Producers intend to harvest 52.8 million acres of all hay in 2019, down less than 1 percent from 2018. If realized, this will represent the lowest total hay harvested area since 1908.

The decrease in acreage is due to a 1 percent decrease in all “other” hay acreage compared to 2018, to 35.9 million acres. Acres of alfalfa and alfalfa mixture hay are estimated at 16.8 million, up 1 percent compared with 2018.

Record-low all hay harvested area is expected in California, Illinois, Maine, Michigan, New York, Ohio, Pennsylvania, Vermont, Washington and West Virginia in 2019.

Among the 24 major dairy states, all hay was expected to be harvested from about 27.7 million acres, down 262,000 acres from 2018. Area devoted to other hay was estimated at 16.6 million acres, down 460,000 acres, while alfalfa/alfalfa mixture hay harvest area was set at just over 11 million acres, up about 198,000 acres.

Among dairy states, all hay acreage is expected to decrease a combined 625,000 acres in California, Idaho, Kansas, Texas and Washington, led by a 275,000-acre decline in Texas. While Texas alfalfa/mixture hay acreage is expected to increase, the other four states will be down 170,000 acres.

Largest increases in all hay area are in Iowa (+140,000) and Minnesota (+80,000), thanks to increases in alfalfa/mixture acreage of 80,000 and 130,000 acres, respectively. South Dakota was expected to boost alfalfa/mixture hay by about 50,000 acres.

Producers may be able to make up for some of the hay acreage decline by harvesting cover crops from “prevent plant” acreage.

Read: USDA Risk Management Agency grants ‘prevented plant’ cover crop harvest flexibility

Drought areas remain small

Excess moisture, rather than drought, continues to be the growing season concern. At Progressive Forage Extra’s deadline, Tropical Storm/Hurricane Barry was threatening to dump more moisture on the nation’s midsection as it moved north.

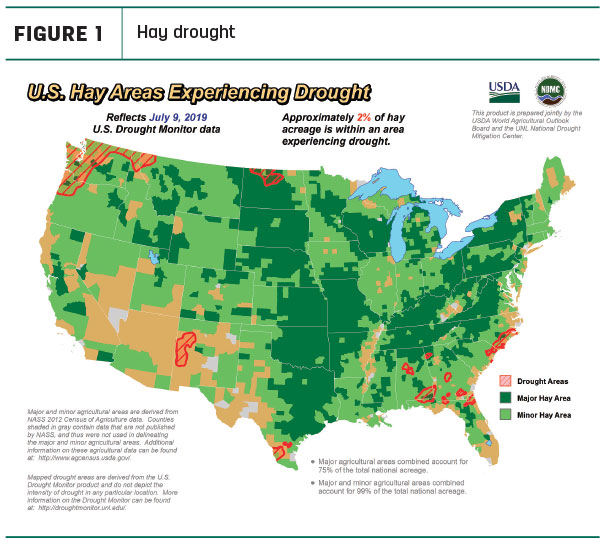

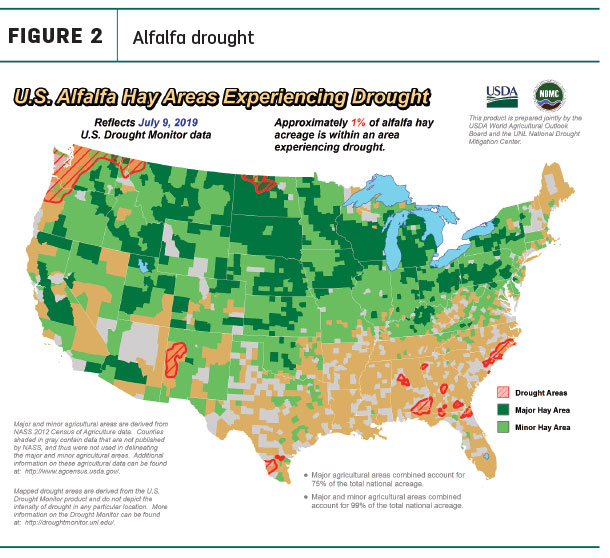

Areas highlighted on the USDA’s weekly drought monitor continued to be the smallest in a decade. About 2% of U.S. hay-producing acreage (Figure 1) and 1% of alfalfa hay-producing acreage (Figure 2) was considered drought areas as of July 9. Dry pockets are in the Pacific Northwest and North Dakota, and are scattered in some areas of the Southeast.

