After a mild start, winter finally arrived about the time groundhogs were poking their heads out of holes in search of an early spring. What they saw were lots of roughage-consuming animals to feed. In beef country, there are more than 31 million cows to start the year – down about 1% from last year – but the snow and cold temperatures have increased the need for supplemental feeding, especially with the first calves of 2021 hitting the ground.

In dairy regions, the barns are full. The USDA’s latest estimates put the U.S. dairy herd at more than 9.44 million cows, the most since the latter half of 1995. Much of the increase is in a handful of states: Compared with last year, dairy cow numbers are up a combined 89,000 head in Texas, Indiana, South Dakota, Michigan and Colorado. Secondary growth areas include Minnesota, New Mexico, Idaho, Kansas, Ohio and Iowa.

There are more than 5 million sheep in the U.S. and about half that many goats. Depending on who’s counting, there are several million horses.

All signs point to higher corn and soybean prices ahead, with multiple impacts on the hay and forage market. First, the higher cost of feed will provide plenty of financial incentive for livestock producers to source protein through forages and other feedstuffs. Second, there may be more competition for acreage as spring planting gets underway.

Beyond that, the degree costs of energy to produce and transport forages rise are clouded on the demand side by COVID-19 and economic recovery and on the supply side by potential environmental regulations.

With all that in mind, here’s a look at domestic and export market conditions during the second week of February 2021.

It’s dry out there

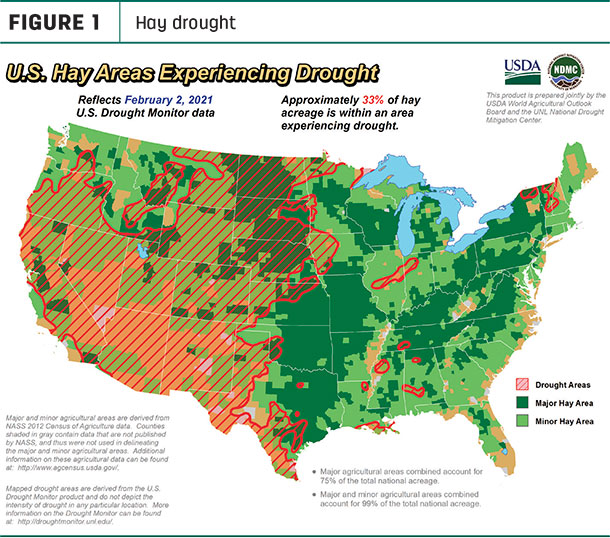

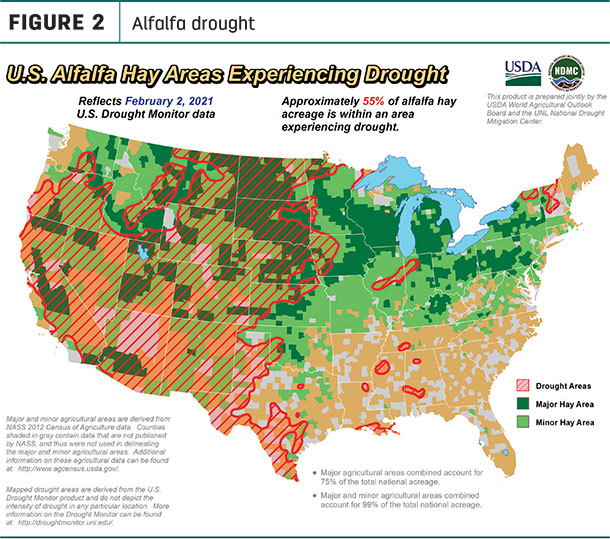

The start of 2021 has delivered little in the form of moisture relief to major U.S. hay production areas. As of Feb. 2, about 33% of U.S. hay-producing acreage (Figure 1) was considered under drought conditions, unchanged from early January. The area of drought-impacted alfalfa acreage (Figure 2) increased another 5% from January to 55%, with most of the drought expansion in Montana and South Dakota.

