Alfalfa hay prices

The latest available USDA monthly Ag Prices report was released Sept. 28, summarizing August 2017 prices.

Alfalfa

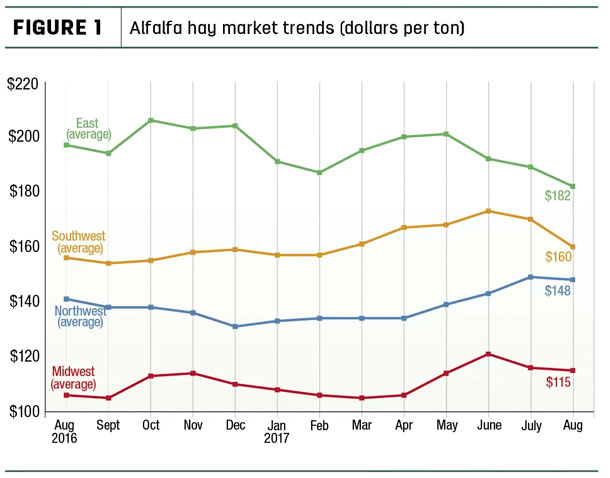

The August 2017 U.S. average price paid to alfalfa hay producers at the farm level was $147 per ton, down $5 from July but $10 more than a year earlier.

August prices were lower than month-earlier levels in all regions (Figure 1), led by a $10-per-ton decline in the Southwest. Among individual states, prices were down $15 to $24 per ton in Michigan, Ohio, Pennsylvania and Texas.

Compared to a year earlier, only the East saw lower prices. There were wide swings among individual states. Prices were $20 to $35 per ton higher in Arizona, Kansas, North Dakota and South Dakota but $15 to $30 lower in Illinois, Kentucky, Michigan, Ohio, Oklahoma and Pennsylvania.

Other hay

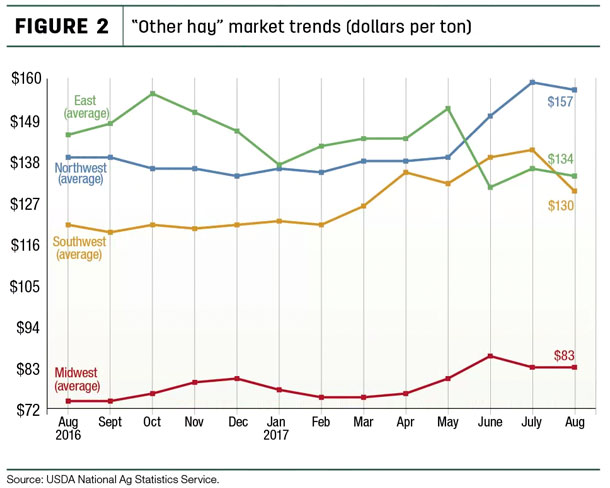

The August 2017 U.S. average price for other hay was estimated at $116 per ton, down $10 per ton from July. Regionally, prices were steady in the Midwest but lower elsewhere (Figure 2). Among individual states, August prices for other hay were down $10 to $20 per ton in California, Michigan, Minnesota, Nevada, Ohio, Oklahoma, Oregon and Washington.

Compared to a year earlier, average prices for other hay were up $60 per ton in Washington and $19 to $30 higher in Idaho, New Mexico, North Dakota, South Dakota and Wisconsin. Prices were $10 to $18 per ton lower in Kentucky, Michigan, New York, Oregon and Pennsylvania.

Figures and charts

The prices and information in Figure 1 (alfalfa hay market trends) and Figure 2 (“other hay” market trends) are provided by NASS and reflect general price trends and movements. Hay quality, however, was not provided in the NASS reports. For purposes of this report, states that provided data to NASS were divided into the following regions:

- Southwest – Arizona, California, Nevada, New Mexico, Oklahoma, Texas

- East – Kentucky, New York, Ohio, Pennsylvania

- Northwest – Colorado, Idaho, Montana, Oregon, Utah, Washington, Wyoming

- Midwest – Illinois, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, South Dakota, Wisconsin

Organic hay

The USDA’s organic hay report, released Sept. 27, reported grower FOB farm gate organic alfalfa prices as follows: Supreme – $265 per ton for small square bales, and Premium – $260 to $290 per ton for large square bales. Good/Premium small square bales of alfalfa/orchardgrass hay averaged $200 per ton. No prices were reported for delivered hay.

Alfalfa hay exports

The USDA’s monthly hay export estimates were released after Progressive Forage’s deadline. Check the website for updates when they become available.

Auction and market summaries

Here’s a peek at late September auction market summaries:

• East: Alabama hay prices were steady with light supply and good demand. In Pennsylvania’s Lancaster area, all varieties of hay and straw sold steady to $10 lower. Supply was light to moderate with moderate demand.

• Southwest: All classes of California hay traded steady with moderate demand. Armyworms were an issue with orchard and timothy grass in the Inter-Mountain region. In Oklahoma, alfalfa trade was slow but slightly improved over the previous two weeks. Prices were mostly steady. Demand was very light for Supreme and Premium quality alfalfa, moderate for dry cow and bunk hay. Grass hay trade remained extremely slow with very few sales.

In Texas, prices remained steady on moderate movement. A wet and dreary week in the Panhandle had buyers stocking up on hay. Supplemental feeding is right around the corner. Plenty of hay should be available this year, but quality may be an issue. New Mexico alfalfa hay prices were weak. Trade was slow on light demand. Heavy rain has put a damper on harvest, with many eastern areas receiving up to 5 inches of rain. Sixth cutting was 30 to 50 percent completed in southern regions.

• Northwest: In Idaho, prices for domestic and export alfalfa were steady in light test. In the Washington-Oregon Columbia Basin, Premium export alfalfa was steady to weak; export timothy was steady. Rain showers over most of the trade area hurt quality. Utah hay prices were mostly firm with trading slow on all qualities. Lower-quality hay demand is light with good supplies. In Montana, prices were steady to weak. Hay market activity was moderate to active. Hay in the eastern portion of the state has weakened some as buyers shop around to find lower prices.

Some ranchers are purchasing hay from states farther east in an attempt to find hay that costs less on a delivered price. Hay prices in the western portion of the state are steady. Ranchers are beginning to step into the market and buy hay for winter. Grass hay sold steady on mostly good demand and light supplies. Prices were mostly steady with demand good in Wyoming. Compared to the previous month, hay sales on the High Plains Hay Exchange were generally steady with moderate demand. The bulk of the alfalfa and grass/alfalfa mix hay graded Good. Fairly good demand was noted for cow hay while dairy-quality hay was scarce. Colorado prices were mostly steady with firm undertones; sales activity and demand was good in all classes.

• Midwest: In Iowa, prices trended mostly steady with a steady to weak undertone. In Missouri, hay supplies were moderate, demand was light, and prices were steady. Across Kansas, hay movement was slow. In southwest and south-central regions, alfalfa fourth cutting was nearly 90 percent complete. In Nebraska, alfalfa, grass hay, ground and delivered hay sold steady. Dehydrated pellets sold steady to $7 higher in the east but $5 lower in the Platte Valley. There was still a lot of forages to be sold and a lot of “off” forages to be baled after soybean and corn is combined.

In South Dakota, alfalfa prices continued to hold mostly steady on light volume. Demand varied from good for alfalfa/grass mix and high-testing alfalfa to moderate at best for lower-quality alfalfa. Recent weather has made it challenging for hay producers to put up quality hay, as the cool temps, rain and heavy overnight dews have creating almost impossible drying conditions. In Wisconsin, there is demand for quality hay but not much available supply at auctions. Overall hay supplies may be contributing to depressed prices. In southwest Minnesota, there’s an adequate supply of mixed hay at steady prices but a limited supply of higher-quality hay.

Drought area

The USDA’s World Agricultural Outlook Board estimated 15 percent of U.S. hay-producing acreage was located in areas experiencing drought as of Sept. 26. Although the nationwide percentage of hay area facing drought was unchanged from a month earlier, conditions worsened in portions of Illinois, Iowa, Oregon and Washington. Much of North Dakota, South Dakota, Montana and northern Idaho remained dry, but widespread rains covering the Northern Plains and Pacific Northwest were reported in weekly hay auction summaries.

Check out the hay areas under drought conditions.

Fuel prices

With refiners ramping production back up after hurricanes Harvey and Irma, the U.S. Energy Information Administration estimated U.S. retail prices for regular gasoline averaged about $2.58 per gallon as of Sept. 25, down 5 cents from the week before but 36 cents per gallon more than a year ago. U.S. on-highway diesel fuel prices averaged about $2.79 per gallon, unchanged from a week earlier but up about 41 cents per gallon compared to a year ago.

Dairy outlook: Weakening is evident

August 2017 milk production grew 2 percent compared to the same month a year earlier, as favorable weather in the Northeast and Midwest strengthened milk output per cow. Nationally, milk cow numbers were unchanged from July but up 71,000 from August 2016. Compared to a year earlier, largest growth was in Texas (+30,000 head), New Mexico (+14,000 head) and Colorado (+8,000 head). California cow numbers were down 13,000 head while Pennsylvania and Minnesota showed declines of 4,000 head.

August 2017’s U.S. average milk price of $18 per hundredweight was up 70 cents from July and up 80 cents compared to August 2016. Combined with lower feed costs, the higher milk price improved U.S. average income margins for August.

While higher milk prices improved August dairy income margins, September prices weakened for much of the month. As of Sept. 29, September 2017-June 2018 Chicago Mercantile Exchange Class III (milk used in cheese production) futures contracts averaged just $15.89 per hundredweight, and Class IV (used to make butter and milk powder) futures contracts averaged just $15.50 per hundredweight.

Without additional improvement, 2018 milk prices could come in no better than 2017, according to Bob Cropp, professor emeritus at the University of Wisconsin – Madison.

Beef outlook: Drought impacts culling

Analysis provided by Katelyn McCullock, American Farm Bureau Federation Market Intelligence economist, indicated weekly beef cow culling has been running ahead of 2016 for almost all of 2017, and fall culling started early. At least some of the reason behind this early surge in beef cow slaughter is drought in the Northern Plains. This not only caused cattle on rangeland to come to market faster, but beef producers made cow-culling decisions sooner. August cull cow prices were down about $1 per hundredweight from July.

The number of beef cattle placed in large feedlots increased in August, according to the USDA’s latest Cattle on Feed report. Feedlot cattle inventories as of Sept. 1 were about 4 percent greater than a year earlier. With greater supplies, projected fed cattle prices were reduced for both 2017 and 2018. Fourth-quarter 2017 steer prices were expected to average nearly $20 to $25 per hundredweight less than the second-quarter average of $133 per hundredweight with only a slight improvement in the first half of 2018. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke