Harvest delays and quality and yield concerns related to rain and pest damage continue to create uncertainty surrounding 2022 hay markets. Here’s Progressive Forage’s monthly update as the calendar turns to summer.

Drought conditions improve but spotty

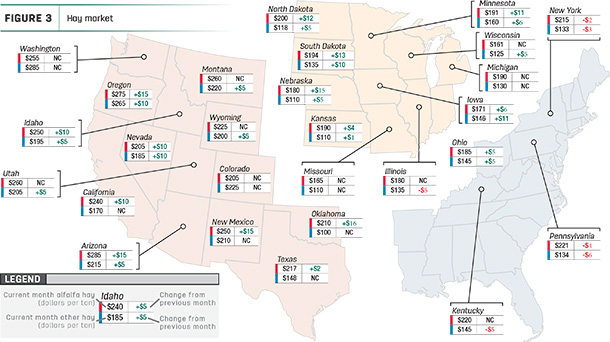

U.S. Drought Monitor maps indicate moisture conditions improved as summer approached. As of June 7, about 33% of U.S. hay-producing acreage (Figure 1) was considered under drought conditions, down 7% from a month earlier.

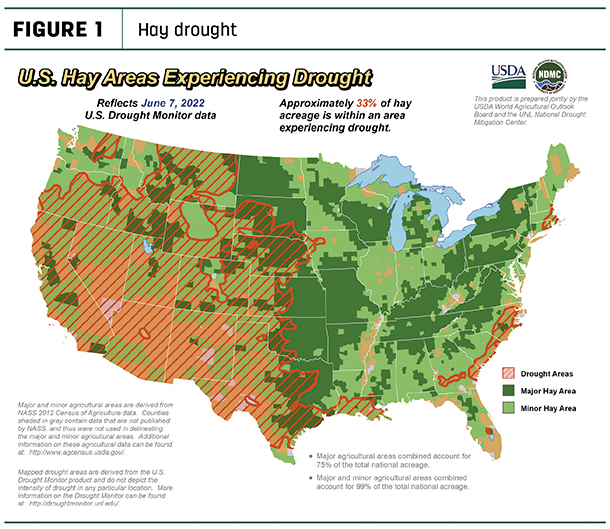

The area of drought-impacted alfalfa acreage (Figure 2) decreased 9% to 48%. Improved conditions were limited to portions of Colorado, Idaho, Kansas, Montana, North Dakota, Oklahoma, Oregon, South Dakota, Washington and Wyoming.

The area of drought-impacted alfalfa acreage (Figure 2) decreased 9% to 48%. Improved conditions were limited to portions of Colorado, Idaho, Kansas, Montana, North Dakota, Oklahoma, Oregon, South Dakota, Washington and Wyoming.

Hay prices mostly tracked

Hay prices mostly tracked

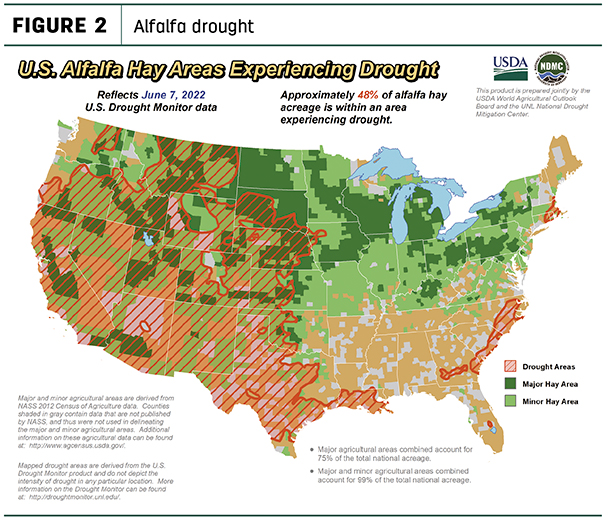

Price data for 27 major hay-producing states is mapped in Figure 3, illustrating the most recent monthly average price and one-month change.