Hay prices continue to rise

Alfalfa

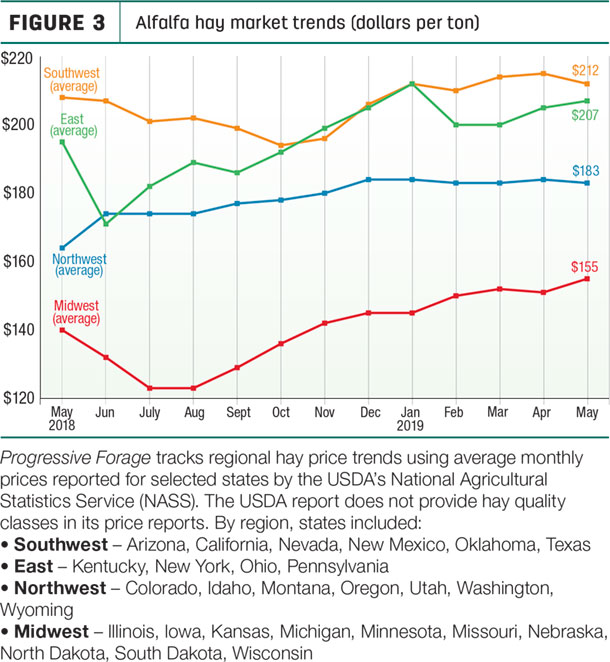

Based on historical USDA data, alfalfa hay prices hit their annual peak in May, as old-crop inventories are drawn down and new-crop harvest gets underway. It’s too early to tell how 2019 will play out, but with May U.S. hay inventories at a six-year low (https://www.progressiveforage.com/news/industry-news/spring-u-s-hay-inventories-lower) and the slow start to the new-crop harvest season, alfalfa hay prices moved higher for a sixth straight month. At $204 per ton, the U.S. average is the highest since August 2014.

On a regional basis, alfalfa hay prices rose in the East and Midwest but were slightly lower in the Northwest and Southwest compared to a month earlier (Figure 3). Among individual states, alfalfa hay prices jumped $33 per ton in Wisconsin, with widespread reports of dairy farmers desperate to find hay. Arizona, Iowa, Michigan and Ohio prices rose $10 to $20 per ton compared to April. Leading decliners were in Kansas, Nevada, Oklahoma and California.

Compared to a year earlier, alfalfa hay prices were up $70 per ton in Pennsylvania, $45 in Wisconsin and $35 to $42 in Iowa, Colorado, Minnesota, Michigan and Utah.

High monthly alfalfa hay prices were in New Mexico ($245), Arizona ($240), Colorado and Pennsylvania ($230). The low price for the month, at $85 per ton, was again in North Dakota.

Other hay

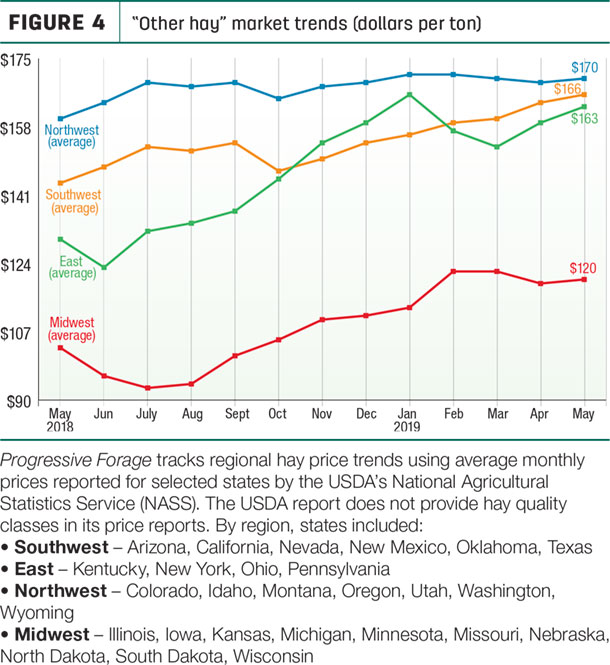

The national average price for other hay was $152 per ton in May 2019, up $1 from April and the highest since May 2014. Regional price increases were highest in the East (Figure 4).

Among individual states, Oklahoma and Wisconsin saw the largest month-to-month increases, up $20 and $19 per ton, respectively, while the average price was down $15 per ton in California. Compared to a year earlier, May 2019 prices were up $70 in Wisconsin, $67 in Pennsylvania and $47 and $46 per ton in Oklahoma and New York, respectively.

Highest average prices for other hay in May were in Colorado ($220 per ton), Arizona and Pennsylvania ($200). On the other end of the spectrum, the average price in North Dakota was just $68 per ton.

