It’s the time of year that the hay market focus turns to anticipation of new crops. Here’s a look at some of the conditions affecting domestic and export hay markets during the second week of April.

Production outlook

The USDA’s annual Prospective Plantings report indicates there will be less acreage devoted to hay this growing season. Based on USDA surveys conducted in early March, U.S. producers intend to harvest 51.7 million acres of all hay in 2021, down 1% from 2020. If realized, this will represent a decline of more than 2.7 million acres since 2015 and the lowest total hay harvested area since 1908.

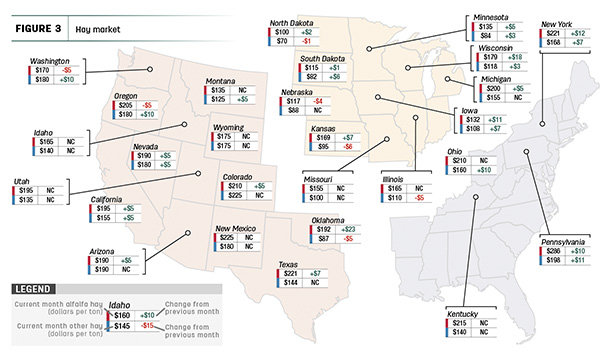

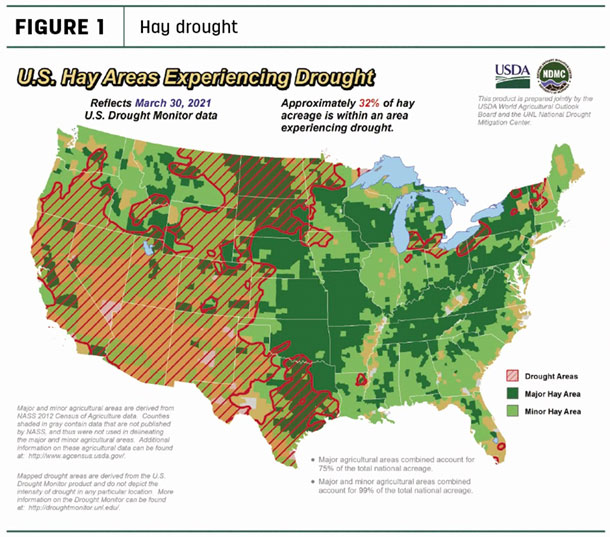

Dry conditions remain

Drought conditions improved little in March, although portions of western Montana and eastern Nebraska and Kansas benefited from moisture. As of March 30, about 32% of U.S. hay-producing acreage (Figure 1) was considered under drought conditions, a 3% improvement from the start of the month. The area of drought-impacted alfalfa acreage (Figure 2) decreased 8% during the month to 46%.

A recent National Oceanic and Atmospheric Administration (NOAA) April-June weather outlook forecast below-normal precipitation across the Southern Plains and much of the West. In contrast, the outlook favored above-normal precipitation for parts of the Midwest, the Great Lakes, the Mid-Atlantic and the Northeast.

Water supply forecasts through spring are predicted to be below to much-below normal for most of the desert Southwest, southern Oregon, southern Idaho into much of the Rocky Mountains, which will play a major role in drought persistence this spring. California’s snowpack levels were described as dismal, and snowpack percentages were far below normal in Arizona and New Mexico. In contrast, the Cascade Mountains of northern Oregon and Washington, and some areas of the Eastern Rockies, register above-normal snow conditions.

Exports show improvement

Hay export activity has picked up despite shipping challenges, according to Christy Mastin, sales representative with Eckenberg Farms, Mattawa, Washington. She expects the sales’ trendline to continue to improve next month, even though port congestion and vessel wait times remain problematic.

Based on USDA reports, February 2021 alfalfa hay exports totaled 210,193 metric tons (MT), the second-highest monthly total since August 2020. Sales to China rebounded, up 47,700 MT from January.

At 106,116 MT, February 2021 exports of other hay were even with a year ago. Nearly 65% (69,000 MT) of the month’s sales went to Japan, with shipments to other major markets steady.

“We still struggle getting vessel space for exports and are having to book six to eight weeks out, and then schedules change daily,” Mastin said. “Blank sailings,” when ships fail to stop in U.S. ports and instead return to China and Southeast Asia empty, are expected in April and May, linked to shipping disruptions caused by the vessel blockage of the Suez Canal. With all the logistical challenges, ocean freight prices have doubled over the past five months.

On the demand side, warehouse hay inventories in China, Japan and South Korea are reportedly getting short and reaching levels of concern. On the supply side, new crop availability is still weeks away, with drought raising production concerns. In the Pacific Northwest, less timothy acreage is expected.

One gateway for hay exports is expanding in the West. In partnership with the Union Pacific Railroad, Savage, a transportation, logistics and materials handling company, is constructing an intermodal rail terminal in Pocatello, Idaho, with operations expected to begin operation by the middle of 2021. According to a press release, the railport will facilitate movement of containerized hay and other agricultural commodities to ports in Tacoma and Seattle, Washington.

Also, while far less hay moves from the East Coast, the Georgia Ports Authority Board approved capital improvement projects that will increase the Port of Savannah’s container capacity by 20%. Agricultural products represent about 60% of the exports going through that port.

Click here or on the map above to view it at full size in a new window.

Prices move higher

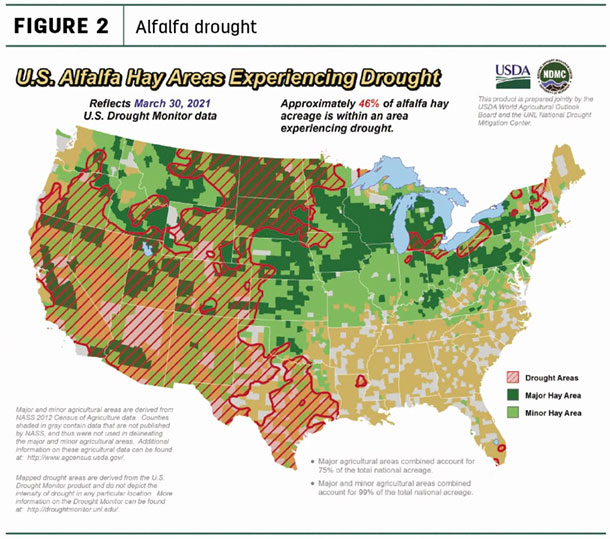

Price data for 27 major hay-producing states is mapped in Figure 3, illustrating the most recent monthly average price and one-month change. The lag in USDA price reports and price averaging across several quality grades of hay may not always capture current markets, so check individual market reports elsewhere in Progressive Forage.

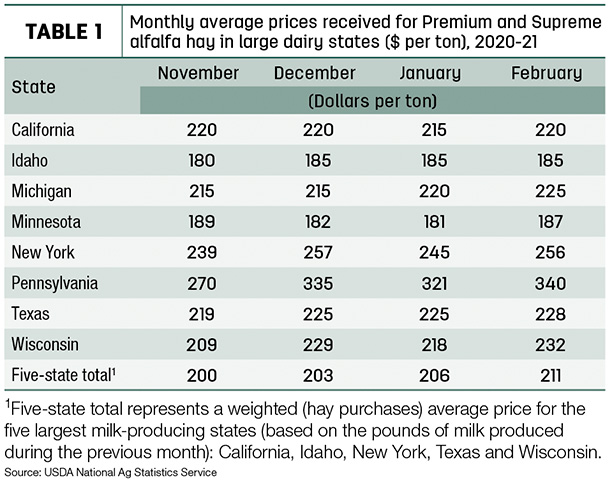

Dairy hay

The average price for Premium and Supreme alfalfa hay in the top milk-producing states averaged $211 per ton in February, up $5 from January (Table 1) and equaling a 20-month high dating back to July 2019. Dairy-quality hay prices were substantially higher in Pennsylvania and Wisconsin.

Alfalfa

The national average price for all alfalfa hay also moved higher, up $4 in February 2021 to $175 per ton, a seven-month high. Compared to a month earlier, average alfalfa hay prices increased in 15 of 27 major forage states, led by Oklahoma, Wisconsin, New York, Iowa and Pennsylvania. February prices declined in just three states, Oregon, Washington and Nebraska. At $286 per ton, Pennsylvania alfalfa hay prices remained the highest in the country and were up $57 from a year earlier.

Other hay

The U.S. average price for other hay rose $6 from January to $143 per ton, a 17-month high. February prices moved higher in 12 states, led by increases of $10-$11 per ton in Pennsylvania, Washington, Oregon and Ohio. Small price declines were reported in just four states: Kansas, Illinois, Oklahoma and North Dakota. Colorado again had the top monthly average of $225 per ton; average prices were under $90 per ton in Kansas, Nebraska, Oklahoma, North Dakota and South Dakota.

Organic hay

The USDA’s latest organic hay price report did not provide price summaries for hay.

Regional markets

Here’s an abbreviated look at local markets:

- Southwest: In Texas, hay prices were firm in all regions as soil moisture levels have shortened. Higher fertilizer prices and a poor precipitation outlook could mean thin margins and little room for error this year, according to the Texas A&M AgriLife Extension Service.

In Oklahoma, hay trade was slow. Warm nights were supporting alfalfa growth, but consistency was reportedly very rough, leading some to believe first cutting could be mostly grinder hay.

In California, prices for most regions were steady with moderate demand.

- Northwest: The Northwest Farm Credit Service’s quarterly hay snapshot forecasts slightly profitable returns for producers over the next 12 months. Producers in drought-stricken areas will face headwinds to production and profitability. Higher prices for corn, soybeans and wheat will provide tailwinds to producer returns in the feed complex.

In Montana, hay sold fully steady, with high prices limiting purchases to an as-needed basis. Some producers are slowly starting to sell excess hay as temperatures warm and grass is starting to green. Drought concerns remain high.

In Idaho, new crop contracts were steady, with buyers willing to contract for one price straight through all cuttings, rain or shine. Buyers remain bullish about new crop prices, with some producers taking a wait-and-see attitude. Some dairies were contracting new crop with a minimum test of 180 relative feed value at $180 per ton, free on board (f.o.b). Dairy-quality hay prices are expected to follow soybean meal markets more closely.

In Colorado, trade activity was light on good demand for new crop contracted feedlot hay and stable-quality hay. Contracting began on first cutting alfalfa based off a standing price of $125 per ton.

In the Washington-Oregon Columbia Basin, trade remains slow, with all grades of domestic alfalfa, retail and wheat straw selling steady in a light test.

In the Oregon-California Klamath Basin, winter hay sales to California drew inventories down in Oregon. With drought concerns, lower production will bolster prices but not enough to offset production losses.

-

East: In Pennsylvania, markets were mixed as weather affected auction attendance as farmers return to working their fields and seasonal grazing practices.

- Midwest: In Missouri, the supply of hay was moderate, demand was light to moderate, and prices were steady. Some early signs of weevils were evident.

In Nebraska, inquiries remained strong, especially from out-of-state buyers.

In Kansas, prices were mostly steady across the state; alfalfa was steady to $10 higher in the southwest. Alfalfa fields had greened up and subsoil moisture seemed to be adequate. Both weevils and aphids were evident, and spraying began early.

In Iowa, the quality of hay offerings was lower.

In South Dakota, good demand remains for dairy-quality hay, especially from out-of-state dairies. A mild winter has helped maintain hay inventories, and large volumes continue to be offered in the regional hay auctions.

Other things we’re seeing

-

Dairy: U.S. milk production and the size of the U.S. cow herd continues to grow. At 9.458 million, February 2021 U.S. cow numbers were up by 81,000 head from the year before. The combined year-over-year growth in Texas, Indiana, Michigan, South Dakota, Minnesota and Colorado totaled 95,000 head. The milk price outlook is also improving as COVID-19 vaccinations increase and travel and facility capacity restrictions are eased and dairy product demand increases.

-

Beef: USDA’s March Cattle on Feed report estimated the number of animals on feed was 1.6% above year-ago levels, in line with most private forecasts. The report provides monthly estimates of the number of cattle being fed for slaughter and the second-highest March inventory since 1996.

- Energy and inputs: The ongoing impacts of COVID-19 vaccinations and an easing of pandemic-related restrictions are expected to significantly affect petroleum markets this summer. The U.S. Energy Information Administration forecasts U.S. diesel fuel retail prices will average $2.96 per gallon this summer, up from $2.43 per gallon last year. The retail price of regular grade gasoline will average $2.78 per gallon during the summer 2021, 72 cents more than last summer’s average of $2.06 per gallon.