The USDA’s November Crop Production report did not update hay production numbers, although the early onset of winter might cut into previous harvest estimates.

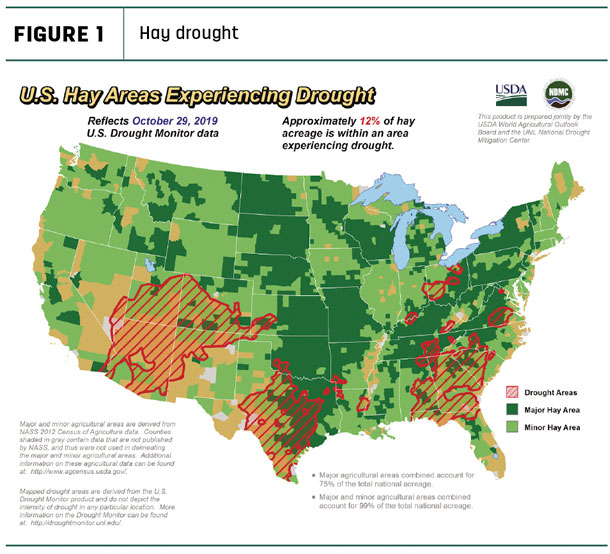

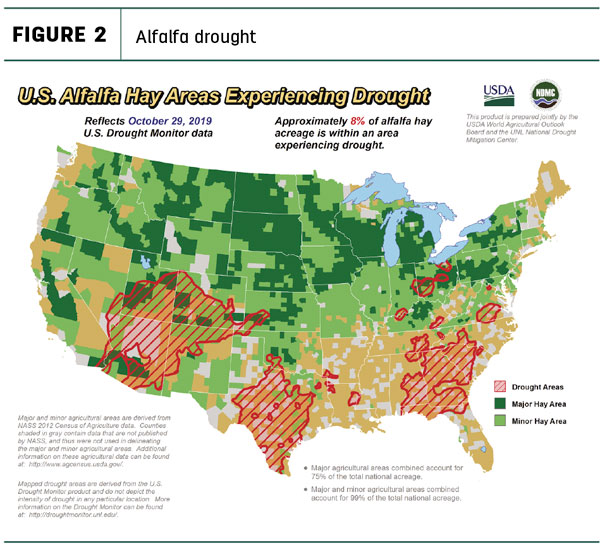

Drought areas

With harvest seasons winding down, hay-producing areas impacted by drought are predominantly in the southern half of the U.S., based on the USDA’s weekly drought monitor. As of the end of October, about 12% of U.S. hay-producing acreage (Figure 1) was considered under a drought, a 4% decline from the previous month. On the other hand, alfalfa-producing areas saw more drought, rising to 8%, a 3% increase from late September (Figure 2). Compared to September, drought areas disappeared in the Pacific Northwest and shrunk somewhat in the Mideast but grew in Utah, Colorado and Kansas.

Further north, unseasonably cold temperatures and snow moved into the Rockies, Northern Plains and Upper Midwest. The early winter weather hampered the crop harvest already delayed by more-than-adequate moisture levels.

Alfalfa price slide stops

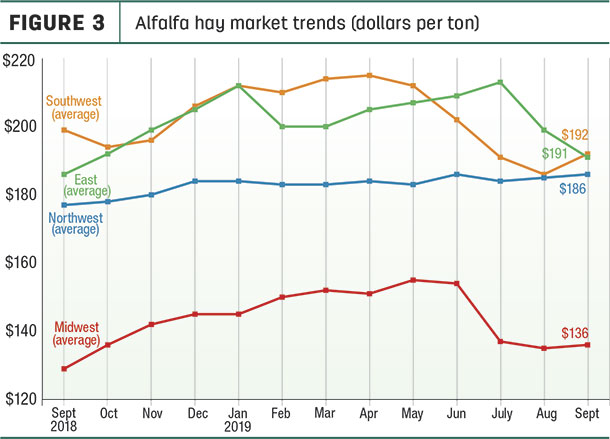

Alfalfa

The U.S. average alfalfa hay price rose $2 per ton in September, ending a three-month slide that saw the national average price drop $25 per ton from May’s peak. On a regional basis, an $8-per-ton decline in the East was offset by a $7-per-ton increase in the Southwest (Figure 3).

Among individual states, month-to-month hay price volatility was tempered with the exception of Oklahoma, where alfalfa hay prices jumped $45 per ton from August, and New York, where the average was down $27. Compared to a year earlier, average prices were up more than $20 per ton in Wisconsin, Michigan, Ohio and Colorado, but down by like amounts in Arizona, Texas and Kansas.

High monthly alfalfa hay prices were in Colorado ($235) and New Mexico ($220); lows were in North Dakota and South Dakota at $90 and $108 per ton, respectively.

