The USDA released its Prospective Plantings report on March 29. Based on surveys conducted during the first two weeks of March, U.S. producers intend to harvest 53.1 million acres of all hay in 2019, up less than 1 percent from 2018. (The report does not differentiate between alfalfa and other hay.) If realized, this will represent the third-lowest total hay harvested area since 1908, behind 2017 and 2018.

Whether these acreage estimates continue to be accurate remains to be seen. Flooding and other weather-related factors could impact hay acreage in a number of major hay-producing states. And the cold, wet spring has delayed determination of alfalfa winterkill levels in many northern states.

Regionally, the USDA estimate indicates modest decreases in hay acreage across most of the Rocky Mountain states, offset by modest increases in most Corn Belt and Northeast states.

Texas is expected to lead all states in hay acreage, followed by Missouri and Oklahoma. Rounding out the top 10 states are South Dakota, Montana, Nebraska, North Dakota, Kansas, Kentucky and Tennessee.

A 60,000-acre decline in California continues a long-term trend that has seen hay acreage drop 455,000 acres since 2014 and 620,000 acres in the past decade. Among other leading dairy states, hay acreage is expected to decline slightly in Idaho and Michigan, but rebound somewhat in Pennsylvania.

Main hay exporting states in the Pacific Northwest (Oregon and Washington) anticipate small increases in acreage devoted to dry hay, but less acreage is estimated for many Southwest states (Arizona, New Mexico, Nevada and Utah.)

Hay exports start year lower

U.S. hay exports declined in January, with foreign sales of alfalfa hay turning in a 12-month low based on both volume (181,442 metric tons, or MT) and value ($56.5 million).

The decline in 2018 crop alfalfa acreage and yield, and this year’s weather-related disruptions of road, rail and vessel shipments could restrict exports throughout early 2019, said Christy Mastin with Eckenberg Farms Inc. of Mattawa, Washington. In the Pacific Northwest, first-cutting harvest has been delayed, so shipments look to get a late start as well.

Among leading markets for alfalfa hay, China’s January total of 25,461 MT was the lowest monthly volume in more than six years. Although the threat of additional tariffs has been reduced, China remains a wait-and-see market.

With a dairy expansion underway, alfalfa sales to Japan remained steady, with increasing demand. For years, Japanese dairy operators sought to take advantage of rising beef demand, using Wagyu embryo transfers to produce pure Wagyu calves from Holstein cows. This gradually led to a shortage of Holstein calves, according to USDA’s Foreign Agricultural Service. The market started to correct itself with increased Holstein heifer births in 2016, and those cattle are now starting to produce milk. Hay shipments to Japan will have to work around a “Golden Week” holiday at the end of April into May, Mastin noted.

Sales of other hay totaled 114,6455 MT in January, the lowest total since September 2018. Total shipments were valued at $38.3 million, also the lowest since last fall. Among leading markets for other hay, increased sales to Japan were offset by lower sales to South Korea, which is oversupplied with timothy, Mastin said.

January 2019 shipments of dehydrated and sun-dried alfalfa meal and cubes were mixed compared to December 2018, but well below January 2018.

