We’ll get an indicator of the 2018 hay harvest with the USDA’s next crop production report, scheduled for Oct. 11.

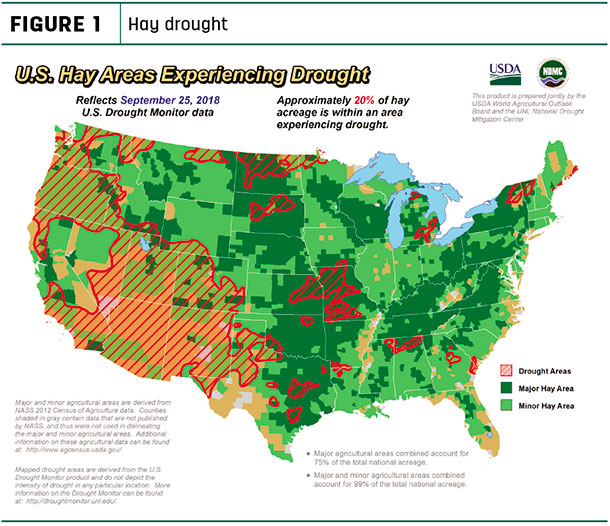

The USDA’s World Agricultural Outlook Board estimated about 20 percent of U.S. hay-producing acreage was located in areas experiencing drought as of Sept. 25, an 8 percent improvement from the start of the month (Figure 1). A closer look at the map, however, showed nearly all the improved moisture conditions occurred in east and central Texas, with virtually no change elsewhere.

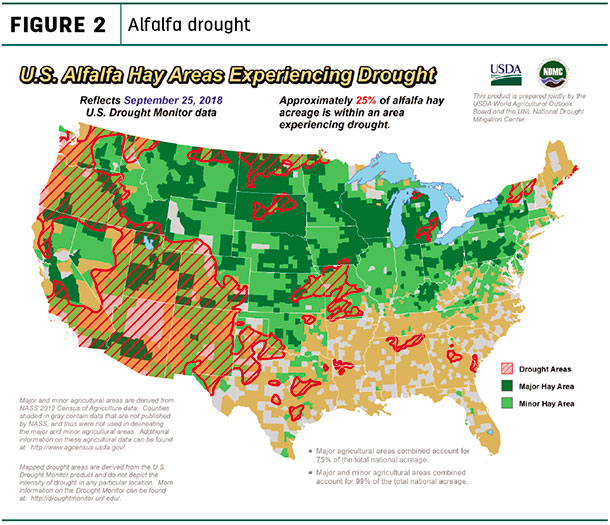

In contrast, about 25 percent of alfalfa hay acreage was under drought conditions (Figure 2), a 1 percent deterioration from the start of September. While moisture levels improved in southern Oklahoma, conditions worsened in pockets of Michigan and New York.

Regional markets

Conditions vary in major hay-growing areas of the country as of early October:

-

Midwest: In Kansas, fall hay cutting shared time with harvesting corn and planting winter wheat. Hay prices continue to stay stable, as sellers are reluctant to back off prices in anticipation of a long, cold winter and shorter supply of alfalfa and grass hay. Potato leafhoppers were in densities exceeding treatment thresholds. Fall armyworms are more commonly thought of as a pest of corn and sorghum, but moths are laying eggs in alfalfa.

In Missouri, market activity was light as many cattle farmers were content to watch fall grass grow prior to frost before determining hay needs. Many sellers are thinking prices will increase as winter begins and are not offering hay into the market.

In Nebraska, producers in some areas were considering taking a fifth cutting of alfalfa. Frost arrived in the panhandle and central regions. Some native grass hay producers dodged water holes to harvest tall, mature grass for feed this winter; quality isn’t the best, but it’s better than nothing.

In Iowa, small squares and Premium hay continued to be hard to find, while large rounds were plentiful. Growers may be storing hay for sales throughout the winter.

In South Dakota, dairies need high-testing hay and are having difficulty finding it. There was good demand for grass hay as cattle feeders need it to start calves, but higher prices are compelling them to look at corn stalks as an alternative forage to blend into their rations. Cool, cloudy and wet conditions delayed hay growers from finishing up their final cutting; devastating rains plagued the eastern side of the state.

In Wisconsin, quality alfalfa hay prices were strong; however, lower quality hay continues to be discounted no matter the package size. Many farmers were taking a late harvest of hay, harvesting corn silage, soybeans and high-moisture corn. After they get feed in storage and take inventory, they’ll make purchasing decisions. Farmers in drought-affected areas were purchasing corn and hay standing in the field to add to their inventory.

In southwest Minnesota, prices were steady to weaker with no quality hay available. Only lower quality hay was offered, with little demand.

-

Northwest: About one-third of Colorado’s fourth-cutting alfalfa was completed. Hay markets saw stronger buyer interest in small squares for horse hay; dairy and feeder cattle hay markets were slow. Below-average water available for irrigation, coupled with extreme drought conditions in the western half of the state, has applied substantial upward pressure to hay prices throughout this haying season. Stored feed supplies were rated 25 percent short or very short.

The bulk of the alfalfa and alfalfa-grass hay offered on the High Plains Hay Exchange internet auction graded Good, with consignments from eastern and central Wyoming and the Nebraska Panhandle. There was fairly good demand for cow hay, while dairy-quality hay was scarce. Large round bales were net wrapped.

Most hay sold in Wyoming was reportedly headed to out-of-state buyers. With frost arriving, many producers are on the third cutting or are done for the year on alfalfa and mixed hay varieties.

In Idaho, most dairies were offering 85 to 90 cents per relative feed value (RFV) point on hay testing 170 RFV or better. There was good demand for all grades of alfalfa.

Alfalfa hay prices sold generally steady in Montana, with heavy supplies.

In Utah, hay prices were mostly firm, with trading slow on all qualities.

Many Montana producers have hay for sale, and with plenty of grazing available, ranchers have been less than enthused about buying hay. Square prices continue to be a premium to rounds due to shipping cost. Demand for hay to sell into drought areas remains good. Export demand is mostly good as buyers continue to purchase clean green hay for Pacific Rim countries.

In Oregon, retail/stable-type hay remained mostly in demand. Demand for export hay has increased.

In the Columbia Basin, exporter demand was light, with more interest shown by dairies. High-testing alfalfa was in short supply.

-

Southwest: Harvest continued in New Mexico. Producers in the eastern and north-central regions were between the fourth and fifth cuttings; southern producers were wrapping up fifth cuttings. The southeastern region was 70 to 100 percent into fifth cuttings.

Oklahoma alfalfa markets were most active in western and northwestern counties. Supplies and offerings remained fairly light, although fourth-cutting alfalfa and second-cutting grass hay harvests were wrapping up. Armyworms were reported in several areas, with infestations ranging from mild to severe.

Texas producers were also battling armyworms. Most of the state has received rainfall. Coastal bermudagrass producers in the north, east and south were hopeful to get dried out to get a fourth cutting. All hay classes traded fully steady, with moderate supply and demand.

-

East: All varieties of hay sold mostly steady at southeastern Pennsylvania hay markets.

Hay prices were steady, with moderate supply and demand, in Alabama.

Early reports estimate about half of North Carolina’s cotton crop was lost to Hurricane Florence, according to Nigel Adcock, with Cottonseed LLC. In terms of cottonseed availability, this would remove about 100,000 tons of cottonseed from an area that typically serves export markets and dairy farmers in New York, Pennsylvania, Ohio and Michigan. In addition to quantity, dairy buyers should also be wary of cottonseed quality, including sprouted seeds and increased risks of molds and mycotoxins, Adcock said.

Hay prices diverge

The latest available USDA monthly Ag Prices report summarized August 2018 prices. Compared to July, average prices were slightly lower for alfalfa hay, but higher for other hay.

Alfalfa

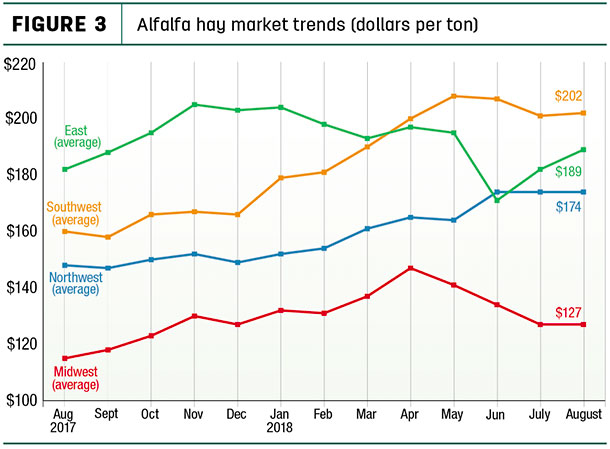

National average alfalfa hay prices continued a slow decline from the spring peak. At $177 per ton, the August 2018 U.S. average price was down $2 from July and $12 from May, but still $30 more than August 2017. Regionally, prices rose in the East, but were mostly steady elsewhere (Figure 3).

Compared to a month earlier, August average alfalfa hay prices rose $20 per ton in Pennsylvania and between $10 to $15 per ton in Illinois, Nebraska, Oklahoma and Utah. Prices declined $5 to $12 per ton in several states west of the Mississippi. Highest average alfalfa hay prices topped $240 in New Mexico and $220 in Kentucky and Arizona. The low prices for the month, under $100 per ton, could be found in South Dakota, North Dakota and Minnesota.

Other hay

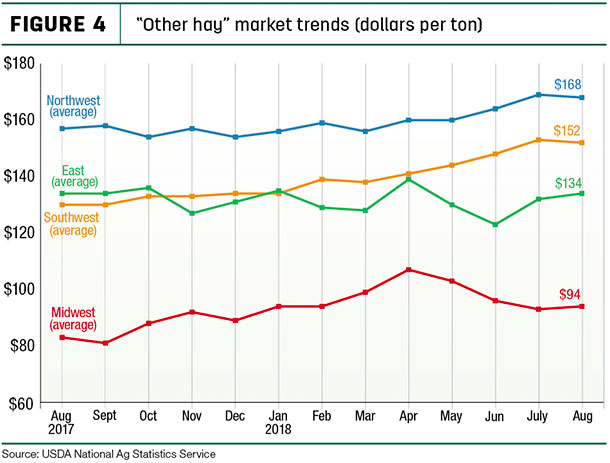

The U.S. average price for other hay was estimated at $130 per ton, up $4 from July and the highest in 16 months. Regionally, August 2018 average prices dipped lower in the Southwest and Northwest, but were higher elsewhere (Figure 4).

