This year’s forecast for net farm income would be the lowest since 2006 and a drop of nearly 53 percent from 2013, which set a record high of $123.7 billion. It seems belt tightening is in order, and the sooner the better.

Potentially tough times ahead for many farmers, to be sure.

And those tough times influence many agri-business sectors, including equipment. Caterpillar Chairman Doug Oberhelman told CNBC that the company was going through a “rough patch.” Caterpillar delivered quarterly earnings and revenue that fell short of expectations. The company lowered its earnings outlook for 2015 and sharply increased estimates on restructuring costs. The downward trend in equipment purchases and manufacturing has hardly been confined to Caterpillar, as other companies are preparing for big hits as well. Equipment leasing programs are on the rise and may well be the biggest focus of equipment movement in 2015.

Farmer Mac released its quarterly perspective on U.S. agriculture (PDF, 12.3MB), which says, “As expected, net farm income is forecasted to decline significantly in 2015 based on lower commodity prices and increased supplies at a global level. Land values are holding up under the adverse economic conditions, but softening is in process in the grain belt, particularly in Iowa and Minnesota. Pasture rents, on the other hand, are on the rise as cattle prices have improved the profitability of cow-calf operations.

“U.S. corn and soybean crops are in good condition, and the harvest is proceeding roughly in line with historical averages. Dairy prices continue to be depressed on lower demand from China and greater competition with European producers due to the Russian ban on European and U.S. dairy products.”

USDA crop production forecast

Alfalfa and alfalfa mixture dry hay production is expected to be up to 63,214,000 tons in 2015, an increase of 1,768,000 tons over the 2014 report of 61,446,000 tons. Even drought-stricken California is forecast to have an increase of 350,000 tons. Wisconsin is forecast to have an increase of 425,000 tons over the 2014 season, and Colorado expects to see a boost of 300,000 tons over the 2014 season as well. Yield per acre is expected to top the 2014 season of 3.33 tons per acre, with 3.45 tons per acre average yield – this in spite of challenging weather throughout the country. Arizona’s yield per acre tops the field with 8.5 tons per acre.

Generally, the same story holds for all other hay in the USDA crop production forecast. Yield per acre is expected to climb to 2.07 average tons per acre, as opposed to the 2.03 tons per acre of 2014. Overall production is forecast to increase by 835,000 tons, reaching 79,187,000 tons.

If the forecast bears true, the increased supply may weaken an already soft hay market.

Weather

Sometimes I wonder, if I write something really ridiculous here, will anybody ever read it anyway? After all, it’s about weather, and we all know that whatever we say about it will be largely incorrect, or will change in five minutes. Take Idaho for instance; in my area, we had no hard frost during the fall season – we dug potatoes at 7:00 a.m. for crimeny sake. And then on Nov. 3, we received our first snowfall. I never remember that happening before – no frost until the first snowfall? I know for sure I’ve never, when seeing the first snowfall, thought, “Die, flies, die!”

However, in case someone is reading this in the hopes of finding actual weather pattern information – the USDA weather report showed heavy downpours, following the previous week’s deluge, which caused heavy flooding through southern and eastern Texas. In contrast, little or no precipitation fell during the last week of October from California to the northern Great Plains.

The drought monitor hasn’t changed much; it’s still showing California and Nevada in exceptional drought, with much of the Northwest in extreme or severe drought. We keep talking hopefully about an El Nino that may offset the drought, but are still waiting to realize that precipitation. Temperature departure from average varied only plus or minus about 4 degrees.

Dairy market

All milk prices received for September 2015 were increased to $17.50 per hundredweight, an increase of 3.69 percent over August prices.

Milk production in the 23 major states during September totaled 15.6 billion pounds, up 0.4 percent from September 2014. August revised production at 16.3 billion pounds, up 0.9 percent from August 2014. The August revision represented an increase of 15 million pounds or 0.1 percent from last month's preliminary production estimate.

Production per cow in the 23 major states averaged 1,805 pounds for September, 1 pound below September 2014. This is the second highest production per cow for the month of September since the 23 state series began in 2003.

The number of milk cows on farms in the 23 major states was 8.63 million head, 41,000 head more than September 2014, but unchanged from August 2015.

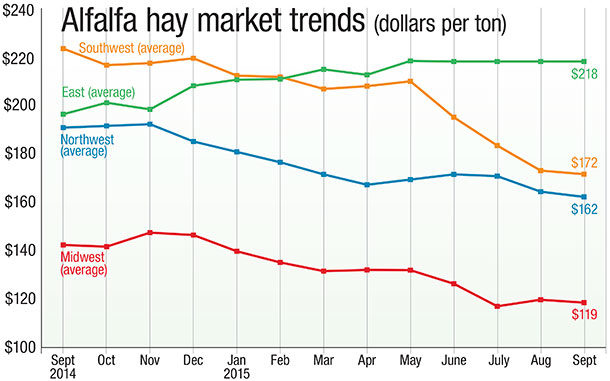

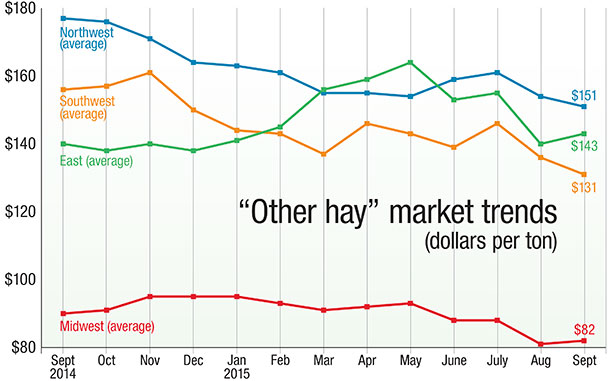

Trend charts

Hay markets vary widely by region and by product – alfalfa hay versus “other hay.” The prices and information in Figure 1 (alfalfa hay market trends) and Figure 2 (“other hay” market trends) are provided by the National Agricultural Statistics Service (NASS) and reflect general price trends and movements. Hay quality, however, was not provided in the NASS reports.

For purposes of this report, states that provided data to NASS were divided into the following regions:

Southwest – Arizona, California, Nevada, New Mexico, Oklahoma, Texas

East – Kentucky, New York, Ohio, Pennsylvania

Northwest – Colorado, Idaho, Montana, Oregon, Utah, Washington, Wyoming

Midwest – Illinois, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, South Dakota, Wisconsin FG