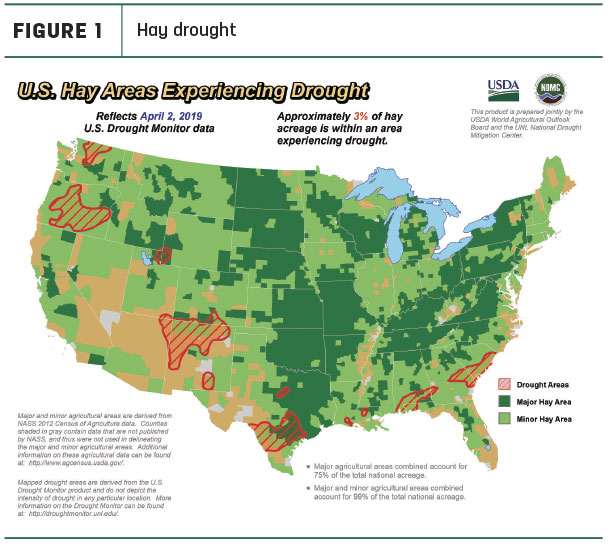

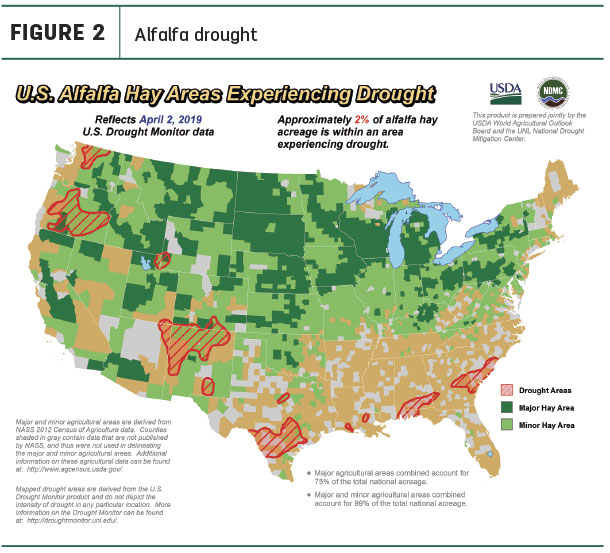

Drought areas

The USDA’s drought monitor shows the smallest hay area under drought conditions in nearly two years. About 3 percent of U.S. hay-producing acreage (Figure 1) and about 2 percent of alfalfa hay acreage (Figure 2) were located in areas experiencing drought at the start of April.

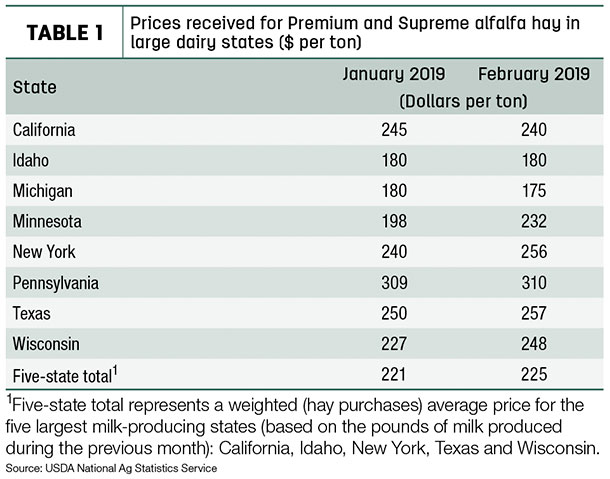

Hay prices: New dairy information

In an effort to more accurately calculate dairy farmer feed costs under federal dairy safety net programs, the 2018 Farm Bill mandated the USDA to begin reporting average “dairy quality” hay prices in the top five milk-producing states. The USDA’s National Ag Statistics Service began reporting prices for Premium and Supreme alfalfa hay with the latest monthly Ag Prices report, released March 28. The report actually lists hay prices in seven states, and an average for the top five: California, Idaho, New York, Texas and Wisconsin (Table 1).

Alfalfa

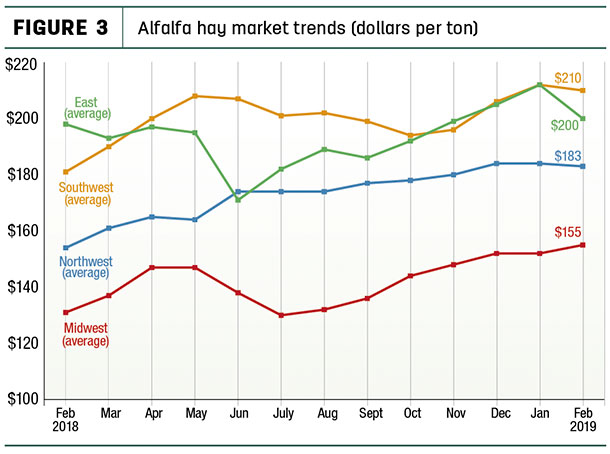

Overall, hay prices were steady in February, according to the USDA. At $180 per ton, the national average alfalfa hay price was down $1 from January. Regionally, averages were down in the East, primarily due to a sharp decline in Pennsylvania, with little change in the Midwest, Northwest and Southwest (Figure 3).

Year-to-year changes among individual states told a slightly different story. Compared to a year earlier, alfalfa hay prices were up $85 per ton in New Mexico, and $49 to $63 higher in Wisconsin, Minnesota, Colorado and Oklahoma. New York again reported the biggest price drop, down $38 per ton from February 2018.

High monthly alfalfa hay prices were in New Mexico ($260), Colorado ($240), California and Kentucky (both $220), and Arizona ($210). The low price for the month, at $90 per ton, was in North Dakota.

Other hay

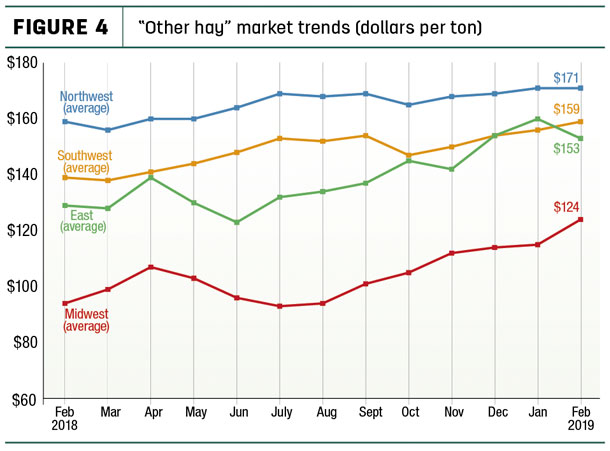

The U.S. average price for other hay was estimated at $146 per ton, unchanged from January and holding at the highest average since April 2014. Regionally, February 2019 average prices were higher in the Midwest and South, unchanged in the Northwest and lower in the East (Figure 4).

Among individual states, Wisconsin and Colorado saw the largest year-over-year increases, up $64 and $55 per ton, respectively, while the average price was down $35 per ton in Washington.

Highest average prices for other hay in February were in Colorado ($240 per ton), Arizona and Washington (both $200), and Pennsylvania ($185 per ton). On the other end of the spectrum, Nebraska averaged $96 per ton, with North Dakota at $68 per ton.

Organic hay prices

According to the USDA’s organic hay report, FOB farm gate prices paid for Premium alfalfa small square bales averaged $250 per ton at the end of March.

Regional markets

A summary of early April conditions and markets:

• East: In Alabama, trade was moderate with moderate supply and demand.

In Pennsylvania’s Lancaster area, large bales of hay traded mostly steady and small bales traded steady to $10 lower. In southeastern Pennsylvania, prices firmed for best quality loads.

An unusually wet winter could cause fertility, weed and disease problems with summer forage crop quality in Georgia.

• Midwest: In Kansas, questions remained regarding new-crop hay, and the jury was divided as to whether the recent flooding in Nebraska, Iowa and Missouri will affect the market. Although more hay was becoming available, most grinders indicated that they are pretty well bought up until May, leaving some with a few extra loads they did not expect.

In Missouri, some livestock producers still needed a few bales to finish the feeding season, supporting demand. Fields were greening up, but grass was still a ways from getting ahead of cattle eager to graze. Many growers along the major rivers in northern parts of the state were dealing with flooding, which exceeded all-time records.

In Iowa, prices slid downward on lower-quality hay, while quality hay held its own. Roads were firming up, and changing weather patterns allowed more producers to sell hay and straw. There were concerns over alfalfa winterkill due to low winter soil temperatures.

In Nebraska, several producers lost piles of bales to flood damage, and county roads and fields remained too soft to haul hay. Many livestock owners were a few weeks away from summer grass.

In South Dakota, there was very good demand for all types of hay, but supplies were tight. Snowmelt and localized flooding caused transportation problems.

In southwest Minnesota, prices were steady with a wide range of prices on lower-quality hay.

In Wisconsin, prices and demand were strong.

In Ohio, winter was characterized by a lot of variability in temperatures, snow depths, rain, sleet and ice, creating the potential for significant winter injury, but the slow onset of spring has delayed the ability to determine the extent of damage.

• Southwest: In Oklahoma, producers were still cleaning out hay as they serviced equipment and sprayed for aphids and weevils. Both wheat pasture and alfalfa fields showed good growth. Grass hay demand has tapered off in central and southern Oklahoma.

In Texas, the wait for new-crop hay continued. Panhandle pastures were in good condition after rains and warming temperatures. Rainfall disrupted east and north Texas coastal bermuda producers preparing to spray fields.

March brought slightly below-average temperatures to California. Soil moisture conditions were rated adequate to surplus. Pastures started to green up, but livestock remained on supplemental feed.

• Northwest: In Montana, demand for square bales to ship out of the state was good, but supplies were limited. Demand for hay in round bales was light to moderate. Good moisture conditions have producers optimistic for the upcoming season.

Rainfall eliminated remaining pockets of abnormal drought in northeastern and east-central Colorado, and another round of moderate to heavy snow across central and western Colorado pushed mountain snowpack water equivalents to record or near-record levels.

In Idaho, first reports of new-crop contracts emerged.

In Oregon, prices trended generally steady; all sales reported were for 2018 crop year hay, and many growers are sold out. In the Washington-Oregon Columbia Basin, demand remained excellent, but remaining supplies are in firm hands. Most growers were forgoing spraying on new-crop hay over concerns regarding harvest delays.

In Wyoming, a majority of the USDA contacts stated they are mostly out of hay. Many areas of the state put up top-quality large and small square bales, with a lot of those bales going to horse owners in the eastern third of the U.S., and other hay has made its way to out-of-state dairies.

Figures and charts

Progressive Forage tracks regional hay price trends using average monthly prices reported for selected states by the USDA’s National Agricultural Statistics Service (NASS). The USDA report does not provide hay quality classes in its price reports. By region, states included:

- Southwest – Arizona, California, Nevada, New Mexico, Oklahoma, Texas

- East – Kentucky, New York, Ohio, Pennsylvania, Tennessee, Virginia

- Northwest – Colorado, Idaho, Montana, Oregon, Utah, Washington, Wyoming

-

Midwest – Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, South Dakota, Wisconsin

-

Dave Natzke

- Editor

- Progressive Forage

- Email Dave Natzke