More acreage planned in 2020

There’s still plenty of time and weather to impact 2020 cropping plans, but U.S. producers intend to increase acreage devoted to hay this year, according to the USDA’s Prospective Plantings report, released March 31.

Producers intend to harvest 53.28 million acres of all hay in 2020, up 858,000 acres (2%) from 2019 and the largest total hay acreage since 2017. The report does not differentiate between alfalfa and other hay.

The acreage estimates in the report are based primarily on producer surveys conducted during the first two weeks of March. Estimates will updated in the USDA’s Acreage report, June 30.

Based on the preliminary estimates, Kansas will see the biggest jump in hay harvest area in 2020, up 420,000 acres from 2019. Nebraska (+200,000), Iowa and North Dakota (each +180,000) will also post substantial increases. Compared to a year earlier, biggest declines in hay acreage are in Oklahoma (-205,000), Montana (-200,000) and Missouri (-110,000).

California hay area is also expected continue to decline, down 90,000 acres from 2019, to 920,000 acres. That’s down 630,000 acres from the 1.55 million acres in 2012 and a new record low.

Record-low hay acreage is also anticipated in Indiana, Maine, Massachusetts, Michigan, New Jersey, Ohio, Oregon, Rhode Island and Washington in 2020.

Producers in the 24 major dairy states are expected to increase area harvested for hay by 775,000 acres, thanks to the strong growth in Kansas and Iowa. While 13 of the 24 dairy states expect modest increases in hay acreage, declines are expected in Colorado, Indiana, Oregon, Texas and Washington.

Alfalfa exports hit three-month high

After hitting a two-year low in January, alfalfa hay exports improved in February after the end of the Chinese New Year, said Christy Mastin, sales representative with Eckenberg Farms, Mattawa, Washington.

The latest monthly USDA report showed shipments totaled 210,896 metric tons (MT), the highest for any month since last November. Sales to China were robust, topping 80,680 metric tons (MT), also the highest since November. Sales to Japan topped 50,000 MT for a fifth straight month.

February exports of other hay continued to struggle, barely above January’s 24-month low. Shipments for the month totaled 106,677 MT, the second-lowest volume in the past 12 months. Japan was the leading buyer, at 63,557 MT, with South Korea taking 22,355 MT.

The Northwest Farm Credit Services (FCS) quarterly hay market snapshot suggested that while export demand remained favorable, limited supplies of shipping containers will continue to be a challenge through the COVID-19 disruption.

The “Phase One” deal between the U.S. and China started the clock on development of timothy and alfalfa cube export protocols, but there was still uncertainty around how strong demand will be. The ability to ship to China is favorable for Northwest timothy growers, according to the FCS report. Chinese buyers tend to focus on “clean and green” alfalfa grades and, if this turns out to be the trend with timothy, it could provide some optimism to an oversupplied market.

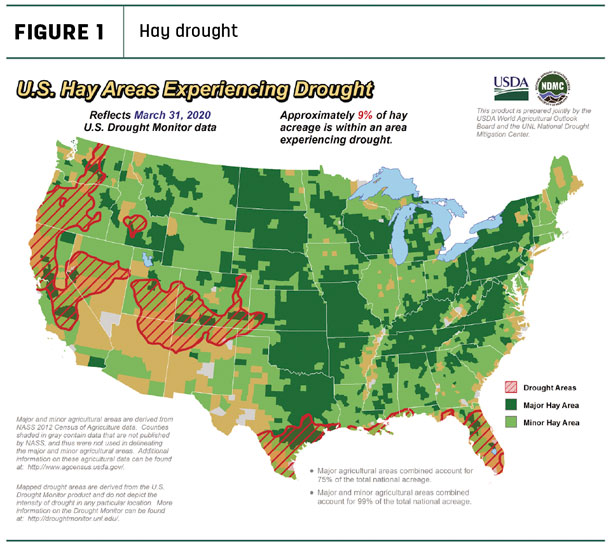

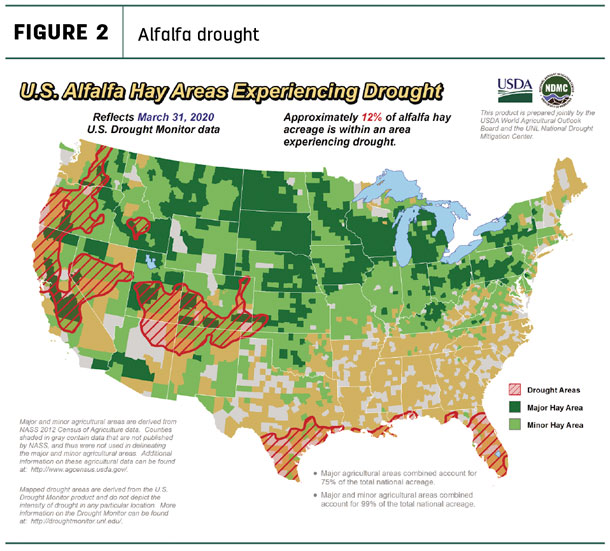

Drought areas, moisture conditions

March brought expanding drought areas in California, Nevada, Oregon and Washington. About 9% of U.S. hay-producing acreage (Figure 1) was considered under drought conditions at the end of March, a 2% increase from four weeks earlier. At 12%, alfalfa-producing areas affected by drought increased 2% from early March (Figure 2). Other large dry areas were in southern Texas, Colorado, central Idaho and Utah.

For the past 30-day period, precipitation was below normal across the Dakotas, eastern Wyoming, southeastern Colorado and portions of western Kansas, while above-normal precipitation was observed across much of Nebraska, eastern Kansas and portions of northeastern Colorado.

Except southern Texas, soil moisture levels are good in much of the state, setting up hope for good hay yield potential.

February prices summarized

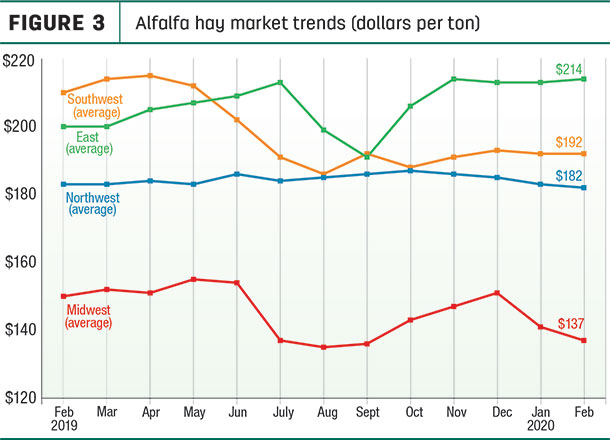

Alfalfa

The U.S. average alfalfa hay price averaged $171 per ton in February 2020, unchanged from the month before but down about $9 from February 2019. Prices were also steady in three of four regions tracked by Progressive Forage, with slight weakness in the Midwest (Figure 3).

Colorado ($230 per ton), Pennsylvania ($229) and New Mexico and Ohio (both $220) again had the highest prices for the month; the low was in North Dakota ($85).

Compared to a month earlier, average prices were down $10 to $13 in Utah, Iowa and Texas but up $5 to $7 in Nebraska, Oklahoma, Arizona, Colorado and Nevada.

Compared to a year earlier, average prices were down $30 to $45 in Kansas, New Mexico and Oklahoma but up $40 in Ohio and $30 in Pennsylvania.

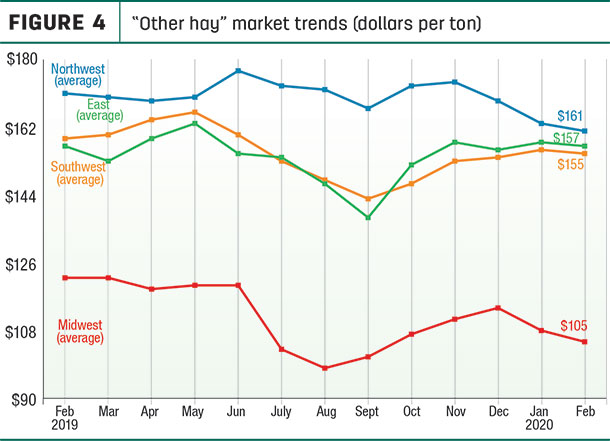

Other hay

Compared to a month earlier, the U.S. average price for other hay remained fairly steady in February 2020, with only small increases in each region (Figure 4). The U.S. average price was down $17 per ton from February 2019.

Highest average prices in February were in Colorado ($230 per ton), followed by Arizona ($200). Prices again averaged under $100 per ton in four states: Nebraska, North Dakota, Oklahoma and South Dakota.

Compared to a month earlier, prices dipped $10 to $12 per ton in Wyoming and Minnesota, with small increases reported in North Dakota, Colorado, Kentucky and Texas.

Compared to a year earlier, average prices were down $34 to $51 in Wisconsin, Washington and Minnesota but up $25 to $35 in Ohio and New Mexico.

Dairy hay

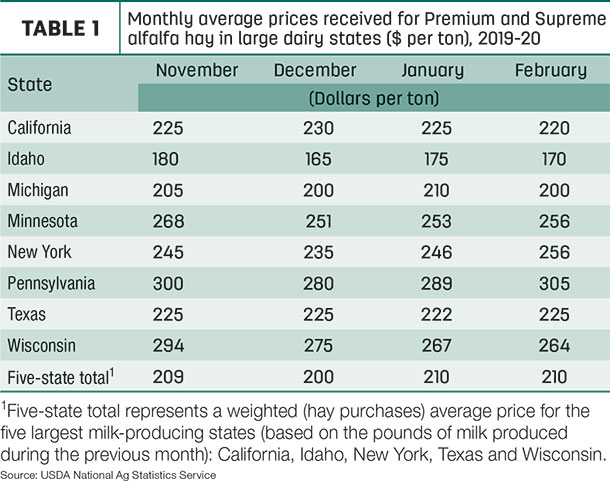

The average price for Premium and Supreme hay in the top milk-producing states averaged $210 per ton in February, unchanged from January (Table 1), although there were modest increases in New York and Pennsylvania.

Organic hay

According to the USDA’s organic hay report, FOB farm gate prices at the end of March were: Premium-Supreme alfalfa small square bales – $250 per ton; Premium alfalfa large square bales – $220 per ton; and Good small square bales of straw – $240 per ton.

Regional markets

Here’s a regional summary of early April conditions and markets:

- Midwest: In Nebraska, buyer inquiry was improving, especially from feedlots seeking grinding-type forages. Some feedlots have switched to alfalfa pellets to help with protein sources as availability of distillers grains becomes tight.

Higher-quality hay in greater volumes was finding its way to markets in Iowa. Prices on Supreme alfalfa were steady, while all other classes of hay were steady to weak.

In Kansas, there were a few reports of increased inquiries and deliveries of alfalfa, directly attributed to a lack of distillers grains availability.

Hay season got underway in southern Missouri. The supply of hay was moderate, demand was light and prices were steady.

In South Dakota, there were ample supplies of lower-quality hay, but high-quality hay is much harder to find. Market uncertainty has beef cattle producers seeking to lower costs, pressuring hay prices lower.

In Wisconsin, low forage inventories kept demand good for all types of hay and prices for top-quality hay were strong; poor-condition hay was discounted.

In southwest Minnesota, prices were steady, with a limited supply of hay at the market.

- Southwest: In Oklahoma, movement of alfalfa and other hay started April at a standstill, hampered somewhat by rain. Most of the alfalfa quoted at the top of the price ranges had to be flawless. Producers were about a month away from new-crop hay and hoping markets come back to some sort of normalcy.

Hay demand in southern Texas remains very good with prices staying firm as hay supplies continue to shorten.

In California, trade activity was moderate on moderate demand.

- Northwest: In Montana, demand was light to moderate. Ranchers and dairies are nervous about current market conditions and are reluctant to buy hay.

In Idaho, demand was slow and likely to continue that way until new-crop hay is available.

In Colorado, trade activity and demand were moderate.

In Wyoming, demand and buyer inquiry was good. Some USDA contacts that are sold out continue to look for hay from other producers to fill orders that keep coming in on small squares.

Winter conditions eased hay demand in the Northwest, according to the FCS report, which suggested alfalfa producer profitability will moderate over the next 12 months. Hay inventories were higher than expected, yet high-quality hay was scarce. In the Washington-Oregon Columbia Basin, price ratios between hay and alternative crop rotations favored increasing alfalfa acreage in 2020. Timothy prices decreased significantly due to an abundant supply and lower quality.

In Oregon, prices trended generally steady in a very limited test. In the Washington-Oregon Columbia Basin, trade remained very slow and expected to stay slow until new-crop hay became available. Most feedlots report inventory supplies out into July.

- East: In Pennsylvania, all varieties of hay traded unevenly steady, with hay supplies and buyer attendance at auctions moderate. Large volumes of milk were being dumped.

In Alabama, hay prices were steady with light supply and good demand.

Other things we’re seeing

-

Dairy markets take a dramatic downturn. What started out looking like a promising year is now turning disastrous. Even though “panic buying” related to COVID-19 created a surge in fluid milk sales at grocery stores, the increase wasn’t enough to offset lost milk and other dairy product sales in foodservice channels, as schools and restaurants remained closed. With no place to go for that milk, widespread milk dumping was reported. At the Chicago Mercantile Exchange, 2020 milk futures prices as of April 1 were down $3 to $6 per hundredweight compared to January. Dairy farmer income margins are forecast to crash, with the severest pain felt this summer and extending well into fall.

-

Cattle markets are volatile. A slowing economy is bad for all of the animal proteins, and beef stands to suffer as consumers spend less in response to wage cuts and job losses. Additionally, beef is heavily used in foodservice channels. Packing plant disruptions are a significant risk to the cattle and beef markets.

- Fuel prices have an impact. Reduced gasoline demand due to COVID-19-related travel restrictions is also fueling sharply lower demand for ethanol. Some ethanol plants are reducing production, and others are closing. That not only affects ethanol production but also availability and price for a byproduct, distillers grains, for livestock feed. Some livestock feeders are turning to alfalfa to fill a ration protein void.

Figures and charts

Progressive Forage tracks regional hay price trends using average monthly prices reported for selected states by the USDA’s National Agricultural Statistics Service (NASS). The USDA report does not provide hay quality classes in its price reports. By region, states included:

- Southwest – Arizona, California, Nevada, New Mexico, Oklahoma, Texas

- East – Kentucky, New York, Ohio, Pennsylvania

- Northwest – Colorado, Idaho, Montana, Oregon, Utah, Washington, Wyoming

- Midwest – Illinois, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, South Dakota, Wisconsin.

-

Dave Natzke

- Editor

- Progressive Dairy

- Email Dave Natzke