Larger harvest forecast

The USDA did update 2019 hay harvest estimates in its August Crop Production report. Production of alfalfa and alfalfa mixture dry hay for 2019 is forecast at 55.4 million tons, up 5% from 2018. Harvested area is forecast at 16.8 million acres, unchanged from the June forecast, but up 1% from 2018. Based on conditions as of Aug. 1, yields are expected to average 3.29 tons per acre, up 0.12 ton from last year. Record-high yields are expected in Arizona, California, New Mexico, and Oregon.

Production of other hay is forecast at 75.7 million tons, up 7% from 2018. Harvested area is forecast at 35.9 million acres, unchanged from the June forecast, but down 1 percent from 2018. Based on Aug. 1 conditions, the yield is expected to average 2.11 tons per acre, up 0.15 ton from last year and a new record high, surpassing the previous record of 2.09 tons per acre in 2016.

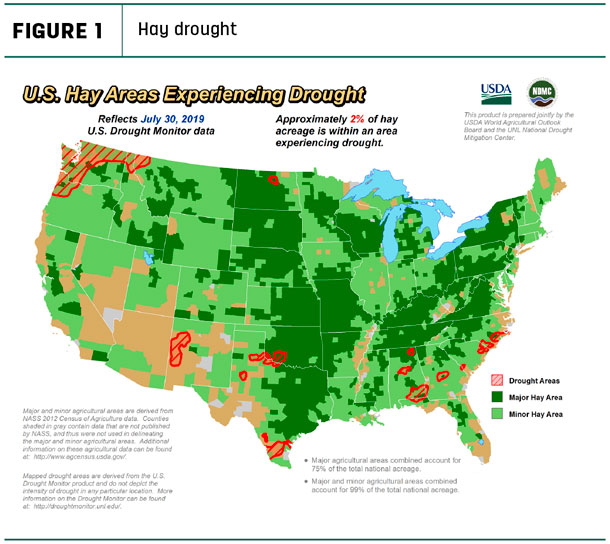

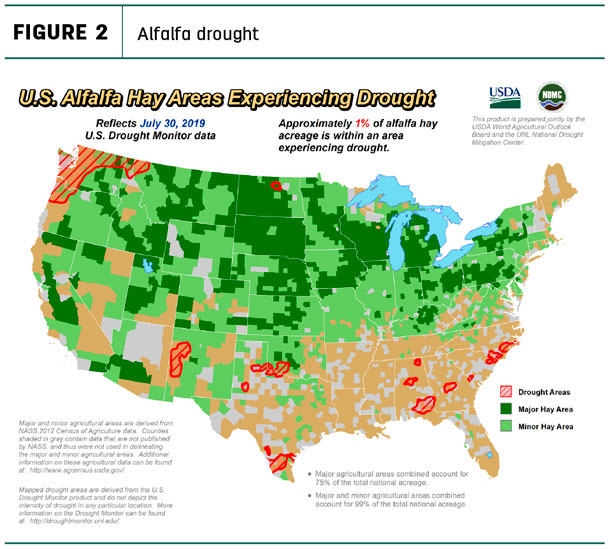

Drought areas remain small

Although some hay-producing areas of the country are showing normal summer drought patterns, areas highlighted on the USDA’s weekly drought monitor continued to be the smallest in a decade. About 2 percent of U.S. hay-producing acreage (Figure 1) and 1% of the alfalfa-hay producing acreage (Figure 2) was considered drought areas at the end of July, unchanged from early in the month. Dry pockets were in the Pacific Northwest, along the Oklahoma/Texas border, North Dakota and scattered in some areas of the Southeast.

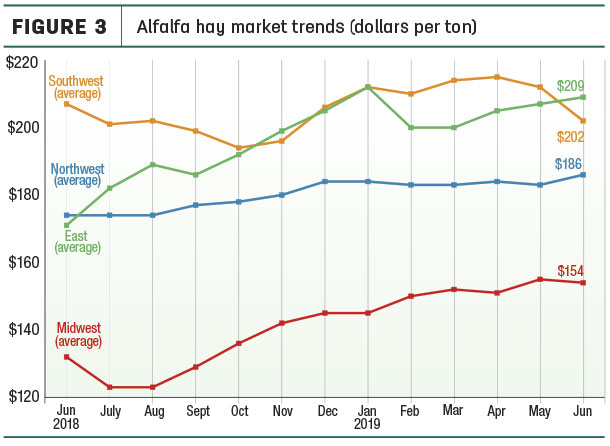

Hay prices slip from May highs

Alfalfa

U.S. average alfalfa hay prices ended a six-month increase. At $193 per ton, the June average was down $11 from May’s peak. On a regional basis, alfalfa hay prices rose in the East and Northwest but were lower in the Southwest compared to a month earlier (Figure 3).

Among individual states, June alfalfa hay prices jumped $20 per ton from May in Ohio, and $10-$14 in North Dakota, Minnesota and Colorado. Leading decliners were in Iowa, California and Arizona, down $20-27.

Compared to a year earlier, alfalfa hay prices were up $65-$76 per ton in Minnesota, Pennsylvania, Wisconsin and Michigan, and up $25-$48 in New York, Colorado, Ohio and Utah. In contrast, Texas alfalfa hay prices declined $25 from May.

High monthly alfalfa hay prices were in New Mexico and Colorado (both $240), Arizona ($220) and Wisconsin ($219). The low price for the month, at $99 per ton, was again in North Dakota.

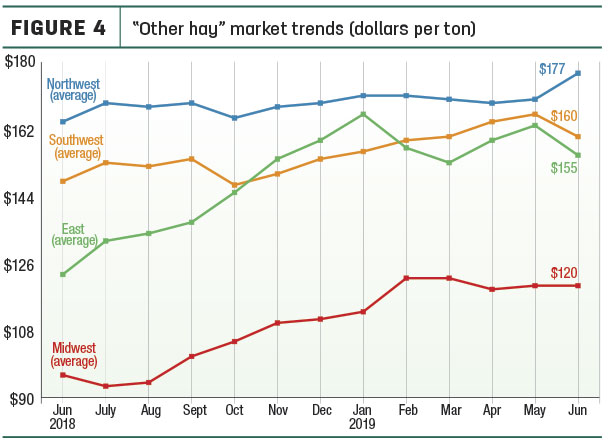

Other hay

After hitting a five-year high in May, the national average price for other hay fell $6, to average $146 per ton in June. Regionally, prices were higher in the Northwest; steady in the Midwest; and lower in the East and Southwest (Figure 4).

Among individual states, Washington saw the largest month-to-month increase, up $30 per ton, while average prices were down $15-$20 in California, Pennsylvania, Oklahoma and Michigan.

Compared to a year earlier, June 2019 prices were up $46-$63 in New York, Wisconsin, Minnesota and Pennsylvania. Of the 27 reporting states, only Kansas and New Mexico saw small declines from a year earlier.

Highest average prices in June were in Colorado ($230 per ton), Washington ($220) and Arizona and Oregon (each $200). North Dakota turned in the lowest average, at $77 per ton.

Dairy hay

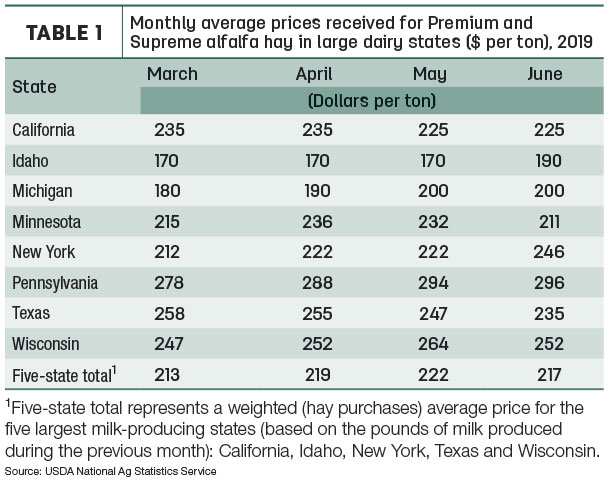

June prices for Premium and Supreme hay in the top milk-producing states averaged $217 per ton, down $5 from May (Table 1). Prices were up in Idaho, New York and Pennsylvania, but down in Texas and Wisconsin.

Organic hay prices

USDA’s July 31 organic hay report showed FOB farm gate prices paid for Premium/Supreme alfalfa small square bales averaged $200 per ton. Fair mid square bales of alfalfa brought $555 per ton. Good/Premium large squares of organic triticale averaged $165 per ton. No price data was available for delivered organic hay.

Hay exports hinge on many factors

At 113,622 metric tons (MT), June shipments of other hay were about average so far in 2019; monthly sales were valued at $38.8 million. At nearly 685,000 MT, January-June 2019 exports of other hay are slightly ahead of last year’s pace.

Japan remained the most prolific buyer of other hay, topping 60,000 MT for the sixth consecutive month. June sales to South Korea, Taiwan and the United Arab Emirates (UAE) were down marginally, with South Korea and Taiwan totals at or near lows for the year.

June alfalfa hay shipments totaled 212,456 MT, falling about 16,000 MT from May’s eight-month high. The June alfalfa hay exports were valued at $68.5 million, down nearly $5 million from May. At 1.25 million MT, January-June 2019 exports of alfalfa hay are slightly behind last year’s pace.

Among leading markets, Japan led all alfalfa hay buyers in June, at 61,918 MT, followed by China, at 56,909 MT. Sales to Saudi Arabia remained strong, while shipments to the UAE, South Korea and Taiwan were down slightly from May.

June exports of alfalfa meal and cubes remain mixed compared to a month earlier. The alfalfa hay cube market continues to decline, according to Christy Mastin, international sales manager with Eckenberg Farms Inc., Mattawa, Washington. While foreign feed mills are using hay cubes to add fiber to rations, direct feeding is not as common as it once was.

On the export demand side, South Korea’s ongoing review of import policies and requirements has slowed hay shipments as importers wait for decisions, Mastin said.

For the most part, Japan’s domestic hay harvest went well and quality is very good, Mastin said. As such, Japanese farmers are looking to purchase domestic feed at lower prices before seeking imports. Exported timothy pricing is down about $40 per ton from last year but even this is higher than domestic prices. The alfalfa price increase from last year is raising concerns, and rations are being revised to use less alfalfa. Some Japanese customers are already looking to next year’s shipping schedules and Tokyo’s Summer Olympics, which could impact port traffic.

On the supply side, Pacific Northwest weather conditions were not ideal for first-crop alfalfa harvest, resulting in disappointing protein levels and lower relative feed values. Most foreign customers were waiting to see if quality improves in future cuttings.

July’s timothy harvest started out better, and supplies and quality are good. However, combined with large carryover inventories of lower-quality timothy, prices have been pressured lower. Japan and South Korea also have carryover supplies, limiting demand.

U.S. forage producers will see some federal financial support. U.S. alfalfa hay and triticale producers are among those eligible for USDA payments under the Market Facilitation Program, designed to offset the negative financial impacts of ongoing trade and tariff wars (see related article.) Signup runs through Dec. 6, 2019, at USDA Farm Service Agency (FSA) offices.

Read: Alfalfa hay, triticale growers eligible for Market Facilitation Program payments

Regional markets

A summary of early August conditions and markets included:

• Midwest: In Iowa, weather conditions were good for making dry hay. Prices moved higher, reflecting the quality of hay and bedding being marketed.

In Nebraska, buyer inquiry was light to moderate. Some producers continue to struggle with getting top-quality hay put up this summer as heavy dews, low winds and cloudy days have been normal. Native prairie hay producers have been getting some areas baled that were missed last year, and tonnage has been good.

In Kansas, demand remained slow and prices trended down just a little for most hay types. An abundance of grinder hay and brome hay hit the market. However, some buyers, both in and out of state, seem willing to pay a little more for better quality hay and for loyalty to those producers they have utilized for years. This could account for some of the wide variations in recent price.

In Missouri, early August pasture conditions were good. Hay prices seem to have settled for the time being.

In South Dakota, demand was good for high-quality hay and straw; more moderate for lower qualities, especially on plentiful supplies of rougher grinding-type hay.

• Southwest: In California, all classes traded steady with moderate to good demand. Alfalfa yields were good, with lower quality decreasing prices.

In Oklahoma, triple-digit temperatures had producers worried about yields. Rain has been limited and fields are beginning to show the effects, with many producers choosing to cut early and take a loss on overall tonnage.

In Texas, hay trades were mostly steady to $5 lower. Movement was moderate with hay trade picking up due to drought concerns. Some suppliers were holding onto hay and storing it in barn for now. Quality issues remain a concern, with the extreme early season rainfall followed by extreme heat taking a toll.

In New Mexico, large bales of alfalfa hay were selling steady. Many regions were in their fourth cutting.

• Northwest: In Idaho, demand remained good, especially for high-testing alfalfa and orchard grass and alfalfa mixtures. Alfalfa testing over 185 relative feed value was hard to find. Demand was lighter for feeder hay. Fires on Bureau of Land Management land this summer where ranchers winter their cattle will use up most of the unsold feeder hay. Timothy for export has been committed to but no price has been determined yet. Demand has turned light on Premium quality horse and dairy timothy; demand for lesser quality timothy for export is very light. The large carryover of old-crop timothy and lower prices have created an atmosphere of caution with overseas buyers.

In Colorado, bids offered from dairy and feedlots have been steady. Producers in the mountains attempting to cut meadow hay were hampered by rain. Reports of above-normal grass hay yields favor buyers.

In Oregon, prices trended generally steady. Retail/stable-type hay remains most in demand. Some hay acreage has been changed over to grow hemp this year. In the Washington-Oregon Columbia Basin, all grades of alfalfa and timothy for domestic and export were steady. Many producers were taking third and fourth cuttings. Some timothy growers in Washington had plowed up timothy fields and did not intend to harvest a second cutting due to the lower market.

In Montana, new-crop alfalfa hay has hit the market; moderate-to-good demand was seen for all hay in square bales. Hay in round bales continues to struggle as many cattlemen are putting up their own hay and have carryover from last year. Much of first cutting received at least some rain, limiting the volume of available high-quality hay. Some producers had hay down for 10-15 days or more before finally getting it baled. Much of this hay sold or is selling for or near bedding prices. Some producers opted to rerun it through the swather and bale it with second cutting. Much of the grass hay is selling into Canada. Dairies in Idaho are searching for straw, boosting demand.

In Wyoming, hay sold steady with good demand for large and small squares shipped out of state. The Goshen Irrigation District continued repairs on the Fort-Laramie Gering irrigation tunnel, which collapsed in mid-July, threatening supplies of irrigation water on than 100,000 acres of farmland in southeastern Wyoming and the Nebraska panhandle. Demand was good to very good in the first video Internet auction since January. The sale featured first and second cutting alfalfa consigned from eastern Wyoming and Nebraska, with the majority testing Good quality. Approximately 50 percent of the alfalfa sales went to Colorado, with the other half to dairies in Iowa, Illinois, Indiana and Ohio.

• East: In Pennsylvania, alfalfa/grass hay sold $40-$50 per ton higher on a very light test. Mixed grass hay sold $50-$60 higher.

In Alabama, hay prices were steady on good supplies and moderate demand.

Dairy outlook

Latest USDA dairy numbers point toward a shrinking herd, limited growth in milk production and an improving price outlook. And, while they aren’t out of the woods yet, dairy farmers are getting cash infusions from the USDA Dairy Margin Coverage and Market Facilitation Program payments.

The 2019 all-milk price is forecast at $18.30 per cwt, up $2.04 per cwt from 2018; it would be the highest annual average since the record high of $23.97 per cwt set in 2014.

And, with improving milk prices, average prices paid for dairy replacement cows came off the floor. Preliminary July 2019 U.S. quarterly replacement dairy cow prices averaged $1,240 per head, up $100 from April 2019. Even with the increase, the U.S. average was near a two-decade low and 42% per head less than the latest peak of $2,120 in October 2014.

Figures and charts

Progressive Forage tracks regional hay price trends using average monthly prices reported for selected states by the USDA’s National Agricultural Statistics

Service (NASS). The USDA report does not provide hay quality classes in its price reports. By region, states included:

• Southwest – Arizona, California, Nevada, New Mexico, Oklahoma, Texas

• East – Kentucky, New York, Ohio, Pennsylvania

• Northwest – Colorado, Idaho, Montana, Oregon, Utah, Washington, Wyoming

• Midwest – Illinois, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, South Dakota, Wisconsin ![]()

-

Dave Natzke

- Editor

- Progressive Forage

- Email Dave Natzke