Like unpredictable teenagers, lingering drought in the Southwest and a stubborn winter in the Midwest were enough to keep hay producers up at night as the calendar moved toward Mother’s Day.

Based on late April/early May auction market summaries from USDA’s Ag Marketing Service, alfalfa sales in Oklahoma were at a near standstill as supplies and offerings dried up. Demand was very good, but buyers were either looking out of state or waiting on new crop harvests.

Hay in the Texas Panhandle has become nearly impossible to find, and many feedyards were changing rations to use cotton burrs. Further west, alfalfa harvest was well underway in California.

In Colorado and Wyoming, less hay was available as growers planned to use remaining inventories for their own livestock. Moving north to the Washington-Oregon Columbia Basin, export and feeder alfalfa sold steady in a light test. Feeder hay supplies were tight. Cutting in the southern basin was expected to start the second week of May. Most Oregon hay producers are sold out for the growing year.

Many Kansas producers estimated first cutting of new-crop alfalfa would be delayed 30 to 45 days due to the cool, dry weather. Early hatching alfalfa weevil larvae may have been killed – or at least their population levels reduced – by the cold weather. Contacts are reporting that a number of new alfalfa stands will be planted this spring and fall.

Quite a few Nebraska producers also planned to seed additional acreage of alfalfa, with some waiting until the middle of May in case there is a late freeze.

In South Dakota, hay supplies were very tight, and all hay and bedding materials sold steady to higher as the cold, wet spring increased the need for bedding materials and delayed pasture turnout. In Wisconsin, there was demand for high-quality hay, and with limited supplies, prices increased considerably.

Extended winter had some farmers making unexpected hay purchases. The extended winter in the Upper Midwest was delaying evaluations of winterkill in Minnesota and Wisconsin.

According to Curt Reese, University of Minnesota agronomy and soil scientist, April 2018 was the coldest on record since 1886 in Minnesota. The West Central Research and Outreach Center, located about 150 miles northwest of Minneapolis/St. Paul at Morris, Minnesota, accumulated just 42 growing-degree days during the month, compared to a historical average of 118 for April.

Reese said the probability of alfalfa winterkill is likely above average due to the cold 2017-18 winter temperatures and lack of snow cover. However, the area did not see extreme thawing and freezing cycles as in the winter of 2016-17.

Drought area reduced, but concentrated

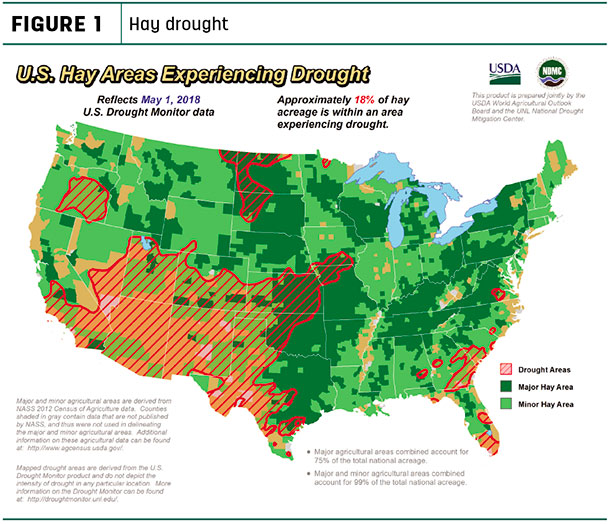

The percentage of U.S. hay acreage located in areas experiencing drought improved slightly from last month. The USDA’s World Agricultural Outlook Board estimated 18 percent of U.S. hay-producing acreage was located in areas experiencing drought as of May 1 (Figure 1), a 3 percent improvement from March.

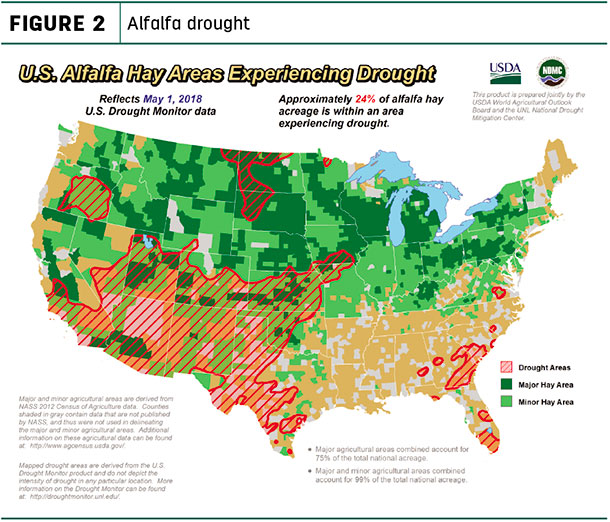

Similarly, about 24 percent of alfalfa hay acreage remained under drought conditions as of early May, about 3 percent less than March (Figure 2).

Drought areas stretch from southern Iowa into Kansas, central Oklahoma, western Texas, Colorado, New Mexico, Arizona, Utah and California in the Southwest, with Oregon, northeastern Montana and western North Dakota and South Dakota still under dry conditions. Dry pockets also exist in southeastern Georgia.

Check out the hay areas under drought conditions.

In late April, the USDA’s Farm Service Agency declared natural disaster areas due to the drought in selected counties in Colorado, Nevada, New Mexico, Texas and Utah. The declaration makes producers in about 50 counties eligible for federal disaster assistance.

Hay prices

The latest available USDA monthly Ag Prices report was released April 27, summarizing March 2018 prices.

Alfalfa

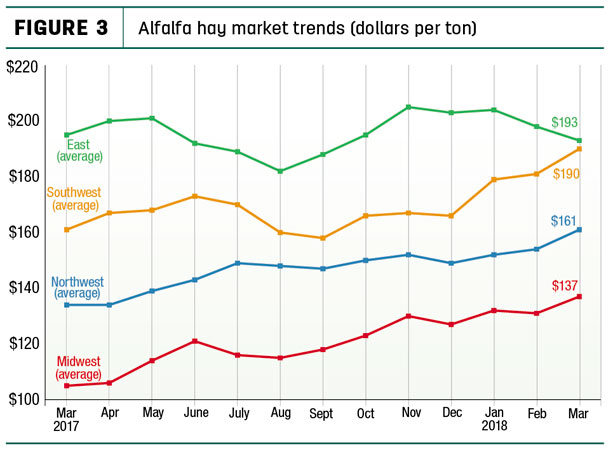

Western and Midwest markets have pushed U.S. alfalfa hay prices to their highest average since July 2015. March 2018’s average price of $166 per ton was up $11 from February and $32 more than March 2017. Regionally, averages were up everywhere but the East (Figure 3).

Compared to a month earlier, March average alfalfa hay prices were up $25 per ton in New Mexico, $20 in Ohio, $17 in Iowa and $10 to $14 per ton in Arizona, Idaho, Kansas, Minnesota, Montana, Nebraska, Pennsylvania, Washington and Wyoming.

Compared to a month earlier, March average alfalfa hay prices were up $25 per ton in New Mexico, $20 in Ohio, $17 in Iowa and $10 to $14 per ton in Arizona, Idaho, Kansas, Minnesota, Montana, Nebraska, Pennsylvania, Washington and Wyoming.

Average alfalfa prices fell off sharply in New York, down $48 per ton. Wisconsin was the only other state to show a monthly price decline, down $3.

Compared to a year earlier, alfalfa prices were up everywhere except New York, Illinois and Missouri. Prices rose at least $30 per ton in 16 major states, with prices in Kansas, Minnesota and Washington up $50 per ton or more.

Highest alfalfa hay prices were in Kentucky ($215 per ton) and California and Texas (both $205 per ton); lowest prices were in North Dakota ($109 per ton) and Nebraska ($113 per ton).

Other hay

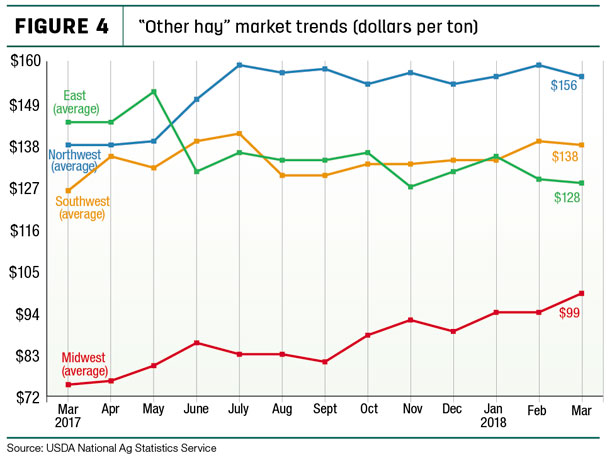

The March 2018 U.S. average price for other hay was estimated at $123 per ton, down $1 from February and $4 less than March 2017.

Average prices were down in three of four regions (Figure 4).

Among individual states, Iowa saw the largest jump from February, up $22 per ton, with increases of $14 to $15 per ton in Kansas, Ohio and South Dakota. Washington led decliners, down $30 per ton from a month earlier followed by New York (-$17) and Michigan (-$15).

Price changes from a year earlier were more notable. March 2018 prices for other hay were up $40 to $48 per ton in Arizona, Iowa and Washington, but down $67 per ton in New York.

Highest other-hay prices were in Arizona and Washington (both $200 per ton); lowest prices were in Kansas ($76 per ton), Nebraska and North Dakota ($79 per ton).

Figures and charts

The prices and information in Figure 3 (alfalfa hay market trends) and Figure 4 (“other hay” market trends) are provided by NASS and reflect general price trends and movements. Hay quality, however, was not provided in the NASS reports. For purposes of this report, states that provided data to NASS were divided into the following regions:

- Southwest – Arizona, California, Nevada, New Mexico, Oklahoma, Texas

- East – Kentucky, New York, Ohio, Pennsylvania

- Northwest – Colorado, Idaho, Montana, Oregon, Utah, Washington, Wyoming

- Midwest – Illinois, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, South Dakota, Wisconsin

Organic hay

According to the USDA’s organic hay report, released April 25, f.o.b. farm gate organic hay prices were as follows: Premium/Supreme alfalfa small square bales – $250 per ton; Fair alfalfa midsquares – $190 per ton; and Good grass large square bales – $145 per ton. No prices were reported for delivered organic hay.

National organic grains and feedstuffs report

Other factors

Other factors impacting forage producers as we move into May include:

- Exports: U.S. hay exports improved in March, but could face headwinds going forward.

March 2018 alfalfa hay shipments totaled 228,203 metric tons (MT), the largest volume since June 2017. The month’s exports were valued at $70.3 million. China’s total of 91,278 MT was the highest since December 2017, with sales to Saudi Arabia and Japan also higher.

Sales of other hay totaled 119,134 MT in March, the highest total since November 2017. Those shipments were valued at $38.6 million. Sales to Japan were the highest since April 2017, but shipments to South Korea, Taiwan, the United Arab Emirates and Canada were steady with recent months.

Sales of alfalfa cubes and meal were mostly mixed to lower.

Higher U.S. hay prices and adequate inventories among major buyers will impact exports during the rest of 2018, according to Christy Mastin, international sales manager at Eckenberg Farms, Mattawa, Washington. Returning from a recent sales trip to South Korea and Japan, she said there was little demand for alfalfa, timothy or straws.

New-crop alfalfa sourced from the Pacific Northwest is running $30 to $60 per ton higher than a year ago, and potential buyers are balking at those prices. U.S. timothy hay prices are currently not competitive with supplies sourced from Canada and Australia.

Price isn’t the only hindrance. Although hay was not listed as a target for retaliation in the tariff and trade dispute with China, customers there said testing of every load of alfalfa for genetically modified organisms (GMOs) will begin in the next two to three months.

-

Dairy outlook: Thanks in part to the higher alfalfa hay prices, U.S. dairy farmer March 2018 income- over-feed-cost margins were the slimmest since June 2016. Combined with higher corn and soybean meal prices, total feed costs hit a 22-month high. With changes in the federal Margin Protection Program for Dairy, some dairy farmers will recoup income resulting from low milk prices.

Based on current estimates, USDA projected 2018 average milk prices are down about $1.70 per hundredweight from 2017 and are now lower than prices seen in 2016.

U.S. milk production posted a more modest 1.3 percent year-over-year increase in March, but the subplot in the story was the USDA’s reduction in cow numbers. Compared to a year ago, California (-18,000 head), Wisconsin (-6,000 head) and Minnesota (-5,000 head) led decliners. The largest year-over-year growth in cow numbers was in Texas and Colorado (both +11,000 head), and New Mexico and Arizona (both +7,000 head).

-

Beef outlook: April 1 cattle feedlot inventories were up 7 percent compared to a year earlier, the second-highest inventory for that date since the USDA began tracking inventories in 1996. However, March 2018 placements into feedlots were down 9 percent compared to March 2017.

The USDA lowered its 2018 beef production forecast, based on lower first-half slaughter and lighter weights, but this decline is partly offset by higher expected third-quarter slaughter. Projected cattle price forecasts were reduced as demand for cattle has softened and supplies are expected to be large in the coming quarters. Highest cattle prices for the year are already behind us.

-

Fuel prices: Growing global demand and a reduction in global crude inventories have pushed oil prices higher. At the end of April, U.S. gasoline prices averaged about $2.85 per gallon, 44 cents higher than a year earlier. Late April U.S. diesel prices were up 22 percent from a year earlier, averaging about $3.16 per gallon and nearing levels last seen in late 2014.

-

Interest rates: The first of the quarterly ag banking reports are out, and first-quarter 2018 interest rates on all types of loans were higher in the Dallas Federal Reserve District, covering all or portions of Texas, New Mexico and Louisiana. Interest rates on variable-rate loans for feeder cattle, farm operating and intermediate-term loans topped 6 percent for the first time since 2012. Interest rates on fixed-rate loans were the highest since the first quarter of 2013.

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke