Although the decline is small, U.S. hay acreage attrition will continue in 2018, according to the USDA Prospective Plantings report, released March 29. The report provided a survey-based estimate of acreage to be harvested as dry hay this year.

On an acreage basis, four states are expected to increase area for hay harvest by more than 120,000 acres, led by Montana (+150,000 acres) and Ohio (+140,000 acres). Others are Minnesota and Oklahoma (both +120,000 acres). Producers in Montana, North Dakota and South Dakota are optimistic about harvesting more acres than last year to replenish reduced stocks resulting from a dry 2017 production cycle.

In contrast, states expected to reduce hay harvest area are Pennsylvania (-170,000 acres), Missouri (-100,000 acres) and Oregon, Kentucky and New York (down 90,000, 80,000 and 70,000 acres, respectively). States in the Southeast are planning to harvest fewer acres than in 2017.

Record lows for all hay harvested area are expected in California, Connecticut, Illinois, Rhode Island and Wisconsin in 2018.

Among the top dairy states, California, Wisconsin, Idaho, Pennsylvania and New York are expected to reduce hay acreage with Texas unchanged and only Michigan increasing acreage (+20,000).

Drought area improves

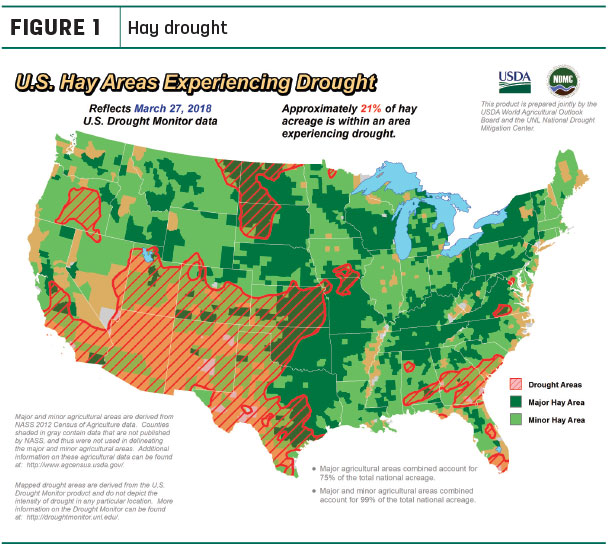

The percentage of U.S. hay acreage located in areas experiencing drought improved somewhat from last month. The USDA’s World Agricultural Outlook Board estimated 21 percent of U.S. hay-producing acreage was located in areas experiencing drought as of March 27 (Figure 1).

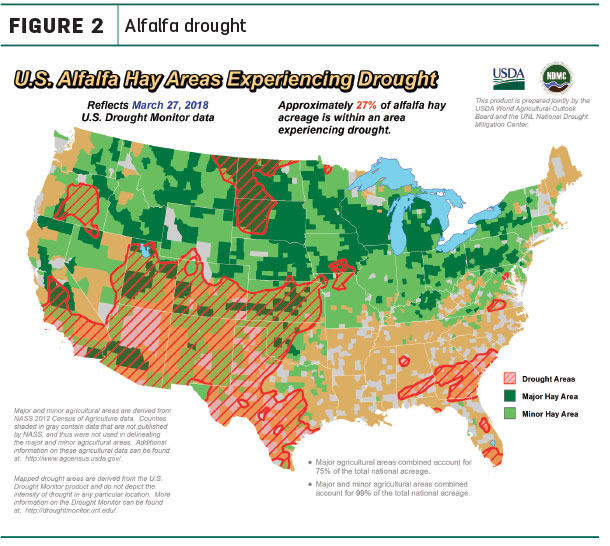

That’s a 4 percent improvement from a month earlier. Similarly, about 27 percent of alfalfa hay acreage remained under drought conditions as of late March, also about 4 percent less than a month earlier (Figure 2).

Drought areas cover Kansas, Oklahoma, Texas, Colorado, New Mexico, Arizona, Utah and California in the Southwest, with Oregon, northeastern Montana, North Dakota, South Dakota still under dry conditions. Dry pockets also exist in the Southeast.

Check out the hay areas under drought conditions.

As of March 27, the USDA weekly weather and crop bulletin reported Arizona’s alfalfa crop was rated mostly good to excellent, with harvesting taking place on almost three-quarters of the state’s acreage. Alfalfa started to green in some locations of Nevada.

Hay prices

The latest available USDA monthly ag prices report was released March 28, summarizing February 2018 prices.

Alfalfa

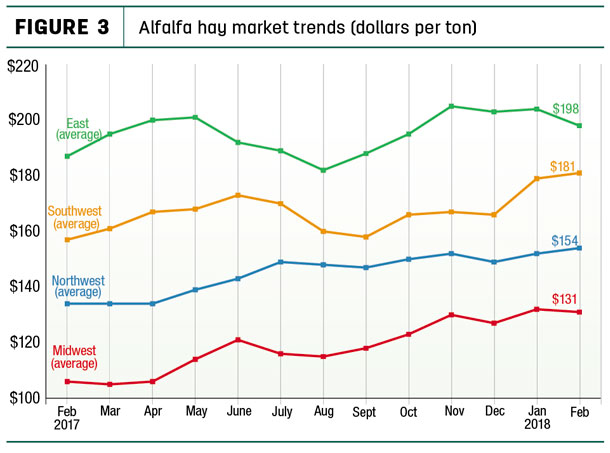

Western markets were the primary driver in pushing U.S. average alfalfa hay prices higher. February 2018’s average price of $155 per ton was up $3 from January and $28 more than February 2017; it was the highest since May 2017.

Regionally, averages were up in the Northwest and Southwest (Figure 3) where dry conditions remain the most extensive.

Compared to a month earlier, February average alfalfa hay prices were up $10 per ton in Arizona and Colorado, but also up $8 in Wisconsin. In contrast, averages were down $19 per ton in Pennsylvania, and $10 in Nevada, Ohio and Oregon.

Compared to a month earlier, February average alfalfa hay prices were up $10 per ton in Arizona and Colorado, but also up $8 in Wisconsin. In contrast, averages were down $19 per ton in Pennsylvania, and $10 in Nevada, Ohio and Oregon.

Price increases from a year earlier were more dramatic and widespread. February 2018 prices for alfalfa hay were up $54 per ton in Kansas and $40 or more in California, Minnesota, New York, Washington and Wisconsin. Only Illinois and Pennsylvania saw lower alfalfa hay prices compared to a year earlier.

Highest alfalfa hay prices were in New York ($238 per ton), Kentucky ($215 per ton) and California ($205 per ton); lowest prices were in Nebraska ($101 per ton) and North Dakota ($102 per ton).

Other hay

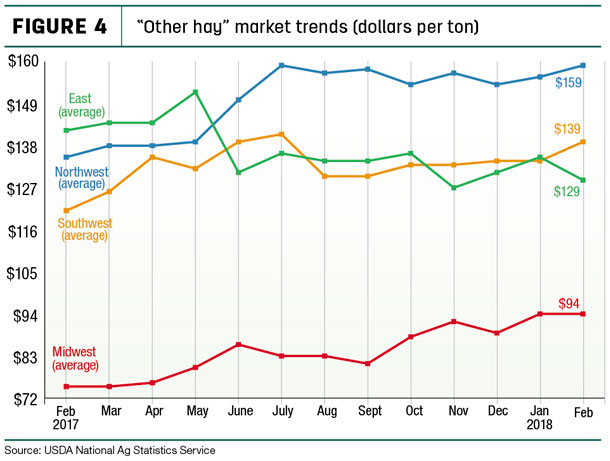

The February 2018 U.S. average price for other hay was estimated at $124 per ton, unchanged from January and just $3 more than February 2017.

Like alfalfa hay, regional averages were higher in the Northwest and Southwest, but steady to lower in the East and Midwest (Figure 4).

Oklahoma saw the largest jump from January, up $19 per ton, with Washington up $10. Pennsylvania led decliners, down $22 per ton from a month earlier; Iowa, Kansas, Michigan, Ohio, South Dakota and Texas saw lower prices as well.

Oklahoma saw the largest jump from January, up $19 per ton, with Washington up $10. Pennsylvania led decliners, down $22 per ton from a month earlier; Iowa, Kansas, Michigan, Ohio, South Dakota and Texas saw lower prices as well.

As with alfalfa hay, individual state price changes from a year earlier were more notable. February 2018 prices for other hay were up $75 per ton in Washington and $35 per ton in Arizona. In contrast, New York saw a $47 drop in the year-to-year average other hay price, and the price in Pennsylvania was down $18 per ton.

Highest other hay prices were in Washington ($230 per ton) and Arizona and Colorado (both $190 per ton); lowest prices were in Kansas ($76 per ton) and Nebraska and North Dakota ($79 per ton).

Figures and charts

The prices and information in Figure 3 (alfalfa hay market trends) and Figure 4 (“other hay” market trends) are provided by NASS and reflect general price trends and movements. Hay quality, however, was not provided in the NASS reports. For purposes of this report, states that provided data to NASS were divided into the following regions:

- Southwest – Arizona, California, Nevada, New Mexico, Oklahoma, Texas

- East – Kentucky, New York, Ohio, Pennsylvania

- Northwest – Colorado, Idaho, Montana, Oregon, Utah, Washington, Wyoming

- Midwest – Illinois, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, South Dakota, Wisconsin

Organic hay

The USDA’s organic hay report, released March 28, reported delivered Supreme organic alfalfa large square bales in a range of $330 to $360 per ton. No prices were reported for FOB farm gate organic hay.

National organic grains and feedstuffs report

Other factors

Other factors impacting forage producers include:

-

Exports: Latest monthly (February 2018) hay export numbers were not available at Progressive Forage’s deadline.

- Dairy outlook: U.S. milk production posted another 1.8 percent increase in February, fueled primarily by year-over-year gains west of the Mississippi River. Cow numbers grew for a fourth consecutive month. Compared to a year earlier, the largest growth in cow numbers was in Texas (+16,000 head) and Colorado (+12,000 head), with New Mexico (+9,000 head), Arizona (+6,000 head) and Utah (+5,000) also posting significant gains. California (-17,000 head) and Minnesota and Wisconsin (each -5,000 head) led decliners.

The number of U.S. dairy cows culled during February was the highest for the month dating back to 2012 (a leap year).

February milk prices weakened and will likely be the low point of the year. The U.S. average margin over feed costs slipped to $6.88 per hundredweight (cwt), with corn, soybean meal and alfalfa hay prices all increasing during the month. Together, total February feed costs of $8.42 per cwt of milk sold were up 44 cents from January and the highest since July 2016.

Based on milk and feed futures prices as of March 27, the Program on Dairy Markets and Policy projects monthly Margin Protection Program for Dairy (MPP-Dairy) margins will hover around $7 per cwt through June.

- Beef outlook: A slower-than-expected pace in first-quarter cattle slaughter implies second-quarter beef production could pick up, putting pressure on prices. U.S. cattle and calves in large feedlots totaled 11.7 million head on March 1, 2018, 9 percent more than a year earlier.

Pasture and range conditions were rated poor to fair across a wide section of the Plains and Southwest, with supplemental feeding a common chore in the region.

Colorado livestock producers were aggressively trying to purchase hay in preparation for potentially poor grazing conditions. In the Texas Panhandle, rainfall started turning pastures green again, but hay remains in demand and difficult to find.

-

Fuel prices: Retail pump prices were unseasonably higher, with demand on the rise. Fuel taxes have also increased in some states. The U.S. Energy Information Administration (EIA) estimated U.S. retail prices for regular gasoline ended March up a nickel from the previous week, to $2.65 per gallon, and stood 33 cents per gallon higher than a year ago.

The weekly U.S. average diesel fuel price rose 4 cents to $3.01 per gallon and was 48 cents higher than a year ago. The early rise in prices does not bode well for summer.

-

Dave Natzke

- Editor

- Progressive Forage

- Email Dave Natzke