Whether it’s counting the slow accumulation of growing degree days, watching milk futures prices rise and fall, or trying to follow trade negotiations with China, the spring of 2019 is turning into one that tests the patience of nearly everyone involved in the hay industry.

Hay exports show life in March

U.S. hay exports picked up a bit in March. At 124,743 metric tons (MT), shipments of other hay showed a modest gain, turning in the highest monthly total since last November. March sales were valued at $42 million.

Shipments of other hay increased to all four major foreign markets: Japan, South Korea, Taiwan and United Arab Emirates (UAE). At more than 66,000 MT, Japan remained the leading market, taking 53 percent of the month’s total.

March alfalfa hay shipments totaled 222,403 MT, the highest monthly total since last September; exports were valued at $69.7 million. Among leading markets for alfalfa hay, the top buyer continued to be Japan at more than 66,600 MT. Shipments to China also increased to 58,635 MT, a three-month high, but remain well below pre-tariff levels. Sales to Saudi Arabia were down slightly from February, but volumes to the UAE, South Korea and Taiwan were all up.

Trade negotiators had fueled hope the tariff wars between the U.S. and China could be resolved, but at Progressive Forage’s deadline, President Trump had threatened to impose additional tariffs on goods imported from China, leading to the likelihood more retaliation could be in store.

In addition to the potential escalation of a U.S.-China trade war, another thing to watch will be the African swine fever epidemic in China. Rabobank global dairy strategist Mary Ledman said the disease could reduce China’s pork production by 25 to 30 percent this year, and herd recovery could take years.

What’s that got to do with hay? Rising demand for alternative protein sources, especially beef, could accelerate China’s dairy cow culling to fill some of that protein demand gap.

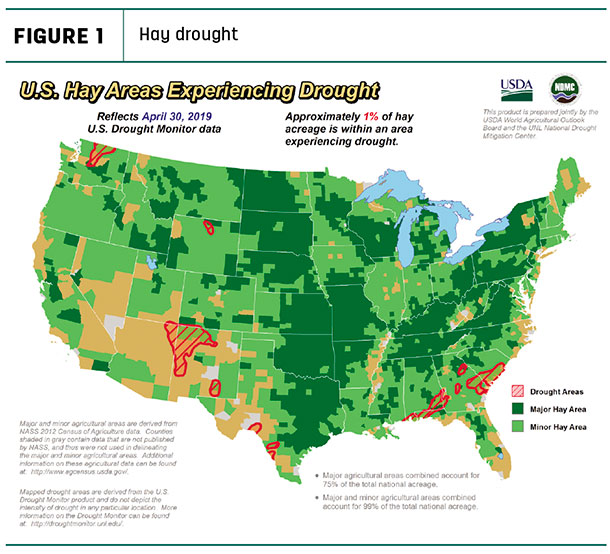

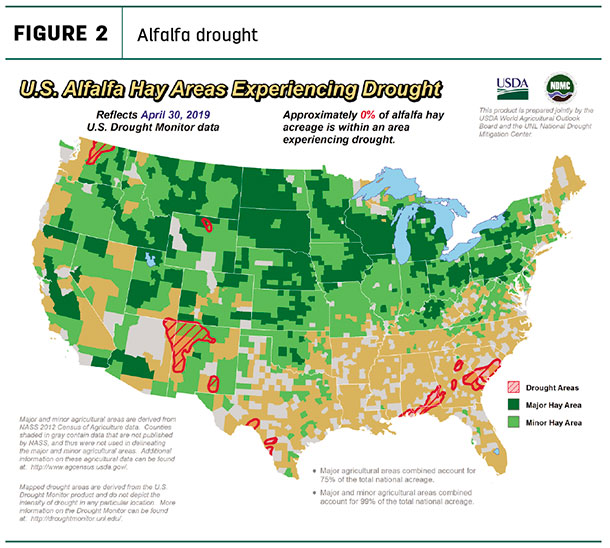

Drought areas disappearing

The USDA’s drought monitor shows the smallest hay area under dry conditions in a decade. If anything, there’s probably more acreage suffering from flooding rather than drought.

About 1 percent of U.S. hay-producing acreage (Figure 1) was considered a drought area as May began, with small pockets in Washington, New Mexico and the Southeast. The drought map was even better for alfalfa hay-producing areas, where less than 1 percent (Figure 2) was located in areas experiencing drought at the end of April.

In contrast, the USDA’s weekly weather and crop bulletin, updated May 7, indicated 32 percent of all U.S. cropland topsoil was surplus in moisture. Excess moisture issues were most severe in the Upper Midwest and South Dakota, south along the Mississippi River, Oklahoma and New England.

