September alfalfa hay exports totaled 199,443 MT, valued at about $60 million. China was the leading buyer with 79,0855 MT, its second-lowest total of the year.

September 2017 sales of other hay totaled nearly 135,500 MT, the third-highest monthly total of the year. Japan and South Korea remained top buyers. The other hay exports were valued at about $42.7 million.

September hay exports reflect the impact of higher-priced new-crop U.S. hay, according to Christy Mastin, international sales manager at Eckenberg Farms, Mattawa, Washington. Hay quality is also not as good as last year, reducing purchases.

“Most of the early months shipments for 2017 were old-crop, and the increase in April/May was due to U.S. suppliers moving as much out of the old crop as possible,” Mastin said.

Mastin said many of her foreign customers are reporting strong inventories, with larger supplies of domestic feed available in South Korea and Japan this year.

“Domestic harvest is coming to an end in Asia, so they also were slowing purchases to see if lower-priced domestic feed would be available,” she said. “Last year, there were typhoons that hit the largest production areas in both South Korea and Japan. This year saw less damage, so the hay quality is better and volume increased over last year, although still not to normal levels.”

A negative impact on sales is an unfavorable currency exchange rate with Japan, making U.S. hay more expensive.

U.S. domestic demand and its impact on prices will be a determining factor on exports going forward. The severity of winter weather in the U.S. will be key to how much feeder hay and lower-grade hay is purchased for domestic feed.

West Coast fires this summer affected hay production across multiple states, which will also mean more hay is purchased domestically. Many export customers can’t afford high-priced forage products and are looking for lower priced alternatives.

Among U.S. competitors, Canadian timothy is selling well, with this year’s harvest yielding the highest-quality hay in the past four to five years. Australia oaten hay also competes with U.S. forages, and the start of that harvest season is going well. Carryover from last year’s crop is keeping pressure on prices, allowing foreign customers to purchasing oaten hay from Australia instead of higher-priced timothy.

Moving forward, China is becoming more active in the market and starting to buy alfalfa again after a few months of lower movement. China buyers purchased heavy volumes of old-crop hay at lower prices and then slowed as prices rose. Milk prices in China remain low.

Alfalfa hay exports have risen to the equivalent of over 15 percent of alfalfa production and 50 percent of the grass hay production from seven Western states (Arizona, California, Idaho, Nevada, Oregon, Utah and Washington), according to Daniel Putnam, University of California Extension alfalfa and forage specialist.

“Given the world demand for forages, primarily for dairy production, the hay export markets may be an important component of the western U.S. hay production scene for years to come.”

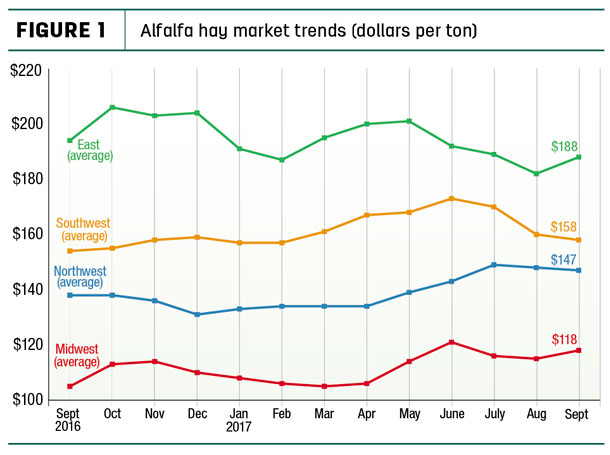

Alfalfa hay prices

The latest available USDA monthly ag prices report was released Oct. 30, summarizing September 2017 prices.

Alfalfa

The September 2017 U.S. average price paid to alfalfa hay producers at the farm level was $149 per ton, up $2 from August and $13 more than a year earlier.

September prices were higher than month-earlier levels in the East and Midwest (Figure 1) but steady to lower in the Southwest and Northwest.

