Drought areas expand a bit

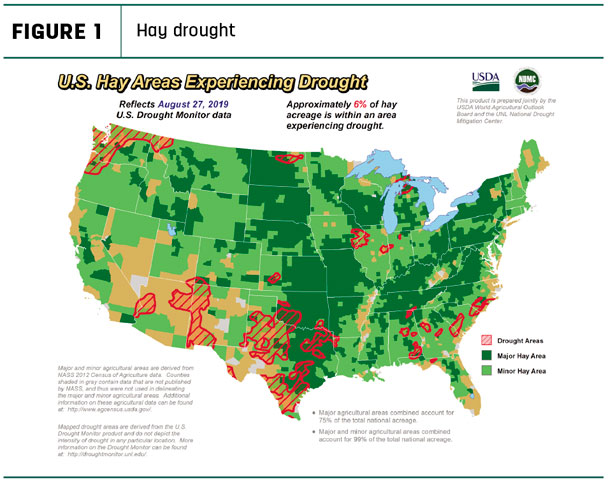

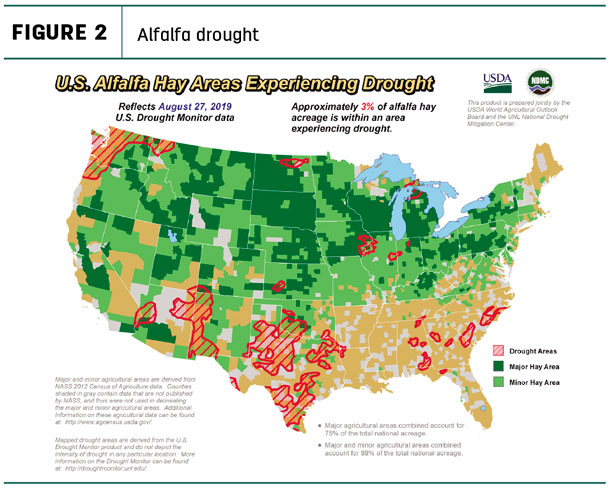

Hay-producing areas impacted by drought grew modestly in August and early September based on the USDA’s weekly drought monitor. About 6% of U.S. hay-producing acreage (Figure 1) was considered under a drought, a 4% jump in the past month. Alfalfa-producing areas impacted by drought rose to 3%, a 2% increase (Figure 2). Dry areas were in the Pacific Northwest, Oklahoma, Texas, New Mexico, Arizona and North Dakota, with scattered spots of the Midwest and Southeast.

Average hay prices continue slide

Alfalfa

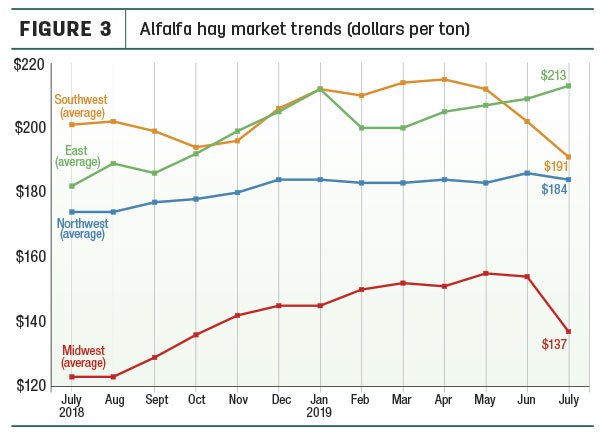

U.S. average alfalfa hay prices continued to dip, down $10 per ton from June and $21 off May’s peak.

On a regional basis, alfalfa hay prices rose in the East, but were lower in the Southwest and Midwest compared to a month earlier (Figure 3). Among individual states, July alfalfa hay prices jumped about $10 per ton in New York and Pennsylvania, but dropped $41 and $52 per ton in Minnesota and Wisconsin, respectively.

Compared to a year earlier, alfalfa hay prices were up $71 per ton in Pennsylvania and about $40 higher in Minnesota, Michigan and Wisconsin. In contrast, Kansas and Arizona alfalfa hay prices declined $20 and $30, respectively.

High monthly alfalfa hay prices were in Pennsylvania ($240 per ton), New Mexico ($235) and Colorado (both $230). The low price for the month, at $90 per ton, was again in North Dakota.

Other hay

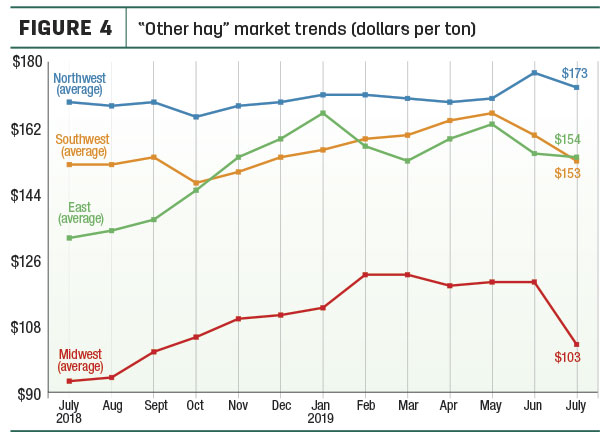

The U.S. average price for other hay also softened after hitting a five-year high in May. The July average of $136 per ton was down $10 from June and $16 from May, and the lowest since October 2018.

Regionally, largest declines were in the Midwest, influencing the national average (Figure 4). Among individual states, July average prices were down $35 to $55 from June in Iowa, Minnesota and Wisconsin, with only New Mexico posting a $10 increase.

Compared to a year earlier, July 2019 prices were up $30 to $44 in Pennsylvania, New York, Wisconsin and Illinois. Of the 27 reporting states, Idaho led decliners, down $30 per ton.

Highest average prices in July were in Colorado ($230 per ton), Oregon ($205) and Arizona ($200). Prices averaged under $100 per ton in six states, with the low in North Dakota ($70 per ton).

Dairy hay

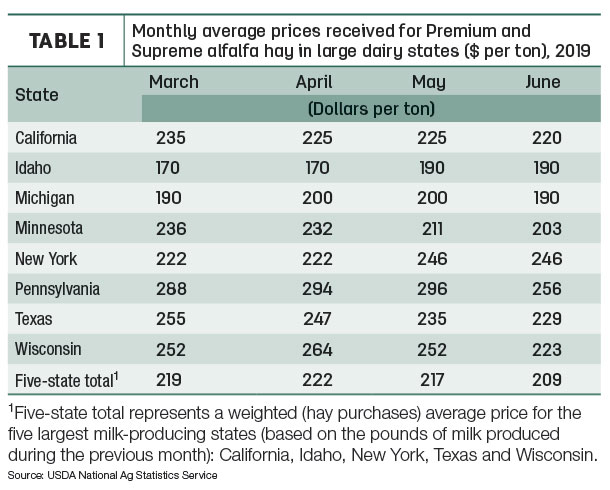

July prices for Premium and Supreme hay in the top milk-producing states averaged $209 per ton, down $8 from May (Table 1). Sharpest declines were in Pennsylvania and Wisconsin.

Organic hay prices

USDA’s Aug. 28 Organic Hay report showed f.o.b. farm gate prices paid for both Supreme large square bales and Good small square bales averaged $260 per ton; Premium and Supreme alfalfa large square bales averaged $245 per ton. No price data was available for delivered organic hay.

China alfalfa purchases hit 13-month high

While Japan and South Korea remain oversupplied with domestic timothy, quality grades are lower than earlier estimates, according to Christy Mastin, international sales manager with Eckenberg Farms Inc., Mattawa, Washington. The market for U.S. alfalfa is holding, but higher prices are causing concerns about rations and the need to replace the high-cost alfalfa with lower-priced forage.

Japan’s exchange is better for buying U.S. products, but customers are purchasing smaller volumes and making spot purchases instead of signing long-term contracts. That leads to shipping challenges as the U.S. hay export market moves into its busy season (October through February). Normally during this time, vessel space is in high demand, so early bookings are needed to secure cargo space. Shipping lines may also have issues with equipment availability and relocating containers. Adding to shipping costs, low-sulfur fuel surcharges are being announced for Oct. 1.

The political environment and never-ending threat of tariffs hangs over the hay export market in China, with concerns there may be additional tariffs placed in the middle of December.

Mastin said she believes export sales to China will be strong into November, as customers move to beat those tariffs.

Elsewhere, demand for U.S. alfalfa remains strong in the Middle East, Mastin said.

Here’s a look at the numbers:

- July alfalfa hay shipments totaled 233,547 metric tons (MT), the highest volume since June 2018. The July alfalfa hay exports were valued at $73.6 million, up nearly $5 million from June. At 1.48 million MT, January-July 2019 exports of alfalfa hay are slightly ahead last year’s pace and trail only 2017 in terms of sales for the first seven months of any year on record.

Despite tariff headwinds, China climbed back atop the U.S. alfalfa hay buyers’ list. At 71,799 MT, July’s total was the highest since July 2018. Among other leading markets, sales to Saudi Arabia, Japan, the United Arab Emirates (UAE) and South Korea remained strong and near normal monthly volumes.

- July shipments of other hay remained average at 112,336 MT; monthly sales were valued at $38.2 million. At nearly 797,225 MT, January-July 2019 exports of other hay are slightly ahead of last year’s pace, but trail seven-month sales totals for every other year dating back more than a decade.

Japan topped 60,000 MT in shipments for the seventh consecutive month, but sales to Japan, South Korea, Taiwan and the UAE were all down slightly from the previous month.

Regional markets

A summary of early September conditions and markets included:

- Midwest: In Iowa, continued sunny and dry weather meant most hay producers were expecting to get another cutting of hay. Most livestock producers are not quibbling about the prices as the images of last winter are still in their minds.

In Nebraska, dry hay concerns took a back burner to silage harvest. Many buyers are taking a look-and-see approach on what hay or forages could cost this fall. Most areas of the state will only get three cuttings of alfalfa, and some areas impacted by drought and hail damage might only get two cuttings. High humidity continues to delay hay drydown.

In Kansas, hay market trade was slow to moderate, demand was moderate and prices remained steady. Areas in southwest Kansas remained hot and dry, while the east and southeast continued to see rain, limiting harvest of prairie hay.

In Missouri, hay prices were steady to weaker. Fall-like temperatures and abundant moisture should help keep pastures growing and allow some stockpiling of grass prior to the arrival of frost. Hay movement has slowed as many have acquired at least enough hay to start the feeding season. Most producers have fencerows and barns back to capacity.

In South Dakota, demand was good for high-quality hay, especially from out-of-state buyers.

In Wisconsin, prices and demand remain strong for higher-quality hay due to limited supplies, and questions remain whether will be enough forages to carry through winter. Lower-quality hay supplies are stronger.

Supplies are also tighter in southwest Minnesota.

- Southwest: In California, trade activity was light to moderate on moderate demand.

In Oklahoma, dairy demand for hay and alfalfa of classes continues to be good.

In Texas, hay demand has recovered as volatility in the feeder cattle markets has begun to stabilize. Producers are beginning to supplement livestock as range conditions continue to decline due to extreme heat and lack of moisture.

In New Mexico, alfalfa hay trade was uneven on limited trade. Most regions were working on fourth cuttings, with some starting on the fifth cutting.

- Northwest: In Idaho, all grades of alfalfa sold steady to firm. Alfalfa testing over 185 relative feed value (RFV) remained hard to find due to weather conditions. Demand remains good especially for high-testing alfalfa.

In Colorado, above-normal temperatures and below-average rainfall were raising drought concerns in some areas. Hay producers were holding out on current offers.

In Oregon, prices trended generally steady. Some hay acreage has been changed over to grow hemp. In the Washington-Oregon Columbia Basin, export and domestic buyers remained cautious. Demand remains moderate to good on alfalfa, but very light on timothy as producers are having a hard time getting any firm offers.

In Montana, hay movement was light. Ranchers expressed dismay over the current market situation and were bidding hay lower. However, with good demand continuing to be seen from out-of-state buyers, producers continue to keep prices steady. Hay producers continue to sell loads of hay weekly to Washington and Idaho. Exporters are still looking for high-quality hay.

In Wyoming, demand was moderate to good from local and out-of-state buyers. With early signs of fall, this might be all of the cutting of hay the producers will get harvested this season. Reports indicate plenty of lower-testing hay available, but a very limited supply of 150 RFV and above.

- East: In Pennsylvania, all varieties of hay traded mostly steady; straw traded mostly steady to $15 higher.

In Alabama, hay prices were steady on good supplies and light demand.

Dairy outlook

Monthly year-over-year milk production growth has now been under 1% for 10 consecutive months, and July U.S. dairy cow numbers declined 9,000 head from June to 9.31 million head, the smallest U.S. dairy herd since January 2016.

Nine states increased cow numbers compared to July 2018, with the largest jumps in Texas (+30,000 head) and Idaho (+9,000). The decline in Pennsylvania (-30,000 head) was offset by a 30,000-head increase in Texas. Other states seeing substantial declines were Ohio (-12,000) and California, Florida, New Mexico, Virginia, Arizona and Illinois (each down 7,000 to 9,000 head). Iowa, Minnesota and Wisconsin were down a combined 14,000 head.

The USDA’s latest milk production forecasts were reduced for both 2019 and 2020. As a result, price projections were increased slightly for 2019, with further improvement in 2020.

Fuel prices

Hay producers were finding some relief in terms of fuel prices entering September, aided by lower crude oil prices this summer. The U.S. Energy Information Administration forecasts stable crude oil prices to end 2019 and into 2020.

At $2.56 per gallon, U.S. average gasoline prices started September about 26 cents per gallon less than a year earlier. Prices on the West Coast (including California) were the highest at $3.25 per gallon; the Midwest saw prices average $2.46 per gallon.

Similarly, U.S. average diesel fuel prices were down nearly 28 cents per gallon compared to a year earlier at about $2.98 per gallon to start September. Prices in California were 90 cents per gallon higher than the national average, while Rocky Mountain states paid an average of $2.92 per gallon.

Figures and charts

Progressive Forage tracks regional hay price trends using average monthly prices reported for selected states by the USDA’s National Agricultural Statistics Service (NASS). The USDA report does not provide hay quality classes in its price reports. By region, states included:

• Southwest – Arizona, California, Nevada, New Mexico, Oklahoma, Texas

• East – Kentucky, New York, Ohio, Pennsylvania

• Northwest – Colorado, Idaho, Montana, Oregon, Utah, Washington, Wyoming

• Midwest – Illinois, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, South Dakota, Wisconsin ![]()

-

Dave Natzke

- Editor

- Progressive Forage

- Email Dave Natzke