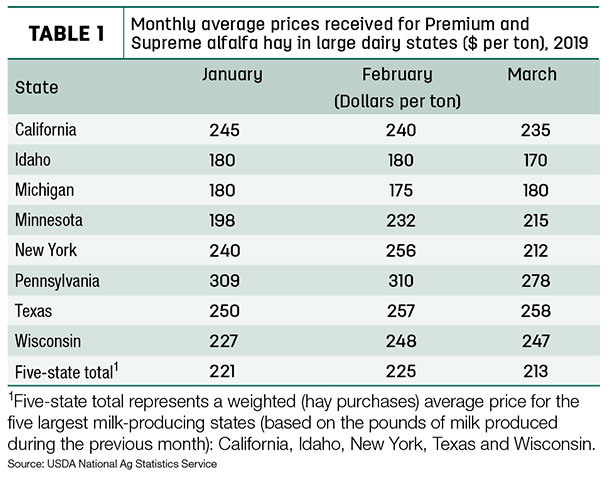

Dairy hay prices decline, but others improve

The USDA’s National Ag Statistics Service has begun reporting average “dairy-quality” (Premium and Supreme) hay prices in the top milk-producing states, averaging prices for the top five: California, Idaho, New York, Texas and Wisconsin (Table 1). March 2019 dairy-quality hay prices in those states averaged $213 per ton, down $12 from February.

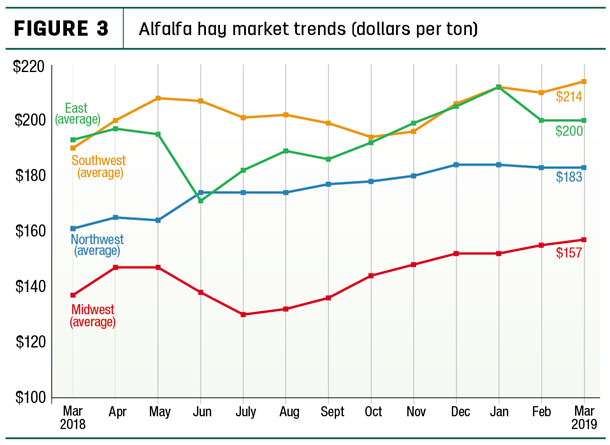

Alfalfa

Despite weaker prices in major dairy states, U.S. average all alfalfa hay prices rose in March to $184 per ton, a 10-month high. Regionally, averages were mostly steady in the East, Midwest and Northwest, but up in the Southwest (Figure 3).

Most states see little month-to-month price changes for all alfalfa hay, with a couple of exceptions: Pennsylvania’s March average was up $31 per ton from February, while its neighbor, New York, saw prices decline $34 per ton.

Compared to a year earlier, alfalfa hay prices were up $68 per ton in Wisconsin, up $60 in New Mexico, and up $50 to $52 in Minnesota, Pennsylvania, Oklahoma and Colorado. New York again reported the biggest price drop, down $24 per ton from March 2018.

High monthly alfalfa hay prices were in New Mexico ($260), Colorado ($240), Pennsylvania and Tennessee (both $230), and California ($225). The low price for the month, at $92 per ton, was in North Dakota.

Other hay

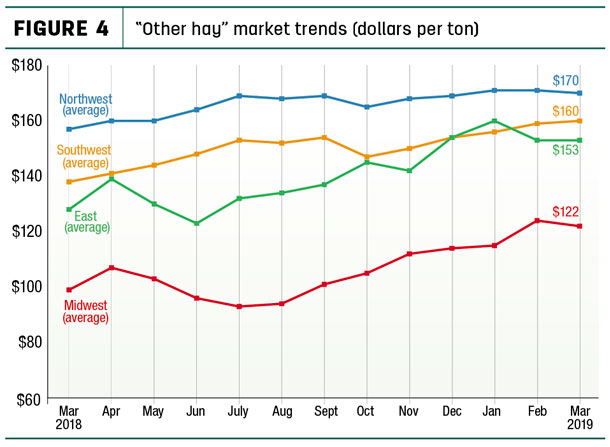

The U.S. average price for other hay was estimated at $147 per ton in March, up just $1 per ton from February, but holding at the highest average since April 2014. March 2019 average prices changed little across all regions from the month before (Figure 4).

Among individual states, Wisconsin, Minnesota and California saw the largest year-over-year increases, up $62, $51 and $50 per ton, respectively, while the average price was down $25 per ton in Indiana.

Highest average prices for other hay in March were in Colorado ($220 per ton), Arizona ($200) and Pennsylvania ($192). On the other end of the spectrum, the average price in North Dakota was just $67 per ton.

Organic hay prices

Limited information was available on organic hay prices. According to the USDA, f.o.b. farm gate prices paid for Supreme alfalfa small square bales averaged $250 per ton at the end of April.

Regional markets

A summary of early May conditions and markets:

• East: In Pennsylvania’s Lancaster area, early May saw the first loads of 2019 hay, but market activity was light, limiting alfalfa price information. Producers continue to clean out the remainder of 2018’s hay crop. Grass and alfalfa-grass hay prices were trending up to $20 per ton lower.

In Alabama, hay prices were steady on light supplies and moderate demand.

• Midwest: In Minnesota, the long winter and spring flooding have taken a toll on alfalfa fields in parts of the state. Varying levels of winter injury and winterkill have been reported. Areas most often affected include hilltops where crowns were exposed during the cold winter months and where extended flooding has occurred this spring. There have also been reports of frost heaves uprooting alfalfa crowns.

In Wisconsin, hay prices were steady to higher, with strong demand for quality hay. Contacts said alfalfa winterkill was substantial; in some cases, 50 to 100 percent of fields were lost.

In Iowa, buyers are continuing to hunt for better-quality hay and appear to be willing to pay for it, as pastures are slow to rebound after this past winter. Forages and straw were tougher to come by. Prices appeared to be a little higher, but the quality also was a little poorer. Straight alfalfa was limited in availability.

In Nebraska, there were more hay sellers than buyers. Snow and rain across the state delayed spring fieldwork. Some producers continue to bale cornstalks. County road conditions were poor across most of the state, with some areas applying weight restrictions that made it difficult to get forage products to farmers/ranchers in remote areas.

In Kansas, treatment of alfalfa weevil infestations has been necessary. Hay market trade activity and demand remained very slow; prices were steady with softer undertones. Much of the hay moving is previously contracted or spot loads. New-crop pricing is still illusive, but there does seem to be a definite split in opinions on price: Folks in the west believe alfalfa hay will start significantly lower while those in the east say their price will remain the same until first cutting is in the barn. Rainfall threatened to delay alfalfa harvest in the Southeast.

In Missouri, fieldwork was brought to a standstill due to heavy rains. After the long feeding season, hay piles are low to nonexistent, and the need to start rebuilding inventories is high.

• Southwest: In California, silage crops were being cut as alfalfa continued to mature.

In Oklahoma, trade was at a standstill as rain and spring storms held up first-cutting alfalfa. Demand for first cutting appears good, but prices remain untested. A small amount of alfalfa had been cut and most of this received rain damage. Widespread rains and flooding also curtailed wheat-hay baling. Demand for wheat hay was very good.

In Texas, most hay classes traded steady to lower as the new crop begins to trickle onto the market. Pastures in the Panhandle are in good condition, and a nice wheat crop is expected. Coastal bermuda producers in the north and east dodged thunderstorms and tornados, delaying baling.

• Northwest: In Idaho, producers were attempting to liquidate domestic old-crop alfalfa supplies to make room for the new crop, leading to weaker prices. Some contracting of new-crop alfalfa has been reported.

In Colorado, light seasonal trade activity has postponed regular market updates until mid-June.

In Utah, most hay movement was limited to existing contracts.

In Montana, many producers have hay priced to move as they are trying to finish selling the last of 2018’s crop. Pasture and rangelands have been slow to green up this year due to cool weather. This has helped ranchers feed through some of their existing supplies; however, round supplies continue to be large.

In Oregon, almost all feeder hay qualities are sold out, so customers needing feeder hay have been forced to purchase higher qualities.

In the Washington-Oregon Columbia Basin, all grades of alfalfa for export were steady in a light test. First cutting of new-crop alfalfa was set to begin, and the first export contracts were reported. The cutoff relative feed value test for export alfalfa is 135.1 or better for the higher prices; lower than 135.1 brings discounted prices.

In Wyoming, all baled hay, sun-cured alfalfa pellets and alfalfa hay cubes sold steady. Winter continued to linger.

Dairy outlook: Heavy culling, better milk prices

At 302,400 head, U.S. dairy farmers moved more dairy cull cows to slaughter in March 2019 than in any month since December 1986. The heavy culling is having an impact on the size of the U.S. dairy herd. U.S. dairy cow numbers dropped to 9.344 million in March, the lowest total since November 2016.

The March 2019 U.S. average milk price rose 70 cents per hundredweight (cwt) from February to $17.50 per cwt and was $1.80 higher than March 2018 and the highest average since November 2017.

Fuel outlook: Oil prices move higher

Tightening global oil supply and demand balance and increasing supply disruption risks led the U.S. Energy Information Administration (EIA) to raise oil price forecasts from last month. Brent crude oil spot prices averaged $71 per barrel in April, up for a fourth consecutive month. Even with that increase, EIA forecasts Brent spot prices will average $70 per barrel in 2019 and $67 per barrel in 2020, compared with an average of $71 per barrel in 2018.

For the April-through-September period, EIA forecasts that U.S. regular gasoline retail prices will average $2.92 per gallon, up from an average of $2.85 per gallon last summer. Full-year retail diesel prices are expected to average $3.18 per gallon in 2019, rising to $3.29 per gallon in 2020. That compares to $3.18 per gallon in 2018.

Figures and charts

Progressive Forage tracks regional hay price trends using average monthly prices reported for selected states by the USDA’s National Agricultural Statistics Service (NASS). The USDA report does not provide hay quality classes in its price reports. By region, states included:

• Southwest – Arizona, California, Nevada, New Mexico, Oklahoma, Texas

• East – Kentucky, New York, Ohio, Pennsylvania, Tennessee, Virginia

• Northwest – Colorado, Idaho, Montana, Oregon, Utah, Washington, Wyoming

• Midwest – Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, South Dakota, Wisconsin ![]()

-

Dave Natzke

- Editor

- Progressive Forage

- Email Dave Natzke