Dairy hay

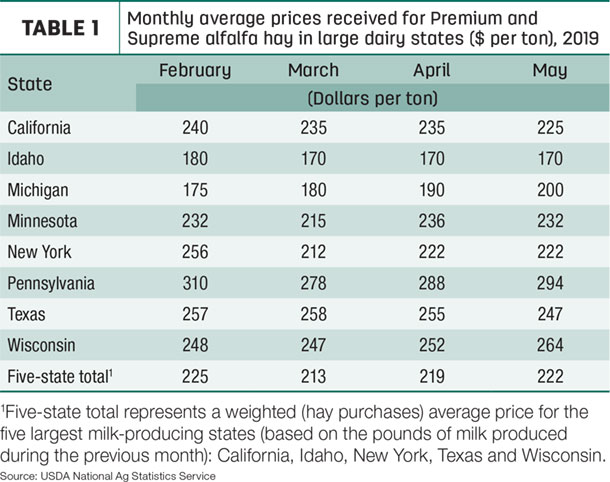

Prices for dairy-quality alfalfa hay also continued to rise. The USDA’s National Ag Statistics Service provides price summaries for Premium and Supreme hay in the top milk-producing states, averaging prices for the top five: California, Idaho, New York, Texas and Wisconsin (Table 1). May 2019 prices in those states averaged $222 per ton, up $3 from April.

Organic hay prices

According to the USDA’s Organic Hay report, released July 3, FOB farm gate prices paid for Supreme alfalfa large square bales averaged $350 per ton. Premium large square bales of old-crop alfalfa brought $215 per ton. No price data was available for delivered organic hay.

Hay exports

Limited U.S. supplies of old-crop hay and a slow start to the new harvest season limited May export potential, according to Christy Mastin, international sales manager with Eckenberg Farms Inc. of Mattawa, Washington.

At 114,588 metric tons (MT), May shipments of other hay were about average so far in 2019; monthly sales were valued at $38.9 million.

Japan remained the most prolific buyer of other hay, topping 60,000 MT for the fifth consecutive month. May sales to South Korea and Taiwan were steady with April, with sales of other hay to the United Arab Emirates (UAE) up slightly.

An oversupply of timothy and other hay in both South Korea and Japan has suppressed further growth in U.S. sales of other hay, putting downward pressure on prices. However, less-than-ideal weather conditions during the current hay harvest season in those two countries is yielding hay of questionable quality, Mastin said. That may draw down inventories in the next couple months, helping boost U.S. sales.

May alfalfa hay shipments totaled 228,558 MT, an eight-month high, and were valued at $73.4 million, the high for the year.

Among leading markets for alfalfa hay, China retained the top spot despite the ongoing trade and tariff war with the U.S. At 66,451 MT, it was China’s largest purchase on a volume basis since last September.

Japan wasn’t far behind, buying 63,468 MT. At 46,910 MT, sales to Saudi Arabia were the strongest since last September, and volumes to South Korea, at 20,448 MT, were the highest of the year.

January-May 2019 exports of alfalfa and other hay are now slightly ahead of last year’s pace, but trail five-month sales in 2017. Alfalfa hay sales total 1.03 million MT.

Currency exchange rates are favorable for Japan, but South Korea’s rates are less stable. China’s exchange rate remains stable and has little effect on the purchasing power of their currency. However, trade policy continues to add uncertainty to the market there.

Chinese customers have stated they have the ability to apply for a waiver of import tariffs imposed on U.S. hay. If approved, those waivers may help increase sales to China, Mastin said. Short-term, buyers are seeking to build inventories in case the U.S.-China trade picture becomes even cloudier.

If the tariffs continue or are increased, other countries may step in to fill the void. There have been reports of Spanish alfalfa entering markets in China and Japan over the last year. While the quality is lower, the dehydrated hay is more affordable.

Back home, the new crop harvest in the Pacific Northwest was hampered by rain and did not start well, Mastin said. Overall hay quality was lower than needed for domestic or export dairy farmers. Second cutting is much better, and quality is more in line with dairy demand.

Regional markets

Back home, a summary of early July conditions and markets included:

• Midwest: In southwest Minnesota, prices were steady with light demand and with a slight increase in hay available.

In Wisconsin, prices remain strong on tight supplies. With a late harvest, quality of the first cut may be lower than what many dairy farmers are used to feeding their herds.

In Iowa, weather conditions have allowed a good amount of hay to put up throughout most regions, with good tonnage reported.

In Nebraska, alfalfa sold steady; dehydrated pellets were steady in the eastern side of the state, $25 higher in the Platte Valley area. Demand was light for rounds bales and ground hay, with moderate to good demand for large squares going to dairies.

In Kansas, trade, activity and demand was moderate, with an increase in alfalfa trades. Alfalfa prices were variable due to the unpredictable weather pattern but seem to have settled a bit. Dairy-quality hay remained elusive.

In Missouri, farmers had a couple of weeks of pretty decent weather to make hay, although much of the hay was well past ideal cutting time. July stock water supplies, pasture conditions and hay supplies were in very good shape. Hay prices were mostly steady although some round bales of mid to lower quality grass hay are being sold at lower prices.

In South Dakota, quality remains the issue as every week has brought rain. Supplies of lower quality hay are more plentiful, high-quality hay less so, although more is becoming available.

• Southwest: In California, all classes traded steady with moderate to good demand. The earthquake in the Southern end of California didn’t affect the hay market, according to USDA contacts. Silage crops were being cut and alfalfa cutting continued.

Hay trade continued very slowly across much of Oklahoma; heavy rains, flooding and tornados left hay markets unestablished. More seasonal weather finally arrived, bringing higher temperatures and drier weather in the forecast. A heavy supply of alfalfa suitable for feedyards was readily available, causing a lower demand from buyers. Rain and warm weather made for lush pastures. Hay buyers are willing to enjoy the green grass and wait to assess needs for hay.

In Texas, hay trades were mostly steady to instances weak, mostly due to quality. In the Panhandle, producers were busy baling wheat hay, but the range in quality was wide.

In New Mexico, large bales of alfalfa hay were selling steady to $20 lower, except in the eastern region, where prices were $10 to $15 higher. The southeastern and eastern regions were in their third cutting; the north central region was in the second cutting.

• Northwest: In Idaho, all grades of alfalfa sold steady. Buyers were committing to timothy hay purchases but not committing to a price until it shipped. Demand remained good, especially for pellet-quality and high-testing dairy hay.

In Colorado, hay producers who typically market dairy-quality hay were hesitant to sell at offers of $1 per point of relative feed value (RFV). Lower quality alfalfa for grinder hay was starting to move in larger volumes. While few areas of the state were just finishing first cutting, regions across the state that received higher temperatures were preparing for second cutting.

In Utah, hay prices were mostly steady, with trading slow on all qualities.

In Oregon, hay prices trended generally steady. Some hay acreage has been changed over to grow hemp this year. In the Washington-Oregon Columbia Basin, all grades of alfalfa and timothy sold steady. Export cubing hay is being hauled out right away, while press hay is being wrapped for later take-out.

In Wyoming, there were several reports of rained-on hay or fields that had been damaged by hail, especially in the Torrington area. Most reports indicate damage isn’t severe, and the hay will make good cow hay and grinding hay for feedlots.

The Northwest Farm Credit Services’ 12-month outlook suggests Pacific Northwest alfalfa and timothy producers will be profitable. Low inventory bodes well for hay prices, despite lower export volume to China.

• East: In Pennsylvania, a steady to firm undertone was noted for all varieties of hay and straw. Supplies were light to moderate, with demand moderate to good. At New Holland, grass hay traded mostly steady to $20 higher. At Leola, alfalfa-grass blended hay traded steady to $20 higher; orchard grass traded mostly steady, while timothy traded firm.

Dairy, beef outlook

The USDA’s latest milk production forecast changed little from a month earlier, but the 2019 price outlook improved somewhat.

Read: USDA raises 2019 milk price forecast slightly

If the forecast plays out, 2019 milk production would be up less than 0.3 percent from 2018. The 2019 all-milk price was forecast at $18.20 per hundredwieght (cwt), up $1.94 from 2018; it would be the highest annual average since the record high of $23.97 per cwt set in 2014.

The USDA has begun distributing Dairy Margin Coverage program payments, which should aid short-term dairy cash flow.

Read: USDA begins issuing Dairy Margin Coverage program payments

The 2019 beef production forecast was reduced, primarily due to lighter carcass weights and slightly lower third-quarter steer and heifer slaughter. The 2019 average cattle price was projected at $115.50 per cwt, with the highest prices already behind us for the year. Weakest prices are forecast in the third quarter.

The USDA’s Cattle report, to be released on July 19, will provide a mid-year estimate of the dairy and beef cow and heifer inventories. ![]()

-

Dave Natzke

- Editor

- Progressive Forage

- Email Dave Natzke