Click here to view it at full size in a new window.

The lag in USDA price reports and price averaging across several quality grades of hay may not always capture current markets, so check individual market reports elsewhere in Progressive Forage.

Dairy hay

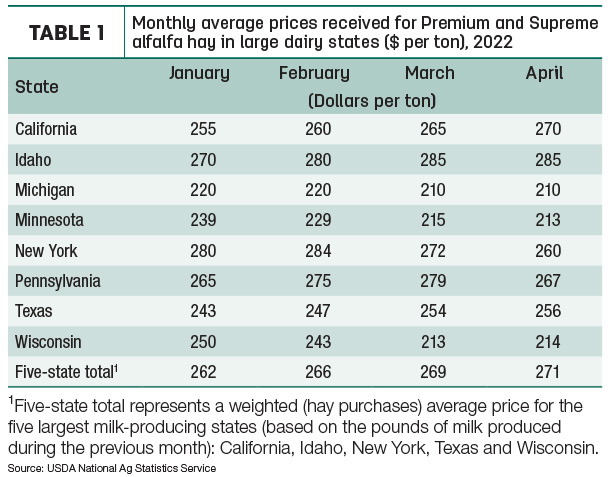

April average prices for Premium and Supreme alfalfa hay in the top milk-producing states rose another $2 from March to $271 per ton (Table 1), up $60 per ton from a year ago. Month-to-month prices increased $5 per ton in California but were down $12 per ton in New York and Pennsylvania.

Alfalfa

The average price for all alfalfa hay jumped $22 in April to $243 per ton. Compared with March 2022, prices increased in 15 of 27 major forage states, with double-digit increases in 11 of them. Only two states, Illinois and Oklahoma, reported slight declines.

Year-over-year price changes remained large: New York alfalfa hay prices were up $105 per ton compared to April 2021, with 2022 prices also at least $75 higher than a year earlier in Utah, Arizona, Missouri, Michigan and South Dakota. The U.S. average was up $58 per ton.

Other hay

The U.S. average price for other hay was down $4 from March to $142 per ton. Despite the overall decline, prices were lower in just four states: Illinois, California, Washington and Oklahoma. Prices moved higher in 15 of 27 major hay-producing states, with double-digit increases in Idaho, Colorado, South Dakota and Minnesota.

Like alfalfa hay, year-over-year average prices for other hay remain substantially higher in some states, up $115 and $85 per ton in Missouri and South Dakota, respectively, and $55-$75 in New York, Wyoming, Iowa and Utah. Illinois and Oklahoma led decliners, down $47 and $38 per ton, respectively. The U.S. average was up $3 per ton.

Organic hay

The USDA’s latest organic hay price report offered a small sample of price summaries for spot transactions (free on board [f.o.b.] farmgate). For the two-week period ending June 1, Good alfalfa in large square bales averaged $260 per ton. There were no price quotes for delivered organic hay.

Hay stocks lower

Contributing to the year-over-year hay price increases, hay inventories stored on U.S. farms as of May 1 were about 7% lower than a year ago. As of May 1, 2022, all hay stored on U.S. farms was estimated at 16.8 million tons, down 1.24 million tons from the same date a year ago and the smallest inventory since May 1, 2019.

The situation was somewhat better among major dairy states, where hay inventories were up 2% from May 1, 2021, according to the USDA’s Crop Production report, released in May. Among the 24 major dairy states, on-farm hay inventories on May 1 were estimated at 9.76 million tons, up 199,000 tons from May 1, 2021.

However, there was a wide variation among individual dairy states: South Dakota hay inventories were down 1.1 million tons compared to a year earlier. In contrast, inventories were larger in Texas (+400,000 tons), Colorado (+350,000 tons), Iowa (+290,000 tons) and New York (+260,000 tons).

Among other major hay-producing states, inventories were down 520,000 tons in Montana and 430,000 tons in North Dakota.

Hay export update

April exports of alfalfa hay were down slightly from March, but an uptick in exports of other hay offset most of that decline.

At 231,906 metric tons (MT), April alfalfa hay exports came off a five-month high, down about 20,000 MT from March. China remained the leading market for alfalfa exports at 110,191 MT, about 48% of the month’s total. At 64,944 MT, Japan was the second-leading market and represented 27% of the month’s total. Alfalfa hay exports were valued at about $399 per ton, up about $5.50 from March.

At 138,353 MT, April exports of other hay hit a 12-month high. Sales to Japan hit a 12-month high at 84,446 MT (63% of the total), while sales to South Korea at 35,441 MT were the highest in 23 months and represented 26% of the month’s total. Other hay exports were valued at about $399 per MT, up about $10 from March.

China’s hay import market still has potential to grow, according to the USDA. In February 2022, China’s government announced a five-year (2021-25) “National Feed Hay Industry Development Plan,” noting China has a 50 million MT shortage of good-quality forage.

Hay exporters are catching up on orders, and warehouses in Japan and South Korea are filling up, said Christy Mastin, sales representative with Eckenberg Farms, Mattawa, Washington. There are plenty of concerns, however.

Past shipping delays mean there is still old-crop hay entering the market, slowing the transition to the movement of higher-valued new crop hay. Additionally, buyer exchange rates have weakened. Since last November, pricing for Japan has increased 36%, South Korea is up 30%, and China is up 7%. Higher hay prices and transportation costs may push U.S. suppliers out of traditional markets, she said, as potential buyers turn to Australia, Europe and Canada for supplies.

Export container availability remains a concern, as many are still being shipped back empty to China and Asia.

Negotiations between the Pacific Maritime Association and the International Longshore and Warehouse Union (ILWU) are underway and remain a worry. The current labor contract for the West Coast ILWU members will expire on June 30. ILWU represents workers at 29 West Coast ports (Los Angeles, Long Beach, Seattle-Tacoma and Oakland).

China buying pellets for swine

Separately, the USDA’s Foreign Agricultural Service said Spanish-origin alfalfa hay pellets are providing some additional competition in the Chinese market. And while U.S. alfalfa hay exports are serving China’s dairy market, swine farms are increasingly using alfalfa pellets as feed for pregnant sows, according to the USDA’s Global Agricultural Information Network (GAIN).

In 2021, China imported 52,254 MT of alfalfa pellets, up 62% from the year before. That trend is continuing, with China’s first-quarter 2022 alfalfa pellet imports up 73% compared to the same period in 2021 at 13,835 MT. Of those imports, Spain held a 90% market share in 2021 and an 85% market share to start 2022. Other leading suppliers are Italy and Kazakhstan.

Currently, there are 12 U.S. hay facilities from Washington, Idaho, California and Utah eligible to export alfalfa pellet and cubes to China. As a comparison, 53 Spanish and 19 Italian facilities are registered to export alfalfa pellets to China. Since gaining market access in early 2020, U.S. alfalfa pellets have not been exported to China.

Mastin said tight supplies and high demand for baled hay mean less hay is available for cubes and pellets. The USDA report did note some Chinese feed suppliers have pelletized imported baled U.S. alfalfa hay for the swine market.

Thus far in 2022, China has purchased about 1,461 MT of U.S. dehydrated alfalfa cubes, after purchasing 10,971 MT in 2021.

Regional markets

Here’s a snapshot of regional markets starting the second full week of June:

- Southwest: In Texas, hay prices were mostly firm to $10 higher in all regions. Spotty rains provided some moisture improvement. Yields on dryland fields were short, and pasture and rangeland conditions were in poor condition in the west, Panhandle, and portions of the central and south, with supplemental feeding taking place in those regions.

In Oklahoma, old-crop hay is finally gone. Improving moisture continues to help crop production in western Oklahoma, but unfortunately, it has also slowed or stopped production in the eastern part of the state.

In New Mexico, hay prices were steady, and demand was very good. Drought conditions and increased input costs remain a concern, as were wildfires. The southern and eastern part of the state were finished with second cutting.

In California, trade activity and demand were very good. Retail, dairy and export hay prices were mostly steady to firm.

- Northwest: In Montana, hay sold mostly $10-$15 lower as timely rains have improved the new-crop outlook, especially in eastern and southern Montana. Asking prices were higher closer to drought-stricken central locations, and most producers were not willing to establish a price until the hay was in the bale. Some producers along the Yellowstone River Valley were starting to take first cuttings, but harvest in central and northern Montana was still about two weeks away.

In Idaho, contracts for new-crop alfalfa were firm as new buyers came into the trade area. Widespread rains affected first cutting, with the worst rained-on hay being chopped. Finding available choppers was an issue.

In Colorado, trade activity was light on good demand for horse hay and retail markets but inactive on all other hay markets. Widespread rainfall across the state brought much needed drought relief.

In the Columbia Basin, export, domestic and retail hay sold firm as new-crop trading got underway. Scattered thunderstorms left a lot of rained-on hay, and buyers and producers noted that the majority of new hay was testing below 170 relative feed value (RFV). Buyers were purchasing new hay with no RFV test requirements as they sought to replenish supplies.

In Washington, intermittent rains caused damage to alfalfa and delayed timothy harvest. Market confusion lingered with some prices $100 per ton higher than a year ago, raising concerns for exporters.

In Wyoming, cooler temperatures held back springtime growth of alfalfa, timothy, triticale and other forages, with some reports of winterkill in some of the perennial hayfields. Many hay contacts think it will be the middle of June before much hay will be cut and baled. Sun-cured alfalfa pellets and alfalfa hay cubes sold steady.

- Midwest: In Nebraska, old-crop hay in squares and round bales and ground hay and alfalfa pellets all sold steady. New-crop supplies were limited. Prices for standing alfalfa ranged from $100-$120 per ton. Widespread hail and wind damage was reported, although a full assessment of damage hadn’t been determined. Most of the state is short on available baled forages and the destruction of some of the first cutting of alfalfa won’t help. Some reports of weevil and frost damage also reduced tonnage.

In Kansas, hay prices were steady with movement slow. Producers report their first-cutting yields are one-half to three-quarters light, with weevil infestations problematic. Uncertainty over prices due to drought, lighter yields and higher input costs are creating hesitancy to make deals on both the buyer and seller sides.

In South Dakota, few sales were reported as new-crop harvest delays persisted.

In Missouri, lack of any extended dry time pushed hay harvest back slightly. There was more hay being offered as supplies slowly grew. Hay supply was moderate, and demand was light to moderate, with prices steady to firm.

In Iowa, most alfalfa and grass hay prices were lower.

- East: In Pennsylvania, alfalfa and alfalfa-grass blends sold somewhat weaker at hay auctions, with moderate and light supplies.

In Alabama, hay prices were steady with light supply and moderate demand.

Other things we’re seeing

-

Dairy: Record-high milk prices offset higher feed costs in April, improving monthly dairy producer milk income over feed cost margins. Despite that, monthly U.S. milk production was below year-ago levels for a fourth consecutive month.

-

Fuel: As of the second week of June, the U.S. regular gasoline retail price averaged $4.88 per gallon, about $1.84 higher than a year earlier; the U.S. average on-highway diesel fuel price was $5.70 per gallon, up $2.43.

-

Trucking: Flatbed prices were slightly higher moving into June, according to DAT Trendlines. The national average price was $3.47 per mile. Regionally, average prices per mile were: Southeast – $3.74, Midwest – $3.65, South – $3.46, Northeast – $3.33 and West – $2.98.

- Interest rates: Average interest charges on variable-rate operating loans averaged 4.88% across Chicago, Dallas, Kansas City and Minneapolis Federal Reserve districts during the first quarter of 2022, up from 4.75% during the previous quarter.