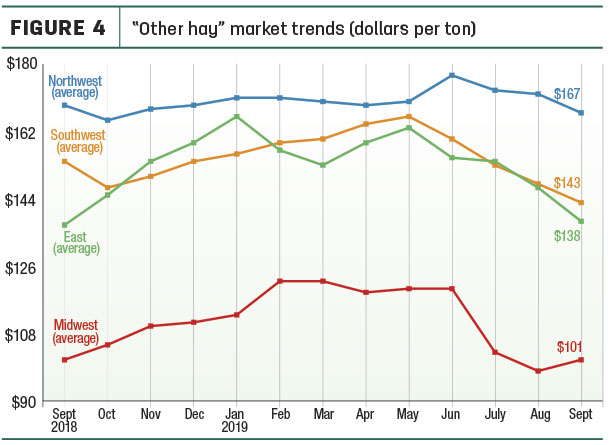

Other hay

While the decline in the national average alfalfa hay price stopped, the same wasn’t true for other hay. September’s average was $120 per ton, down $7 from August and $32 less than May’s five-year peak. The September average was the lowest since December 2017. Month-to-month price declines occurred in three of four regions of the country, with only the Midwest posting a small gain (Figure 4).

Among individual states, September average prices were down $19 to $25 per ton from August in Pennsylvania, Oregon and New York; Wisconsin saw an increase of $23 per ton. Compared to a year earlier, September 2019 prices were down in more than half the states reported by the USDA, led by Idaho, Texas, Nevada and Kentucky. In contrast, average prices were up $25 in Montana and $20 in Illinois.

Highest average prices in September were in Colorado ($230 per ton) and Arizona ($200). Prices averaged under $100 per ton in eight states, including Iowa, Kansas, Texas, Nebraska, Oklahoma, Minnesota, and North and South Dakota.

Dairy hay

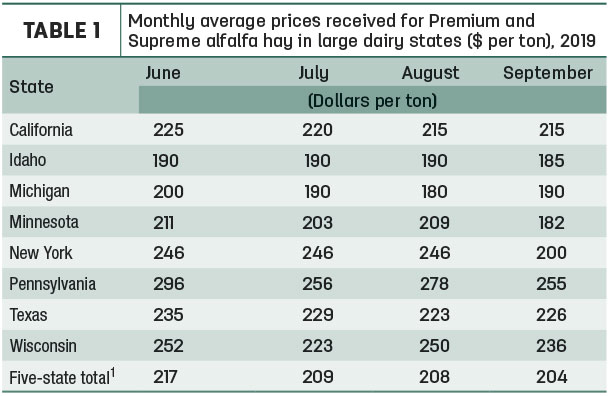

September prices for Premium and Supreme hay in the top milk-producing states averaged $204 per ton, down $4 from August (Table 1). Sharpest declines were in New York and Pennsylvania.

China pushes alfalfa exports up

September alfalfa hay exports surged to 245,147 metric tons (MT), the highest monthly volume since June 2017. September’s total pushed the 2019 year-to-date total to just under 2 million MT, ahead of last year’s sales pace.

Based on USDA records, sales to China at 97,371 MT were also the highest since June 2017. Purchases by the United Arab Emirates were the highest since April, and sales to South Korea were the highest of the year. That offset slight declines in sales to Saudi Arabia and Japan.

Meanwhile, exports of other hay slipped to 111,151 MT, the second-lowest monthly total for the year, even though September shipments to Japan, South Korea and the United Arab Emirates were up from August. Year-to-date exports of other hay nudged above 1 million MT, also ahead of last year’s pace.

Just returning from a trip to South Korea and Japan, Christy Mastin, international sales manager with Eckenberg Farms Inc., Mattawa, Washington, said U.S. hay export companies have been busy seeking sales. There are two areas of focus for exporters.

The first concern is whether there is enough volume of exportable new-crop alfalfa to supply customers. Although supplies of rained-on and feeder hay are more plentiful, 2019 weather conditions hampered harvest of high-quality hay. Early snowfall in parts of the U.S. at the end of September has increased domestic demand from buyers concerned about how cold and long the winter will be.

The second area of focus for exporters is carryover and large new-crop supplies of lower-quality timothy. Most foreign customers are asking for higher-quality timothy at the same price or less than last year. Suppliers are reducing prices of the lower-quality timothy in an attempt to move it.

In China, a rollback in tariffs to 7% on U.S. alfalfa has increased demand for all grades, bringing brokers and direct-buying companies back in the market, and it may be difficult to fill all requests, Mastin said.

In South Korea, weather negatively affected domestic forages, and alfalfa, fescue, ryegrass straw and even bluegrass straw are in high demand.

A super typhoon hit Japan in October, damaging farms, disrupting travel and delaying feed services. Where on-farm storage was limited, there are reports of lower production and even cow deaths. Demand for premium hays is high and expected to continue, with price a limiting factor as supplies tighten.

The Australia oaten hay-growing and harvest conditions have been good, with reports the higher-quality oaten hay will be price competitive with U.S. timothy hay.

Regional markets

Here’s a regional summary of early November conditions and markets:

• Midwest: In Iowa, Supreme and Premium alfalfa and alfalfa-grass mixes maintained price levels regardless of packaging. However, prices for large round bales with grass began to slide lower and may be associated with the declining quality.

In Nebraska, alfalfa hay sold mostly steady, with instances of $5 higher; good demand was noted on large squares going to out-of-state buyers.

In Kansas, most areas received a taste of winter weather. Supplies of high-quality hay are being reported as short, but there seems to be plenty of grinder hay.

Many areas of Missouri got an early taste of winter. Hay supplies were moderate; demand was light, and prices were steady to weak.

In South Dakota, demand was very good for high-quality hay of all kinds, especially on large square bales bound for out-of-state buyers. Summer weather made it very difficult to make large square bales that would not spoil. Demand for round bales was lighter due to plentiful supplies.

In Wisconsin, prices remained strong for top-quality hay. Quality hay supplies remain tight, with a good supply of lower-quality hay.

In southwest Minnesota, prices were steady, with a slow to moderate demand and no top-quality hay available.

• Southwest: In Oklahoma, weather and cattle prices added to hay demand concerns. There were reports of ranchers selling calves just to pay for the higher-priced hay. Some livestock owners have substantial grass and hay inventories, while others have used up pasture and are looking for low-quality hay. Premium-quality hay was very difficult to find; demand for horse-quality hay has weakened. There wasn’t much optimism for quality in last cuttings of bermudagrass and alfalfa.

In Texas, a cold snap in the northern part of the state had hay producers hopeful that hay demand will finally pick up. Pasture conditions were still good in the Panhandle, but grasses were going dormant. Supplemental winter feeding was taking place in the west and north.

In New Mexico, dropping temperatures slowed alfalfa growth, with some areas starting a sixth cutting.

In California, trade activity was light on moderate demand. There are already questions related to the 2020 alfalfa crop, which could be affected by restrictions on use of chlorpyrifos products for alfalfa weevils.

• Northwest: In Idaho, hay trade was slow to moderate with good demand for feeder hay.

In Colorado, hay trade activity and demand were light to moderate.

In Oregon, prices trended generally steady. In the Washington-Oregon Columbia Basis, harvest came to an end. Demand remains good from dairies.

In Montana, alfalfa hay sold steady to firm with very good demand for squares to ship east to Minnesota, Wisconsin and Iowa. A very wet summer has led to a shortage of hay in the Northern Plains, and early season snowstorms had many producers behind in finishing up haying season.

In Wyoming, sales were moderate for local sales, with good demand noted on hay leaving the state. Some contacts stated their hay sheds were emptying quickly.

• East: In Pennsylvania, hay sold with a weaker undertone, with grass slightly better.

In Alabama, hay prices were steady on moderate supplies and good demand.

Dairy outlook

Milk prices and income over feed cost margins are improving, and dairy farmers are responding. September 2019 U.S. milk production grew by about 1.3% compared to the same month a year earlier, ending an 11-month streak in which monthly year-over-year growth was less than 1%.

While much of September’s growth can be attributed to stronger milk output per cow – despite concerns over feed quality – a reversal in the decline in cow numbers in some major dairy states also played a role.

Compared to a year earlier, September’s cow numbers were down 53,000 nationally and down 11,000 in the 24 major dairy states. However, among the major dairy states, September 2019 cow numbers were up 7,000 from August and are now the highest since February.

Interest rates cut

There’s some good news ahead for hay producers: The cost of operating loans should continue to decline. The Federal Reserve’s Open Market Committee made 25-basis-point cuts in the interest rates in both September and October. A preliminary look at third-quarter 2019 interest charged by district Federal Reserve banks shows rates are back to levels charged a year ago.

Figures and charts

Progressive Forage tracks regional hay price trends using average monthly prices reported for selected states by the USDA’s National Agricultural Statistics Service (NASS). The USDA report does not provide hay quality classes in its price reports. By region, states included:

• Southwest – Arizona, California, Nevada, New Mexico, Oklahoma, Texas

• East – Kentucky, New York, Ohio, Pennsylvania

• Northwest – Colorado, Idaho, Montana, Oregon, Utah, Washington, Wyoming

• Midwest – Illinois, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, South Dakota, Wisconsin ![]()

-

Dave Natzke

- Editor

- Progressive Forage

- Email Dave Natzke