First, updated crop production estimates indicate that while hay acreage is still low, it’s up from last year and higher than USDA Prospective Plantings report forecasts earlier this spring.

Second, based on monthly USDA Ag Prices reports, U.S. average prices paid for alfalfa hay were $101 per ton more than average prices for other hay in both April and May. That’s likely the largest price gap in history.

Acreage estimates raised

The USDA released its annual Acreage report on June 30, providing survey-based estimates of 2022 planted and harvested area for major crops.

Producers intend to harvest 51.5 million acres of all hay in 2022, up 2% from 2021 and nearly 1.2 million acres more than indicated in the Prospective Planting report. Compared to the March report, the USDA raised estimated all hay area by 500,000 acres in South Dakota, 320,000 acres in Oklahoma, 230,000 acres in New York and 215,000 acres in Pennsylvania. In contrast, the USDA reduced all hay area by a combined 970,000 acres in Colorado, Iowa, Nebraska and Missouri.

Looking specifically at alfalfa hay, the USDA estimated 2022 harvested acreage is expected to be 15.5 million acres, up 1% (219,000 acres) from 2021, led by a 300,000 acre increase in South Dakota and increases of 100,000 acres or more in North Dakota, Montana and Wyoming. Biggest declines are 290,000 acres in Iowa and 100,000 acres in Nebraska.

All other hay (excluding alfalfa) is expected to be up 2% (552,000 acres) from last year at 36 million acres. Compared to a year ago, area of other hay is projected up 300,000 acres in South Dakota and up 100,000 acres or more in New York, Wisconsin, North Dakota, Minnesota, Montana, Oregon, Pennsylvania and Virginia. Texas acreage is expected to be down 650,000 acres from a year ago.

Price gap widens

Two supply-demand factors are likely contributing to the widening gap in alfalfa and other hay prices: China’s demand for U.S. alfalfa hay and drought in Western dairy states continues to push regional alfalfa hay prices higher due to both supply and demand.

With few exceptions, the U.S. average price difference between alfalfa and other hay hovered in the $25-$50 per ton range from May 2017 through July 2021. Starting last fall, however, the gap has increased, with alfalfa hay drawing a $75 premium over other hay in January and March 2022 and reaching $101 per ton in April and May of this year.

Based on USDA/Progressive Forage records, the price gap between alfalfa and other hay reached about $80 per ton in June-September 2014 and fell to just $6-$8 per ton in the first quarter of 2017.

Monthly update

Here’s Progressive Forage’s monthly look at other market forces entering the second week of July 2022.

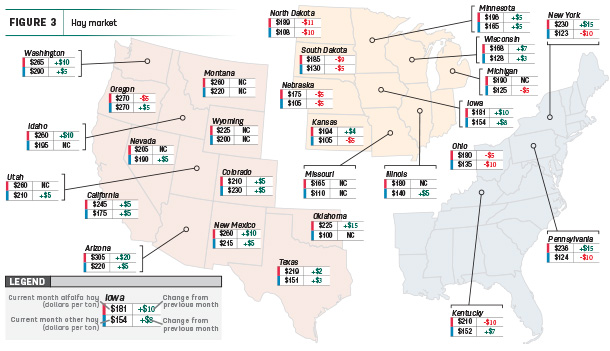

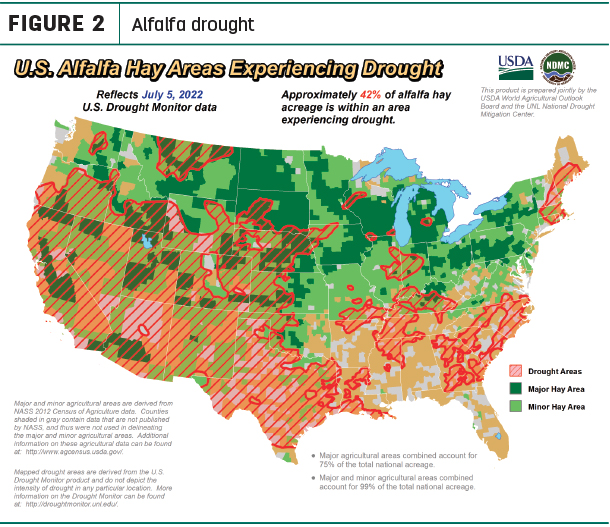

Drought conditions mixed

U.S. Drought Monitor maps indicate moisture conditions were mixed. As of July 5, about 38% of U.S. hay-producing acreage (Figure 1) was considered under drought conditions, up 5% from a month earlier. While conditions improved in parts of the Northwest, scattered widespread dry areas popped up in nearly all regions east of the Mississippi River. In contrast, the area of drought-impacted alfalfa acreage (Figure 2) decreased 6% to 42%, thanks to improved conditions in Idaho, Montana, South Dakota and Washington.