Among individual states, Indiana and Michigan saw the largest price increases from July, up $15 per ton. Price declines of $10 to $20 per ton were seen in Tennessee, Nevada, Minnesota and Washington.

Compared to a year earlier, prices were $35 to $40 higher in Kentucky, Colorado, Oklahoma and Michigan; biggest decliners were New York (-$43) and Washington (-$35).

Highest average prices for other hay hit $200 or more per ton in Arizona and Colorado. North Dakota and Minnesota saw monthly lows of $69 and $73 per ton, respectively.

Figures and charts

The prices and information in Figure 3 (alfalfa hay market trends) and Figure 4 (“other hay” market trends) are provided by NASS and reflect general price trends and movements. Hay quality, however, was not provided in the NASS reports. For purposes of this report, states that provided data to NASS were divided into the following regions:

- Southwest – Arizona, California, Nevada, New Mexico, Oklahoma, Texas

- East – Kentucky, New York, Ohio, Pennsylvania, Tennessee, Virginia

- Northwest – Colorado, Idaho, Montana, Oregon, Utah, Washington, Wyoming

- Midwest – Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, South Dakota, Wisconsin

Organic hay

According to the USDA’s organic hay report, FOB farm gate organic hay prices at the end of September were as follows:

- Good-Premium grass-alfalfa small square bales – $180 per ton

- Good alfalfa mid square bales – $170 per ton

- Fair alfalfa large square bales – $250 to $260 per ton

- Utility alfalfa mid square bales – $130 per ton

- Good-Premium oat hay large square bales – $185 per ton

Hay exports

The USDA’s monthly export report for August was released after the Progressive Forage Extra enewsletter’s production deadline.

Dairy remains weak

One of the U.S. hay market’s biggest customers – dairy farmers – continued to struggle with weak milk prices, although lower feed costs provided some support.

The August U.S. average milk price rose 50 cents per hundredweight (cwt) from July, to $15.90 per cwt, but was still $2.10 less than August 2017. Through the first eight months of 2018, the U.S. average milk price stands at $15.83 per cwt, compared to $17.55 per cwt in the same period of 2017.

Lower feed costs helped boost the national average milk-income-over-feed-cost margin to about $7.43 per cwt in August, the highest since January. As a result, dairy farmers who enrolled in the Margin Protection Program for Dairy (MPP-Dairy) and elected $7.50 and $8 per cwt margin coverage levels will see small payments for milk marketed in August. But those payments will likely be the last of the calendar year.

A decline in cow numbers was offset by stronger milk output per cow, pushing August 2018 milk production up 1.4 percent compared to a year earlier. However, August cow numbers reversed course from July 2018, which had a 9,000-cow drop.

Dairy producers in nine of the major dairy states had more cows than a year ago, led by Texas (+20,000 head), Colorado (+14,000) and Kansas (+8,000). Producers in 13 states had fewer cows than a year earlier, led by California (-12,000 head), Ohio (-7,000) and Pennsylvania and Minnesota (each -6,000 head).

With producers putting an emphasis on cow comfort and most areas seeing more moderate weather conditions compared to July, August’s monthly milk production per cow was up 27 pounds nationally compared to a year earlier.

Other market factors

-

Beef outlook: In the third quarter of 2018, the pace of steer and heifer slaughter in July and August was slower than expected. Resisting lower prices from packers, and with lower feed costs, feedlots may be keeping cattle on feed longer.

Feeder cattle prices have shown strength through the summer, but seasonal pressures will likely take hold, moving prices lower in the fourth quarter. Prices typically decrease when the spring-born calves (about two-thirds of the annual calf crop) are brought to market in the fall. Assuming normal weather in the Great Plains, availability of winter forages for backgrounding could bolster prices in the fourth quarter of 2018.

-

Fuel prices: At $2.84 per gallon, the national average regular gasoline retail price ended September nearly 26 cents higher than a year earlier. Smaller gains were noted in the East and Gulf Coast regions, but those were offset by substantially larger increases in the Midwest, Rocky Mountain and West Coast regions.

At $3.27 per gallon, the U.S. average diesel fuel price was up 48 cents from a year earlier. The regional disparity in increases was not as dramatic as with gasoline, but California diesel prices were up almost 66 cents compared to a year ago.

-

Interest rates: Meeting Sept. 26, the Federal Reserve board raised the federal fund rate by a quarter of 1 percent, the third increase this year. Market analysts forecast another increase in December, as well as three more increases in 2019 and one more in 2020.

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke