The USDA released its annual Acreage report on June 30, providing an estimate of crop acreage after most 2020-21 crop planting is done. This year’s report, based on grower surveys conducted during the first two weeks of June, estimates hay producers intend to harvest 52.4 million acres of all hay in 2020, down about 44,000 acres from 2019 and down about 902,000 acres from the USDA’s March Prospective Plantings report. If realized, this will represent the lowest total hay-harvested area since 1908.

- All hay: Wisconsin leads all states in reduced hay acreage in 2020, down 230,000 acres from 2019 and down 280,000 acres from March intentions. California’s 2020 estimate of 825,000 acres is down another 185,000 acres from last year, continuing a steep reduction from the 1.55 million acres in 2012. Montana, Missouri, Texas, New York and Nevada are all down at least 100,000 acres in 2020. Biggest gains are in Kansas (+450,000 acres) and Nebraska (+220,000 acres).

- Alfalfa hay: At 16.35 million acres, U.S. alfalfa hay area is down 391,000 acres from 2019. Much of that decline is in the 24 major dairy states, which are forecast 368,000 acres lower collectively to 10.54 million acres.

Montana leads all states in alfalfa acreage shrinkage, down 200,000 from last year. California is expecting 145,000 fewer acres, and other large drops are in Wisconsin, down 140,000 acres, and Kansas, down 100,000 acres. Biggest gains are in North Dakota and Washington, up 230,000 and 70,000 acres, respectively.

- Other hay: The loss of alfalfa acreage is almost entirely recouped in “other hay” acreage in 2020, up 347,000 acres from 2019 to 36.03 million acres. In contrast to alfalfa, the major dairy states will see a 360,000-acre increase, but most of that is attributed to a huge jump in Kansas (+550,000 acres) offsetting declines of 100,000 acres in Texas and 90,000 acres in both Wisconsin and New York.

Here’s a look at other factors impacting hay markets as we move into the middle of July.

U.S. alfalfa exports remain strong

Although slipping from April’s record high, alfalfa hay exports remained strong in May. At 280,318 metric tons (MT), May’s sales were the second-highest total on record, and the March-May 2020 exports (827,964 MT) topped a previous three-month high set in March-May 2018 (808,588 MT). The value of May alfalfa hay exports was estimated at nearly $94.8 million.

China was again the biggest customer, although at 117,881 MT, the volume was down nearly 10,000 MT from April. Increases to Saudi Arabia, the United Arab Emirates (UAE) and Taiwan mostly offset a decline in sales to Japan.

May exports of other hay totaled 139,671 MT, the highest monthly volume since August 2017. At 82,188 MT, Japan nearly matched its five-year high for purchases of other hay from the U.S., set in March. Sales to South Korea, Taiwan and the UAE were mostly steady. The value of May exports of other hay was estimated at $47.8 million.

Exports of dehydrated alfalfa cubes surged to 14,875 MT, surpassing previous highs set in May-June 2017.

With COVID-19 travel restrictions, Christy Mastin, sales representative with Eckenberg Farms, Mattawa, Washington, said her company has been busy sending email offers and new-crop alfalfa and timothy samples to potential customers.

The early season sales to Japan were spurred by concerns over port shutdowns, but there now seems to be more domestically available alfalfa and timothy there, which could impact U.S. suppliers.

China’s demand for alfalfa seems to be holding strength during periods of relative calm on the political front.

With domestic supplies short, South Korea has been actively purchasing U.S. alfalfa, and demand should remain strong for other hay and straw for the year.

Drought areas expand

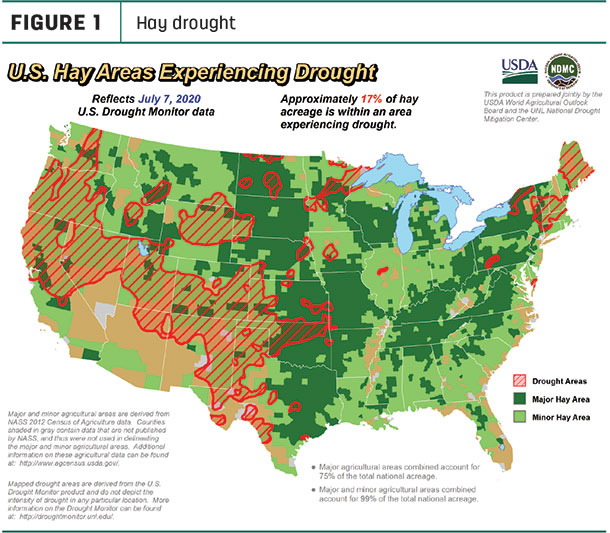

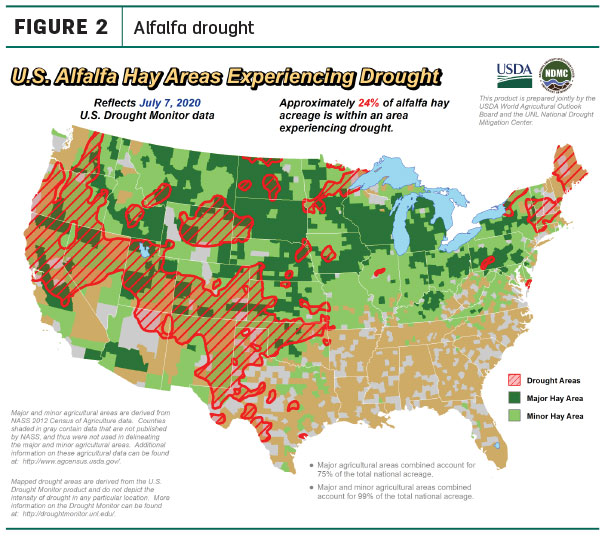

Mid-July weather maps showed an expansion of hay-producing areas impacted by drought, especially west of the Mississippi River. Conditions remained dry in all or portions of California, Colorado, Idaho, Kansas, Minnesota, southwestern Montana, Nevada, northeastern New Mexico, Oregon, Texas, Utah and Wyoming, with expanding areas in North Dakota and South Dakota and emerging areas in New England and upstate New York.

About 17% of U.S. hay-producing acreage (Figure 1) was considered under drought conditions as of July 7, a 4% increase from mid-June. At 24%, alfalfa-producing areas affected by drought increased 3% over the same period (Figure 2).

May prices summarized

The lag in USDA price reports and price averaging may not always capture current markets, so check individual market reports elsewhere in Progressive Forage.

Alfalfa

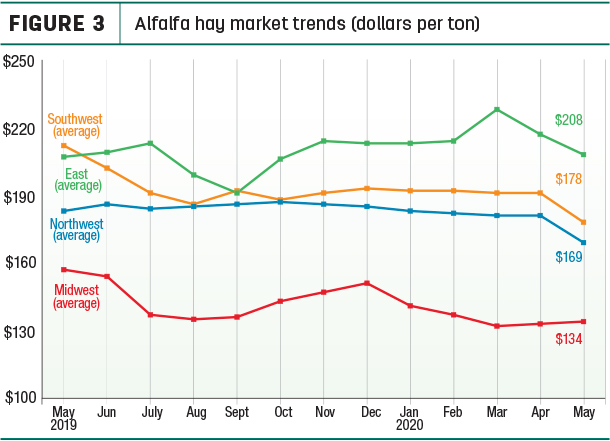

The U.S. alfalfa hay price averaged $179 per ton in May 2020, down $2 from the month before and down about $25 from the 2019 peak of $204 per ton set in May last year. Average prices declined in three of four regions tracked by Progressive Forage (Figure 3), although price changes in just a few states skewed numbers within regions.

Compared to a month earlier, there were modest price increases of $2-$10 per ton in six states, which were more than offset by declines of $5-$20 per ton in 15 others.

Compared to a year earlier, May average alfalfa hay prices were up $47 per ton in New York and $21 higher in Pennsylvania. However, average prices were down $50, $56 and $69 in Arizona, Oklahoma and Wisconsin, respectively.

Pennsylvania ($251 per ton), New York ($233 per ton) and Colorado ($230) had the highest alfalfa hay prices in May; lowest prices were in North Dakota ($85 per ton) and South Dakota ($102).

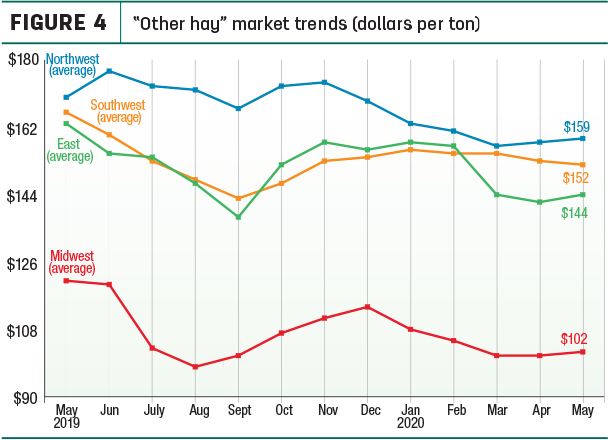

Other hay

The U.S. average price for other hay reversed course in May, rising $7 to $131 per ton but was still $21 below a year earlier. Multistate averaging belies bigger changes in individual states within regions (Figure 4). Compared to the previous month, other hay prices were up $20-$22 in Wisconsin and Oklahoma and $10 higher in Colorado and Iowa, but $10-$20 lower in Arizona and New Mexico. Compared to a year earlier, prices were up $13-$15 in Colorado and Kansas but $30-$50 lower in Iowa, Oregon, Wisconsin, Oklahoma, Michigan, Pennsylvania and Minnesota.

Highest average prices in May were in Colorado ($235 per ton), followed by Arizona ($185). Prices averaged under $100 per ton in five states: Kansas, Minnesota, Nebraska, North Dakota and South Dakota.

Dairy hay

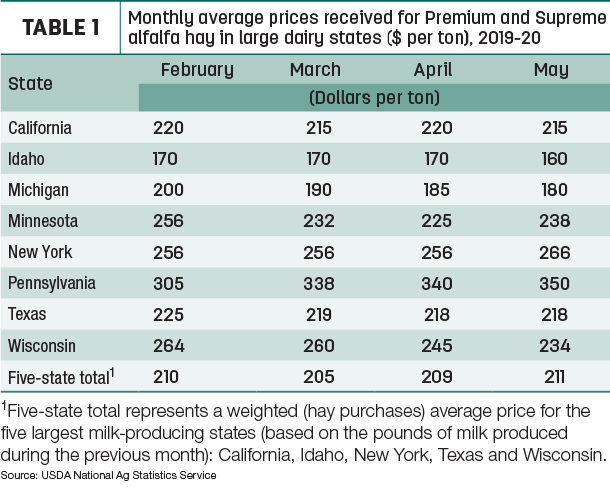

The average price for Premium and Supreme alfalfa hay in the top milk-producing states averaged $211 per ton in May, up $2 from April (Table 1). Prices were higher in the East but mostly lower elsewhere.

Organic hay

Hay prices were not listed in the USDA’s Organic Market report for early July.

Regional markets

Here’s a regional summary of conditions and markets during the first week of July:

- Midwest: In Missouri, farmers continue making and adding to hay piles, which are taking up a lot more space along the fencelines. Weather has been a mix: Counties along the western border south of Kansas City are showing on the latest drought monitor, while a few areas have water standing in fields after isolated downpours. The supply of hay is moderate to heavy, and demand is light. Prices are mostly steady.

In Iowa, lower-quality hay sold steady to stronger.

In Kansas, alfalfa prices firmed up due to the pressure of the worsening drought.

In Nebraska, demand was mixed, and alfalfa sold steady, with ground and delivered hay steady to $10 higher.

In Michigan, a very dry weather pattern affected second alfalfa cuttings in varying ways: Overall, it was below average in yield, with excellent quality. However, in some areas, second cutting was virtually nonexistent. In contrast, some areas in the south that received timely rains reported excellent quality and above-average yields. While some producers of horse hay were planning on taking their second cutting, dairy producers were finished. Third cutting will be very slim if there’s not some rain soon. Producers were scouting for high levels of potato leafhoppers, and dry weather will provide conditions that make it more difficult for alfalfa to withstand insect pressure.

In South Dakota, there was good to very good demand from dairies looking for high-testing alfalfa, more moderate for other qualities and types of hay.

In Minnesota, coronavirus-related livestock marketing disruptions and increasing drought concerns have prompted state agencies to streamline the process of approving haying and grazing on state-owned land. In southwest Minnesota, prices were steady with a limited supply of quality hay at the market.

- Southwest: In Texas, hay trades were mostly steady to firm in all regions to start July. Drought conditions improved in the southern and central regions of the state, but lack of moisture and above-normal temperatures expanded the drought area in the Panhandle and west, forcing many cattle producers to cull deeper into their herds as supplemental feeding has become the new norm.

In California, trade was moderate on moderate demand. Alfalfa harvest continues; silage corn growth is being aided by an increase in irrigation.

In Oklahoma, alfalfa and hay trade movement picked up a little, with no rain in most parts of the state; cow hay is moving fastest. Producers reported that old-crop hay is mostly cleaned up.

In New Mexico, alfalfa hay prices were steady; trade was moderate to active, demand moderate to good. Most regions are taking third cuttings.

- Northwest: In Wyoming, all reported hay sold fully steady on improved demand, with quite a lot of hay moving in the western areas. Some hay is going to local cattlemen, with other loads going out of state. Most areas continue to be dry, with a few fires reported. Some reports indicate irrigation districts have reduced water availability. At a video auction, demand for hay from western Nebraska and eastern Wyoming was good from dairies and ranchers alike.

In Idaho, domestic new-crop alfalfa sold steady in a light test. A lack of higher-testing, new-crop alfalfa has increased demand, while an abundance of feeder-quality rained-on supplies has put pressure on the market for that commodity.

In Colorado, trade activity and demand were light to moderate. In the northeast, second-cutting alfalfa harvest was underway. The southeast was still battling extreme drought, and cattlemen were emergency grazing on Conservation Reserve Program grass in an attempt to retain cow herds. In the San Luis Valley, new-crop dairy-quality alfalfa was beginning to trade, with prices firm due to drought conditions in northern New Mexico. In the southwest, first-cutting alfalfa hay was starting to move at price levels acceptable to producers. No trades were reported in the mountain and northwest regions as hay producers were holding out for better market conditions.

In the Washington-Oregon Columbia Basin, all grades of Premium and Supreme non-rained alfalfa and timothy sold steady. Trade was active with good demand as export and domestic buyers sought supplies. Supplies of new-crop feeder hay are very abundant with local feedlots having large carryover supplies.

The Northwest Farm Credit Services quarterly Hay Market Snapshot, released at the end of June, indicated Individual producer profitability will depend on the ratio of high- and low-quality hay this year. Unfortunately, widespread rain disrupted first cutting across the Northwest, leaving inventories of high-quality hay limited.

- East: In Pennsylvania, alfalfa and alfalfa blends sold firm to $10 lower; grass hays sold $10-$20 higher on limited sales. Straw sold firm to $15 higher.

Other things we’re seeing

-

Dairy. The resurgence continues. The USDA’s July World Ag Supply and Demand Estimates (WASDE) report cut the milk production forecast for 2020, while boosting projected Class III and all-milk prices significantly. With the recent surge in cheese prices, the 2020 Class III milk price was projected at $18 per hundredweight (cwt), a $2.35 increase from last month’s forecast. The 2020 all-milk price is now projected at $18.25 per cwt, up $1.60 from last month.

-

Cattle carcass weights heavier. While coronavirus-related slaughter plant and marketing disruptions have moderated, that backlog is likely to result in heavier beef carcass weights through summer. We will likely see higher fed and feeder cattle prices entering the fourth quarter of 2020, due to incredibly light feedlot placements earlier this spring, according to Michael Nepveuz, economist with the American Farm Bureau Federation. The USDA will release the Cattle report on July 24, providing a midyear estimate of U.S. cattle inventory as well as producer intentions regarding retention of heifers for beef cow replacement.

- Farmer sentiment. The Purdue University/CME Group Ag Economy Barometer indicates farmer sentiment regarding the ag economy improved substantially in June, with ag producers more optimistic about both their current and future farming operations. The report summarizes monthly survey responses from about 400 producers whose annual market value of production is equal to or exceeds $500,000.

Figures and charts

Progressive Forage tracks regional hay price trends using average monthly prices reported for selected states by the USDA’s National Agricultural Statistics Service (NASS). The USDA report does not provide hay quality classes in its price reports. By region, states included:

- Southwest – Arizona, California, Nevada, New Mexico, Oklahoma, Texas

- East – Kentucky, New York, Ohio, Pennsylvania

- Northwest – Colorado, Idaho, Montana, Oregon, Utah, Washington, Wyoming

- Midwest – Illinois, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, South Dakota, Wisconsin

-

Dave Natzke

- Editor

- Progressive Forage

- Email Dave Natzke