Ask any farmer or rancher to give an example of an “alternative forage,” and you can expect a wide range of answers. That’s because, at its core, an alternative forage is any species that is different from the forage base for a given producer’s operation. Many factors go into selecting alternative forages, including growing region, soil type, crop rotation, livestock nutritional needs, etc. For example, a dairy producer would likely use corn silage and alfalfa as base forages but could use forage sorghum and sorghum-sudangrass as alternatives.

Benefits of alternative species

There are many benefits to incorporating different species into your pasture.

Alternative species can:

- Help fill gaps in forage production and quality during certain times of the year.

- Contribute to soil health by increasing plant diversity and, in many cases, helping to cover the soil and producing living roots when the primary forage does not.

- Improve the protein content of existing forages as a mixture.

- Reduce economic risk during periods of climatic hardship.

Using models to select alternative forages

While these unconventional forages can be beneficial, knowing which forage to use and when to use it can be a difficult decision to make. One decision-making tool is using theoretic models to help predict certain economic outcomes. Using multiple models allows a producer to choose the forage option that best suits his or her specific situation to achieve the best economic and environmental outcome.

Examples of useful models include the expected value model, Wald’s maximin model and the min-variance model.

Expected value model

This model can be used to determine the anticipated value of a certain input (new forage species, fertilizer, harvesting method, etc.) at some point in the future. It looks at each possible outcome for a given input and the likelihood of that outcome occurring. For example, a producer has multiple alternative crops to choose from, each with their own set of possible outcomes (net gain) based on weather, disease, market changes, etc., and each of these outcomes has a certain probability of happening.

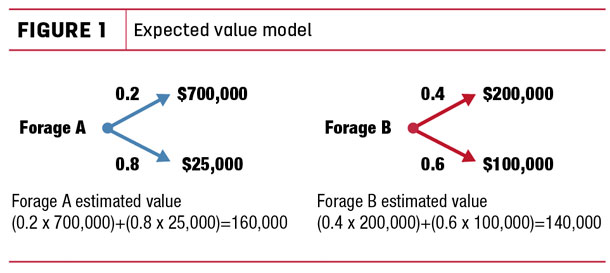

By summing these two variables and comparing the resulting estimated value for any given crop, a producer can choose the forage that will provide the most desired outcome. As shown in Figure 1, forage A has two possible production outcomes – the first has a 0.2 probability of occurring and results in a net gain of $700,000, while the second has a 0.8 probability of occurring and results in $25,000.

Forage B has a 0.4 probability resulting in $200,000 and a 0.6 probability resulting in $100,000. The estimated value model would suggest choosing forage A, as there is more potential for gain. However, there is also much greater risk since the probability of obtaining $700,000 is only 20%, making it much more likely to end up with only $25,000.

While useful, producers who are more wary of financial risk may not prefer the expected value model. Smaller operations that are more sensitive to financial hardship may want to choose a more conservative theory like the Wald’s maximin model.

Wald’s maximin model

This model is often used in the face of great uncertainty to minimize the amount of loss. Let’s say that a particularly cold winter is predicted, and a producer wants to minimize economic loss by using a winter-hardy alternative forage in addition to the existing forage base. The maximin theory can be used to calculate the outcome for each alternative forage under the most severe winter conditions.

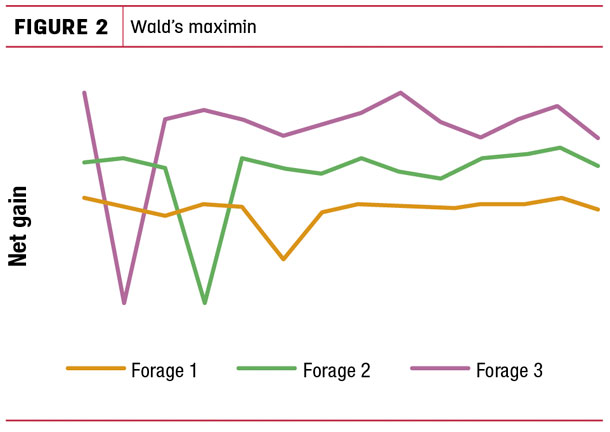

The producer then chooses the forage that has the best possible outcome, if the worst-case scenario occurs. However, while the model minimizes production losses under severe conditions, it can be limiting concerning economic gains. In Figure 2, it is clear that under normal circumstances, forage species 2 and 3 have the highest net gain.

However, the maximin model would suggest choosing forage 1 since it has the highest net gain under the worst-case scenario when compared to the other two forages. If the probability of a catastrophic event is low and can be financially overcome if it occurs, other decision-making methods should be considered to account for overall gain.

Minimum variance model

This method uses the variance of each possible outcome to determine the best forage choice. It allows the producer to choose a crop that has more stability, with less extreme highs and lows. For example, if forage A has a large range of possible outcomes, and subsequently more variability, compared to forage B, it means that forage A has more inconsistent results (net gains) than forage B and establishes a higher risk.

Use models in combination

The models briefly discussed above are examples of just a few of the many models available to help producers make the best decisions for their operations. These models can be used each season to calculate and make decisions regarding alternative forage choices based on economic and environmental performance as well as their associated risks.

If you do not feel comfortable calculating the results yourself, you can go online and find several decision-making tools (often free) available for download. Agricultural consultants, agronomists and extension agents also use models to help producers make the best decisions for their specific operations and circumstances. If you would like assistance from Noble Research Institute consultants, feel free to call the Ag Helpline at (580) 224-6500.