Hay prices mixed

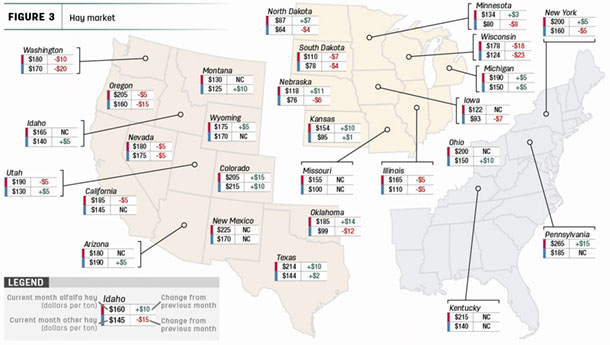

Price data for 27 major hay-producing states is mapped in Figure 3, illustrating the most recent monthly average price and one-month change. The lag in USDA price reports and price averaging across several quality grades of hay may not always capture current markets, so check individual market reports elsewhere in Progressive Forage.

Dairy hay

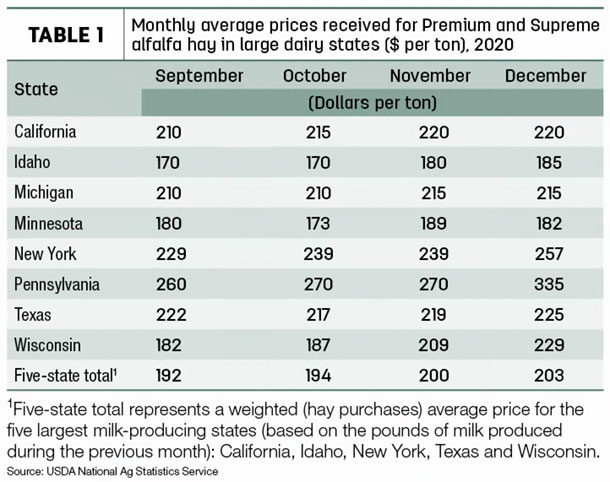

The average price for Premium and Supreme alfalfa hay in the top milk-producing states averaged $203 per ton in December, up $3 from November (Table 1) and the highest since May. Prices in Pennsylvania and New York moved sharply higher.

Alfalfa

With the jump in the average price for high-quality dairy hay, the national average price for all alfalfa hay moved off a 33-month low, up $2 in December 2020 to $169 per ton. Compared to a month earlier, December average alfalfa hay prices increased in 11 of 27 major forage states, led by Colorado, Kansas, Nebraska, Oklahoma, Pennsylvania and Texas. December prices declined in eight states, led by Washington and Wisconsin.

Other hay

The U.S. average price for other hay fell $2 from November to $134 per ton.

December prices moved higher in nine states, led by increases in Colorado, Montana and Ohio. Declines were reported in 12 states, led by Washington and Wisconsin. Colorado again had the top monthly average of $215 per ton; prices dipped all the way to $64 or lower in North Dakota.

With December estimates, 2020 annual average prices for dairy alfalfa, all alfalfa and other hay were about $10 per ton less than 2019 (see special insert, 2020 national forage review).

Organic hay

The USDA’s latest organic hay price report summarized free on board (f.o.b.) farmgate prices for the second half of January. Large square bales of Supreme alfalfa topped the market at $275 per ton, with Premium-Supreme large square bales averaging $260 per ton.

Export outlook still a challenge

At 224,433 metric tons (MT), December alfalfa hay exports rose more than 35,000 MT from November, with sales to China and Saudi Arabia the highest since May, offsetting slightly softer sales to Japan and South Korea.

With December’s total in the books, China purchased nearly 1.2 million MT of alfalfa hay in 2020, up more than 316,000 MT from the year before and representing about 44% of all U.S. alfalfa hay exports during the year. Total alfalfa hay exports hit 2.69 million MT, inching above last year’s previous record high.

At 99,954 MT, December exports of other hay fell under 100,000 MT for the third time in 2020 and just the fourth time since 2007. December exports of other hay were lower to the two largest markets, Japan and South Korea.

Full-year exports of other hay totaled 1.34 million MT, down 51,000 MT from 2019 and the lowest total in at least the past 15 years. Japan was the destination for nearly 60% of all exports of other hay during the year, followed by a 24% market share to South Korea.

Despite the increase in alfalfa hay sales in December, the export story is little changed, said Christy Mastin, sales representative with Eckenberg Farms, Mattawa, Washington.

Hay exporters continue to be challenged by shipping backlogs at nearly every port. Major shipping lines are reporting that wait times for ships, normally 12-24 hours, are now stretching out to two weeks or longer.

The long delays are due to shortages of vessel space, access to terminals, equipment and labor, and conditions were expected to remain that way until the end of March and possibly longer.

The supply chain disruptions are opening the door for U.S. competitors, Mastin said. Adequate numbers and timely access to containers are providing delivery advantages for Australian oaten hay, which competes with U.S. timothy and straws in Southeast Asia. Improved moisture conditions during harvest also aided Australian supplies, and with its domestic market shrinking due to lower cattle numbers, more oaten hay is available for export. Even though quality may be lower, large volumes pressure prices lower.

Regional markets

Here are more local snapshots of conditions and markets:

- Southwest: In Texas, drought conditions in the southwest Panhandle are creating a potential forage deficit, driving up demand and price for forage silage, said Jourdan Bell, Ph.D., Texas A&M AgriLife Extension Service agronomist. This could mean fewer producers will be taking their wheat crop to grain harvest, opting instead to cash in on forages, including wheatlage.

In California, hay demand is strong, and prices are steady.

In Oklahoma, alfalfa trade was improving. Wheat pastures were in good shape, but colder temperatures were expected. Most feedyards and dairies seemed to be current with needs.

- Northwest: The first video hay auction of the new year was held on Jan. 28. With very dry weather, demand was very good for hay sourced from western Nebraska, eastern Wyoming and northeast Colorado.

In Wyoming, large and small squares of alfalfa sold fully steady. Demand and buyer inquiry was very good. Some contacts still had a few loads of small and large squares of hay left to sell. Most of Wyoming had light to no snow at lower elevations.

In Montana, hay sold steady to firm on good demand. Supplies were light in southern areas, especially feeder-quality hay. Dairy-quality hay supplies were moderate, with many producers holding onto the highest-quality hay.

In Idaho, Fair-to-Good alfalfa and wheat straw sold steady to firm. Trade remained slow as most suppliers were shipping previous orders; remaining supplies were in firm hands.

In Colorado, trade activity was moderate on good demand for feedlot and dairy hay but lighter for stable and ranch-quality hay. Northeast Colorado feedlot and dairy hay prices were firm due to supply.

In the Washington-Oregon Columbia Basin, all grades of alfalfa for export, domestic and retail feedstore sold steady to firm in a light test. Domestic users utilized distressed alfalfa and timothy to meet needs.

- East: In Pennsylvania, alfalfa sold strong; alfalfa/grass mixtures and orchardgrass sold weak. Wheat straw and cornstalk straw sold steady to $10 higher.

In Alabama, hay prices were steady with moderate supply and demand.

- Midwest: In Missouri, there was confidence in hay supplies even though there are still a lot of feeding days left. Several new hay listings were available.

In Nebraska, buyer inquiry and demand were good, especially for big squares staying in the state. Livestock owners were expected to boost supplemental feeding, although many were hopeful that they have enough hay to get to summer grass. However, with calving season right around the corner, cold temperatures will force them to go through a lot of hay in a short amount of time.

In Kansas, prices were steady for all classes of hay on limited test. Demand remains strong for alfalfa.

In Iowa, the alfalfa and grass hay market was steady with decent buyer interest. A large selection of grass hay was available.

In South Dakota, alfalfa and grass hay sold steady with few reported sales. Very large offerings in regional hay markets added pressure to the market, especially on lower-quality hay. Best demand came from out of state, looking for high-testing alfalfa. Winter supplemental feeding had been light, but the forecast called for more snow and lower temperatures.