Weather and transportation continue to be two dominant topics as we march into a new growing season. Here’s a look at some of the conditions affecting domestic and export hay markets.

Dry conditions persist

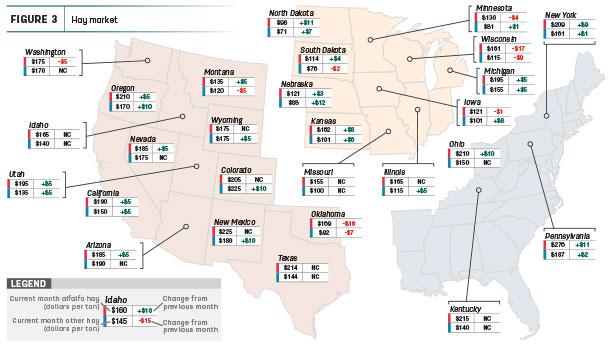

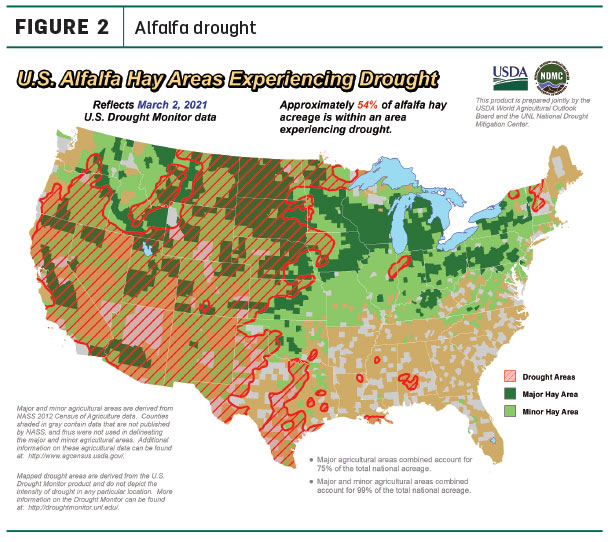

The dry conditions that escalated last fall are persisting in the West. As of March 2, about 35% of U.S. hay-producing acreage (Figure 1) was considered under drought conditions, up 2% from early February. The area of drought-impacted alfalfa acreage (Figure 2) decreased ay 1% from February to 54% in March.

Adding to concern over the dry conditions is the below-normal snowpack in the West and Southwest, affecting water allocation. According to the USDA Natural Resources Conservation Service National Water and Climate Center, snowpack and reservoir levels are below average in most areas.

One exception was the Pacific Northwest, where February storms brought large increases in the snowpack, improving the water supply outlook to above normal for the spring and summer river flows.

Exports start year lower

While January is historically the slowest month of the year for hay exports, logistical problems drove those numbers to the lowest volumes in five years.

At 162,482 metric tons (MT), January 2021 alfalfa hay exports were the lowest monthly total since January 2016. At 65,400 MT, January alfalfa hay shipments to China were down 45,000 MT compared to December. Sales volumes to all major markets were average or lower.

At 108,309 MT, January 2021 exports of other hay were up about just 835 MT from December but about average with June-December 2020 monthly shipments. January sales volume to Japan, at 73,800 MT, was the largest since May 2020.

The export numbers continue to be plagued by shipping problems identified in recent issues of Progressive Forage, said Christy Mastin, sales representative with Eckenberg Farms, Mattawa, Washington. With new crop haying just around the corner, concerns over limited cargo space and delayed shipping schedules are mounting for U.S. marketers, and foreign customers are getting skittish, seeking hay sources in other countries.

“It has been hard to make new sales as the delivery is out of our control and so unreliable, and customers are not willing to risk it when they are running out of inventory,” she said.

With shipping challenges likely to extend into spring, Mastin doesn’t expect export numbers to show much improvement.

Prices move higher

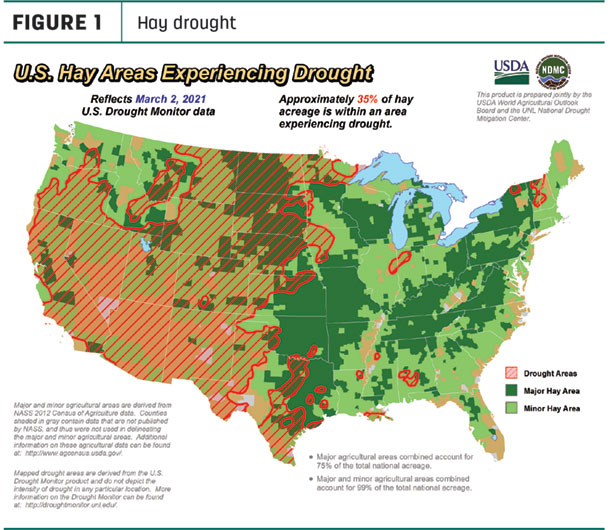

Price data for 27 major hay-producing states is mapped in Figure 3, illustrating the most recent monthly average price and one-month change. The lag in USDA price reports and price averaging across several quality grades of hay may not always capture current markets, so check individual market reports elsewhere in Progressive Forage.

Click here or on the map above to view it at full size in a new window.

Dairy hay

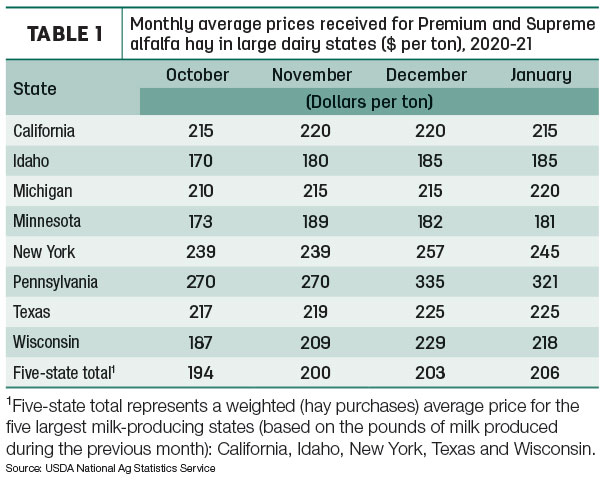

The average price for Premium and Supreme alfalfa hay in the top milk-producing states averaged $206 per ton in January, up $3 from December (Table 1) and the highest since May 2020. Despite the overall increase, dairy-quality hay prices were lower in California, New York, Pennsylvania and Wisconsin.

Alfalfa

With the increase in the average price for high-quality dairy hay, the national average price for all alfalfa hay moved higher, up $2 in January 2021 to $179 per ton. Compared to a month earlier, average alfalfa hay prices increased in 14 of 27 major forage states, led by North Dakota, Pennsylvania, Ohio, New York and Kansas. January prices declined in five states, led by Oklahoma and Wisconsin. Pennsylvania alfalfa hay prices were the highest in the country.

Other hay

The U.S. average price for other hay rose $3 from December to $137 per ton.

December prices moved higher in 15 states, led by increases of $10-$12 per ton in Colorado, Nebraska, New Mexico and Oregon. Declines were reported in just four states, led by Oklahoma and Wisconsin. Colorado again had the top monthly average of $225 per ton; prices were under $80 per ton in North Dakota and South Dakota.

Organic hay

The USDA’s latest organic hay price report was limited, summarizing free on board (f.o.b.) farm gate prices as of the second half of February: Premium alfalfa averaged $225 per ton.

Regional markets

Here are more local snapshots of conditions and markets entering the second week of March 2021:

- Southwest: In Texas, hay supplies continue to tighten across all regions. Prices were firm to $10 higher in the Panhandle, west, north and central Texas. Supplemental feeding was higher than expected as the winter storm brought snow and record-breaking cold. A lot of hay producers were sold out or near sold out as livestock producers were stocking up in preparation for persistent drought. Rain in the far west improved drought conditions, but there’s still a long way to go to improve range productivity.

In California, prices for most regions were steady with modest demand. A late February weather system brought mostly trace amounts of rainfall. Cattle were out grazing with supplement feed. Winter wheat and other small grain fields were growing at a slower pace than usual, due in part to lack of moisture.

- Northwest: In Wyoming, large and small squares of alfalfa and alfalfa/orchard sold mixed and timothy hay sold steady. Sun-cured alfalfa pellets and hay cubes were steady. Some areas in the higher elevation continued to get snow. Regional estimates put the average snowpack at 94% of normal, with highest levels in the Shoshone and lowest levels in the South Platte regions.

In Montana, hay sold steady to firm. Supplies in north-central Montana started to tighten as cold weather weighed on hay usage. Supplies of feeder type hay are very light. Hay is moving at $1 per point of relative feed value point. Many producers held on to hay for personal use or in case poor weather and/or drought conditions persist.

In Idaho, Utility/Fair alfalfa was steady to firm in a light test. Other grades of alfalfa were steady in a light test. Trade remains slow with continued good demand for light supplies.

In Colorado, trade activity was moderate on good demand for feedlot and dairy hay but lighter for stable and ranch-quality hay. Northeast Colorado feedlot and dairy hay prices were firm due to supply.

In the Washington-Oregon Columbia Basin, export and retail alfalfa sold steady in a light test. Trade remains slow and demand is light to moderate. With grain prices rising, hay producers are more optimistic about prices. February storms brought large increases in the snowpack of the Cascade Mountains in the Pacific Northwest.

- East: In Pennsylvania, overall buyer demand and hay supply were moderate to strong. Prices for alfalfa and alfalfa/grass blends were mixed.

In Alabama, hay prices were fully steady with moderate supply and demand.

- Midwest: In Missouri, hay prices were steady, and demand was moderate.

In Nebraska, inquiries picked up, especially for alfalfa, as prospective buyers looked for large quantities of dairy and lesser-quality hay. Some producers were looking to bale cornstalks when fields dried out. Alfalfa, ground and delivered alfalfa and grass/meadow hay, and cornstalks sold steady. Overall moisture levels are still down.

In Kansas, prices were steady for all hay types, and demand remained strong for alfalfa, although warmer weather has lessened the urgency. Many were counting on the bales they had left to carry them until the first greenup of pastures. That may prompt some to let loose of inventories they feel they don’t need.

In Iowa, the alfalfa and grass hay market was steady to stronger; the general quality of hay was weaker.

In South Dakota, alfalfa sold mostly steady. Good demand remained for dairy-quality hay, with best demand coming from out-of-state dairies. There was very light demand for straw. A large amount of cornstalks were baled last fall, which also lessened the demand from cattle producers. Muddy conditions made it difficult to get hay loaded out of fields. A mild winter in western regions lessened the need for supplemental feeding of beef cattle which has created a large supply of available grass hay.

Other things we’re seeing

-

Dairy: The number of U.S. dairy herds continues to decline. The USDA estimated the number of herds licensed to sell milk commercially fell to 31,657 in 2020, down about 2,550 (7%) from 2019. Despite that decline, the number of dairy cows increased again to start 2021. At 9.45 million, January 2021 cow numbers were up by 8,000 head from December 2020. Since bottoming out in June 2020, cow numbers are up about 102,000 head in the major dairy states.

-

USDA program news: The USDA Farm Service Agency (FSA) extended the sign-up period, through April 9, for the Quality Loss Adjustment (QLA) program. The new program provides assistance to producers who suffered eligible crop quality losses due to natural disasters occurring in 2018 and 2019. Forage crop quality losses are eligible for payments. Eligible forage crops must have had at least a 5% nutrient loss, such as total digestible nutrients, and producers must provide verifiable documentation to support loss claims. More information on QLA eligibility and payments can be found here.

- Economic outlook: Results from the March 2021 Purdue University/CME Group Ag Economy Barometer survey indicate U.S. farmers remain optimistic with short-term financial conditions but concerned about the future. Survey respondents were a bit less optimistic regarding their upcoming farm machinery purchase plans, but very bullish about farmland values. That bullishness regarding farmland values spilled over into expectations for rising farmland cash rental rates. Responses suggest more ag producers think alternatives to animal protein will make inroads in the total protein marketplace over the next five years, with a corresponding negative impact on farm income.