Among individual states, prices were up $20 to $30 per ton in Michigan, Ohio and Wisconsin but down $30 per ton in Oregon and $17 per ton in New York. Highest alfalfa hay prices were in Kentucky ($205 per ton) and New York ($199 per ton); lowest prices were in Minnesota ($98 per ton) and Nebraska ($90 per ton).

Compared to a year earlier, only the East saw lower prices. There were wide swings among individual states. Prices were $29 to $34 per ton higher in Minnesota, North Dakota and Wisconsin but $37 lower in Oklahoma.

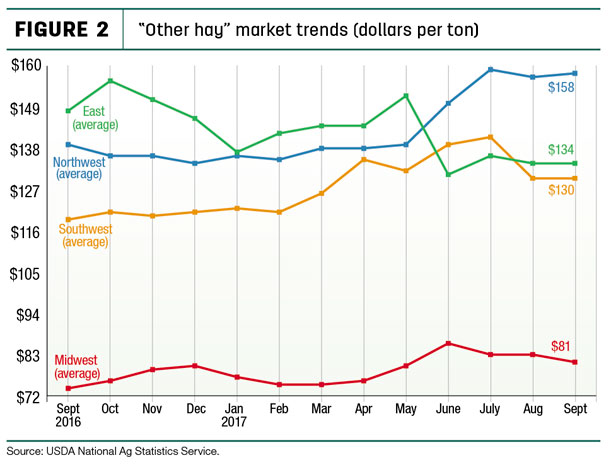

Other hay

The September 2017 U.S. average price for other hay was estimated at $113 per ton, down $3 per ton from August and equaling a 12-month low. Regionally, prices moved little, holding in a $1 to $2 range of last month across all regions (Figure 2).

Among individual states, September prices for other hay were down $12 to $20 per ton in New York, North Dakota, South Dakota and Washington. Highest other hay prices were in Oregon ($180 per ton) and Washington ($200 per ton); lowest prices were in Minnesota ($67 per ton) and Wisconsin ($70 per ton).

Compared to a year earlier, average prices for other hay were up $45 per ton in Washington and $20 to $30 higher in Colorado, Nevada, New Mexico and Wyoming. Prices were $28 to $29 per ton lower in New York and Pennsylvania.

Figures and charts

The prices and information in Figure 1 (alfalfa hay market trends) and Figure 2 (“other hay” market trends) are provided by NASS and reflect general price trends and movements. Hay quality, however, was not provided in the NASS reports. For purposes of this report, states that provided data to NASS were divided into the following regions:

-

Southwest – Arizona, California, Nevada, New Mexico, Oklahoma, Texas

-

East – Kentucky, New York, Ohio, Pennsylvania

-

Northwest – Colorado, Idaho, Montana, Oregon, Utah, Washington, Wyoming

- Midwest – Illinois, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, South Dakota, Wisconsin

Organic hay

The USDA’s organic hay report, released Oct. 25, reported grower FOB farm gate organic alfalfa prices as follows: Premium large square bales – $260 per ton; Premium-Supreme small square bales – $250 to $265 per ton; and Fair small square bales – $230 per ton. Good-Premium large square bales of triticale averaged $145 per ton. No prices were reported for delivered hay.

National organic grain and feedstuffs report

Regional auction and market summaries

Here’s a peek at early November auction market summaries:

-

East: Alabama hay prices were firm, with moderate supply and good demand. In Pennsylvania’s Lancaster area, alfalfa sold mostly steady to firm on a light test. Grass and alfalfa/grass mixed hay sold mostly steady to $15 higher; straw and fodder were steady to $10 higher on moderate to good demand.

-

Southwest: All classes of California hay traded steady with moderate demand. New heat records were set in late October across southern California. Alfalfa fields, still going strong, continued to be cut and baled. In Oklahoma, Premium and Good alfalfa hay trade was light to mostly moderate. Demand improved for better-quality wheat hay with prices fully steady.

In Texas, all hay classes traded steady except for alfalfa, which sold steady to $5 higher. Demand increased as buyers stock up in preparation for winter supplemental feeding. Coastal bermuda producers were taking final cuttings of the year. In the final New Mexico hay report of the year, alfalfa hay prices were steady with demand light to moderate. All areas are wrapping up final cuttings.

