The state-run Korea Development Bank (KDB) and other creditors of Hanjin Shipping agreed on Tuesday, Aug. 30, 2016, not to extend fresh loans to the debt-ridden shipper. They unanimously decided to stop supporting Korea’s largest shipping line at a meeting, as the shipper's self-rescue program was not viable enough for the creditors to keep the company afloat.

Hanjin Shipping has outstanding loans of 1.3 trillion won (approximately U.S. $1.1 billion) that are set to mature next year. Of them, 650 billion won is required to aid them immediately this year. Hanjin Shipping’s parent group, Hanjin Group, said that they can only offer 200 billion won this year and another 200 billion won by next July through a capital increase by issuing new shares. Hanjin Group asked creditors to finance the shortage of oncoming debt payments. Creditors, however, rejected the offer. They are demanding Hanjin Group shoulder a greater burden in order for creditors to also take risks of extending more loans to the shipper. Following the creditors' decision, the Korea Stock Exchange issued a halt on the trading of Hanjin Shipping shares as of Aug. 30, 2016.

Hanjin Shipping, with 99 container vessels, 11 terminals, 23 foreign corporate bodies and over 100 overseas business branches, is expected to be put up for sale, a severe blow to the nation's shipping industry. After the decision, the Korean government said that it will seek ways for Hyundai Merchant Marine to take over some of Hanjin Shipping’s profitable assets, including vessels, network and key personnel. Industry people view this deal as a de facto merger by Hyundai. Hyundai Merchant Marine, the second largest shipping company in Korea, has decided to mobilize 13 substitute vessels, but it will not be enough to cover the full amount of freight that Hanjin Shipping has been handling.

Hyundai will begin to operate four container vessels on the U.S. route (Gwangyang Port – Busan Port – Los Angeles). Each container vessel (with a capacity of 4,000 TEU [20-foot equivalent unit]) will depart for the U.S. on a weekly basis to fill in the gap caused by the absence of Hanjin, which is reported to have been handling 7 percent of sea container shipping between Korea and the U.S. Hanjin is known to have been handling 25,000 TEU on a daily basis. Hanjin’s subsidiary company, called TTI, owns Pier T located in Long Beach.

Hanjin Shipping’s court decision will have limited impact on financial institutions as lenders already assigned reserves to cover potential loan losses. It is almost certain, however, that difficulties with port operation and shipping lines will occur for the next two to three months.

Since Hanjin’s line from the U.S. West Coast to Korea was the shortest route, there will be some impact and changes on trade between the U.S. and Korea. About 30 container vessels owned by Hanjin have been either seized or banned from leaving or entering ports throughout the world. A total of 13 ports so far have banned the entry or exit of Hanjin vessels out of concern that Hanjin will not be able to pay for the port usage charges. U.S. agricultural products being shipped by Hanjin to other Asian or international markets may also encounter delays in processing.

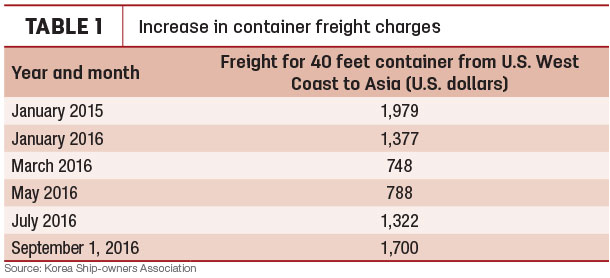

According to a newspaper report quoting the Korea Ship-owners Association, the freight for containers from the U.S. West Coast to Asia jumped after the Hanjin went into court receivership. The following table shows the increase in container freight charges. The industry is speculating that freight costs could double the current rate.

Prices of imported agricultural products in Korea will likely also increase and lose competitiveness as the freight costs go up. But the more immediate problem is that some owners of Hanjin-shipped containers are not releasing their cargo of imported goods out of concern that they would not have any collateral to collect any unpaid dues that they need to receive from Hanjin Shipping. The Hanjin case will have an immediate impact on chilled agricultural products such as fresh fruits and meat with a limited shelf life. Dry and frozen products with a longer shelf life are not a major concern at this moment as retail stores usually maintain enough inventory that can last for a couple of months. It is reported that about 40 to 50 percent of all citrus coming to Korea use this shipping company. Some of the fresh meat importers are known to be putting up collateral for pulling out the container from the port, as the ports are not willing to release the containers without such guarantees. As Hanjin only operates a few vessels for bulk products, commodities such as feed corn, etc., are not expected to be severely impacted by the problem with Hanjin Shipping.

U.S. exporters are encouraged to ensure that their brokers and shippers are arranging alternative transportation methods. We anticipate that these shipping difficulties will moderate as additional capacity comes online and as the Korean shipping industry gains a better handle on Hanjin’s situation. ![]()

—From USDA Foreign Agricultural Service news release