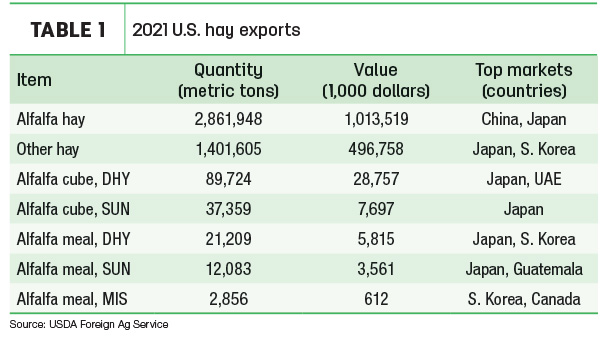

Despite logistical challenges, U.S. exports of alfalfa hay set a new record high in 2021 at 2.86 million metric tons (MT), according to latest data from the USDA’s Foreign Agricultural Service. Total year alfalfa hay exports were valued at more than $1 billion (Table 1).

The 2021 total surpasses previous highs of about 2.69 million MT in both 2019 and 2020. The record came even though December shipments were the lowest since July.

Alfalfa hay sales to China totaled 1.56 million MT in 2021, a new record high for any single country and representing about 55% of annual sales. At 612,710 MT, Japan was the second-leading market and represented 21% of the year’s total.

December exports of other hay were again on par with the average over the second half of 2021. Total shipments in 2021 hit 1.4 million MT, the highest total since 2017. Total year exports of other hay were valued at about $497 million.

At 835,625 MT, 2021 sales to Japan were the highest since 2013 and represented 60% of the U.S. total for the year. Sales to South Korea, at 304,410 MT, hit a nine-year low but still represented 22% of total annual sales in 2021.

Exports of alfalfa cubes and meal (dehydrated and sun-dried) were a mixed bag in 2021. Total volume was estimated at 163,231 MT, with a value of about $46.4 million.

Christy Mastin, sales representative with Eckenberg Farms, Mattawa, Washington, noted different factors impact hay exports to various countries.

December hay exports to China are usually down to avoid shipments arriving during the Chinese New Year’s festivals. Strength in yearlong 2021 exports can attributed to China’s attempt to increase milk production, believing milk boosts immunity to COVID-19.

In other markets, hay inventories in Japan and Korea are very low.

“The delay in shipments is being felt, and we get asked to increase shipments or make earlier shipments often,” Mastin said.

Japan milk pricing hasn't changed, but dairy farmers are seeing increases in all costs, including feed. The increase in hay costs due to ocean freight, as well as unstable delivery, is causing concern among customers, and Japanese producers in search of a more consistent source of feed are turning to grains that arrive in breakbulk vessels on a more regular schedule.

In January, several days of work were lost because of the snow in Washington state, closing mountain passes and creating scheduling issues with trucks.

Container ship delays and schedule changes have continued with little improvement, Mastin said. Hay volumes have not fully recovered for some exporters, who must be diligent to get bookings and educated about vessel opening dates, allocation and services.

Longer term, contract negotiations between the Pacific Maritime Association (PMA) and the International Longshore and Warehouse Union (ILWU) are a concern, with hopes there is no strike or slowdown.

For more on hay exports and market conditions, check out Progressive Forage’s Forage Market Insights update.

-

Dave Natzke

- Editor

- Progressive Forage

- Email Dave Natzke