-

Northwest: In Idaho, alfalfa sold $10 to $15 higher in light test. Demand remains good, especially for higher-testing alfalfa. In the Washington-Oregon Columbia Basin, Premium/Supreme alfalfa prices were firm in light test; prices for other grades of alfalfa were steady. Demand remains good for all grades of alfalfa.

Local dairies report it is cheaper to buy corn silage this year than grow it themselves. Utah hay prices were mostly firm with trading slow on all qualities. Lower-quality hay demand is light with good supplies. In Montana, hay prices were fully steady, but activity was slow. Colorado prices were mostly steady with activity and demand moderate to good in all classes.

-

Midwest: In Iowa, hay prices were slightly higher. Straw was in demand. In Missouri, a hard freeze ended the growing season. Hay movement remains slow, supplies are moderate, demand is light, and prices are steady. Across Kansas, demand was moderate to good; offerings of grinder hay were light. Prices were steady with grinding alfalfa and ground/delivered hay prices strengthening. In Nebraska, large square bales of dairy alfalfa sold steady to $5 higher; round bales of alfalfa and grass hay sold mostly steady.

Demand was good for dairy alfalfa and light to moderate for all other baled hay. Very heavy losses of corn grain were reported due to wind damage. In South Dakota, prices continued to hold mostly steady for all classes of hay. Demand was moderate for alfalfa, moderate to good for grass hay and bedding materials. Many feedlots are starting to get calves into their yards and are in need of grass and grinding.

In Wisconsin, there is demand for quality hay but not much supply available at auctions. Overall hay supplies may be contributing to depressed prices. In southwest Minnesota, there’s an adequate supply of mixed hay at steady prices but a limited supply of higher-quality hay.

Drought area

The USDA’s World Agricultural Outlook Board estimated 14 percent of U.S. hay-producing acreage was located in areas experiencing drought as of Oct. 31. The most extreme drought areas cover Montana and western South Dakota and North Dakota. A large swath also covers southern Iowa, southeastern Missouri and northwestern Arkansas.

Check out the hay areas under drought conditions: U.S. drought monitor

Fuel prices

The U.S. Energy Information Administration estimated U.S. retail prices for regular gasoline averaged about $2.49 per gallon as October came to a close, up about a penny from the week before but 26 cents per gallon more than a year ago. U.S. on-highway diesel fuel prices averaged about $2.82 per gallon, up 2.2 cents from a week earlier and up about 34 cents per gallon compared to a year ago.

Dairy outlook: Production taps the brakes

September 2017 U.S. milk production grew 1.1 percent compared to the same month a year earlier, the smallest year-over-year increase since May 2016. Declining cow numbers and a meager increase in milk output per cow slowed the overall growth rate.

While the slowdown should lend support for milk prices, the outlook for 2018 remains clouded by uncertainty, hinging on the strength of exports and global milk production.

Nationally, September milk cow numbers were down 4,000 head from August’s revised estimate but still 69,000 head more than September 2016. Compared to a year earlier, largest growth was in Texas (+30,000 head), New Mexico (+13,000 head) and Colorado (+10,000 head). California cow numbers were down 12,000 head.

September 2017’s U.S. average milk price of $17.80 per hundredweight was down 20 cents from August, and margins weakened slightly due to higher soybean meal and alfalfa hay costs. Dairy margins have been steady to a little better since the middle of October, following slightly higher milk prices along with weakness in feed costs.

Beef outlook: Drought impacts culling

Cattle placements in feedlots during September 2017 were 13 percent above 2016, and feedlot inventories as of Oct. 1 were about 5 percent greater than a year earlier. The USDA raised beef production projections for 2018, forecasting heavier fed cattle weights.

The heavier weights largely reflect the likelihood of increased overall placements of heavier cattle in feedlots because forage conditions in some parts of the country are expected to offer cow-calf operators and backgrounders more flexibility in timing the sales of calves. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke