the month before. Exports to China totaled 123,614 MT, a three-month high and represented about 54% of February’s total. At 62,768 MT, Japan was the second-leading market and represented 26% of the month’s total. Alfalfa hay exports were valued at about $399 per ton, up $19 from January.

At 116,897 MT, February exports of other hay also rebounded slightly. Sales to Japan were estimated at 72,139 MT, representing 62% of the U.S. total for the month. Sales to South Korea at 24,881 MT hit a four-month high and represented 21% of February sales. Other hay exports were valued at about $394 per ton, up $18 from January.

Exporters are learning how to work in a broken system that features empty containers and vessel schedule delays, Mastin said. Headwinds are being created by changing currency exchange rates, especially in Japan and South Korea, adding to already high U.S. prices. With local supplies limited, Japan has been turning to Australia and New Zealand in search of lower prices and more on-time delivery.

China’s exchange rate has been more stable and its appetite for alfalfa hay remains strong. Buyers have been seeking less expensive alfalfa from Spain and Canada, but quality and supplies are limited. U.S. timothy and hay cubes and/or pellets are making a slow entry into the Chinese market, Mastin said, but more education is needed to help feeders incorporate those products into livestock rations.

Regional markets

Here’s a snapshot of regional markets during the first week of April:

- Southwest: In Texas, moisture deficits were supporting prices, which were mostly firm in all regions.

In California, old-crop retail hay prices were higher, while new-crop prices were firm. Dairy and export prices were steady to $10 higher. Growers and brokers said alfalfa sold as fast as they could put it up.

- Northwest: In Montana, many ranchers were being forced to buy hay, but supplies were tight. Discussions of new-crop contracts reopened, and ranchers seemed willing to pay $250-$300 per ton, but producers were not willing to pull the trigger, concerned with input costs and moisture going forward. Hay continued to move in from neighboring states, delivered for $305-345 per ton depending on location.

In Idaho, domestic hay sold steady in a light test. Demand remained good as upcoming irrigation water availability and supply remain an uncertainty.

In Colorado, activity was light to moderate on good demand for horse hay. Precipitation, snowpack, soil moisture and stream flow are showing signs of improvement.

In the Columbia Basin, all grades of domestic, retail and export old-crop hay sold steady. More dairies and feedlots were adding wheat straw into rations to offset high hay prices. Export demand remained strong.

In the Pacific Northwest, harvest of new crop hay had started, and prices are high, according to Mastin. With the drought still holding strong on the West Coast, domestic demand for hay has held feeder hay prices high.

In Wyoming, livestock owners were in search of hay with little if any to be found. Prospective buyers were also seeking contracts for 2022 alfalfa hay, but no contracts were confirmed, and the new-crop price outlook remained uncertain. Precipitation and/or irrigation was needed to get the new crop started.

- Midwest: In Nebraska, all reported hay products sold steady. Although there’s been some early talk, no contracts for the 2022 alfalfa crop have been confirmed. There were reports of some growers planting oats into alfalfa stands, hoping to add tonnage to the first cutting, and some producers were running irrigation pivots on wheat or rye to give cattle some place to graze after calving to cut down on feeding hay. There were reports of some winterkill in alfalfa stands.

In Kansas, alfalfa and grass hay prices were steady on a limited test. Movement was slow and no new-crop pricing had reached the market.

In South Dakota, good demand remained for all types and qualities of forage as supplies continued to tighten. The calving season was in full swing, and everyone was anxiously awaiting spring moisture.

In Missouri, springtime instability persisted. Supplemental feeding was winding down as cattle producers chased emerging grass. Hay supplies were moderate, demand was light to moderate, and prices were mostly steady.

In Wisconsin, prices were strong for dairy-quality hay and sharply discounted for low-quality hay. Snow cover and frozen ground remained to start April, making it too early to evaluate alfalfa winterkill levels.

- East: In Pennsylvania, alfalfa and alfalfa-grass mix hay sold steady to mostly higher with demand moderate.

In Alabama, hay prices were steady with light supply and moderate demand.

Other things we’re seeing

- Dairy: Despite rising milk prices, higher feed costs ate into milk income margins in February. At $24.70 per hundredweight (cwt), February’s U.S. average milk price was the highest since October 2014. Offsetting that gain were higher average costs for alfalfa hay, corn and soybean meal.

February 2022 milk production was lower than a year earlier, but an eight-month decline in cow numbers came to a halt. For the first time since April-May 2021, U.S. cow numbers increased from the previous month but remained well below year-ago levels. February 2022 U.S cow numbers were up 3,000 from the revised January estimates but down 96,000 head from a year ago and 137,000 head lower than the peak in May 2021.

-

Fuel: At the beginning of April, the U.S. regular gasoline retail price averaged $4.17 per gallon, about $1.31 higher than a year earlier; the U.S. average on-highway diesel fuel price was $5.14 per gallon, up $2.

- Trucking: Flatbed demand was rising and so were prices to start April, according to DAT Trendlines. The national average price was $3.46 per mile, up 34 cents from January. Regionally, rates hit $3.81 per mile in the Midwest, $3.58 in the Southeast, $3.48 in the Northeast, $2.98 in the West and $3.28 per mile in an area covering Texas and adjacent states.