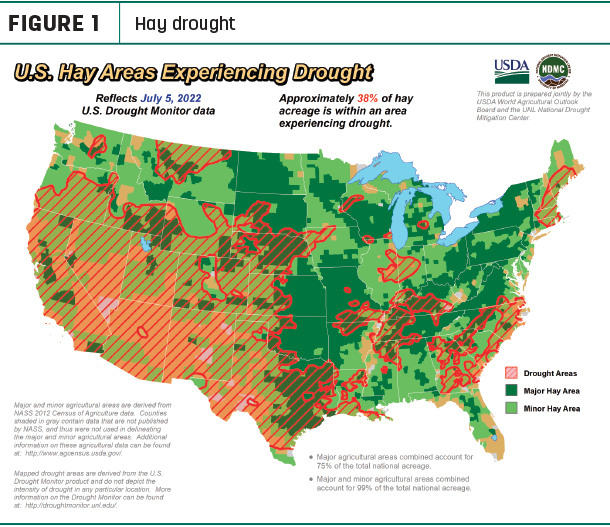

Hay prices tracked

Smaller hay inventories entering the new growing season contributed to slightly higher prices in May. Price data for 27 major hay-producing states is mapped in Figure 3, illustrating the most recent monthly average price and one-month change. The lag in USDA price reports and price averaging across several quality grades of hay may not always capture current markets, so check individual market reports elsewhere in Progressive Forage.

Click here or on the map above to view it at full size in a new window.

Dairy hay

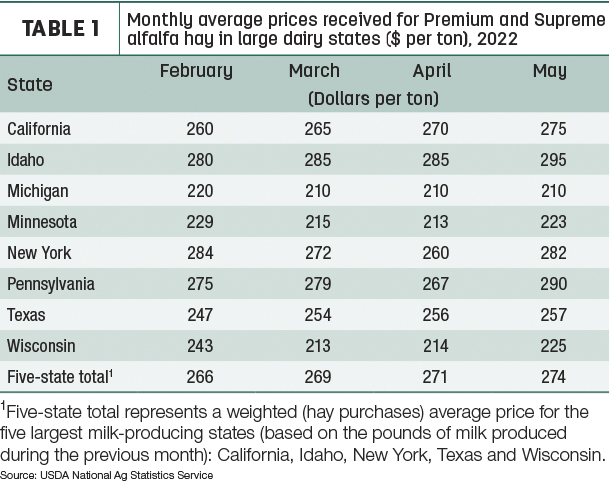

May average prices for Premium and Supreme alfalfa hay in the top milk-producing states rose another $3 from April to $274 per ton (Table 1), up $48 per ton from a year ago. Among individual states, month-to-month prices increased $22-$23 per ton in New York and Pennsylvania, respectively, and was up $10 per ton in Idaho and Minnesota.

Alfalfa

The U.S. average price for all alfalfa hay rose $1 in May to $244 per ton. Compared with April, prices increased in 14 of 27 major forage states, with double-digit increases in eight of them. Only six states, Kentucky, Nebraska, North Dakota, Ohio, Oregon and South Dakota.

Year-over-year price changes again remained large: Arizona and Idaho alfalfa hay prices were up $105 and $100 per ton, respectively, compared to May 2021, with 2022 prices also at least $50 higher than a year earlier in Nebraska, North Dakota, Utah, Oregon, Washington and Montana. The U.S. average was up $50 per ton.

Other hay

At $143 per ton, the May 2022 U.S. average price for other hay was also up just $1 per ton compared to a month earlier. Small average price increases in 14 of 27 major hay-producing states were offset by declines in eight others.

Average prices for other hay remain $75 and $90 per ton higher than a year ago in Montana, Oregon, Utah and Washington. Despite that, the U.S. average was up $3 per ton.

Organic hay

There were no price quotes for organic hay in the USDA’s latest National Organic Grain and Feedstuffs Report.

Hay export update

At 240,606 metric tons (MT), May alfalfa hay exports were the second highest since last October and the second highest of the year, rebounding slightly from April levels. China remained the leading market at 120,795 MT, a three-month high and about 50% of the month’s total. Exports to Japan fell to a four-month low at 51,954 MT, representing 22% of the month’s total. Alfalfa hay exports were valued at about $387 per ton, down about $12 from April.

At 129,166 MT, May exports of other hay dipped from April, with all the decline coming in reduced sales to Japan, where shipments totaled 72,233 MT, 56% of the total. Sales to South Korea at 35,909 MT were the highest in 24 months and represented 28% of the month’s total. Other hay exports were valued at about $399 per MT, unchanged from April.

Export customer visits have picked up, said Christy Mastin, sales representative with Eckenberg Farms, Mattawa, Washington. New-crop pricing is very high, a shock to customers in Japan and South Korea. China has held the exchange rate and is aggressively purchasing alfalfa.

Past shipping delays mean large volumes of hay are arriving at foreign buyers’ warehouses all at one time, Mastin said, and customers are asking for lower prices to move the product out to end users. The storage of hay by keeping it in the shipping containers is becoming more expensive as shipping lines are reducing the amount of free time allowed.

Pacific Northwest timothy harvest was mostly finished with good weather contributing to high quality. However, due to high prices, customers are seeking lower-quality timothy – which is in limited supply – at lower prices.

The volume of second-cutting alfalfa looks to be smaller, with most reports from the Southwest (Arizona, California and Utah) citing reduced volumes. That’s throwing out the old rule that first cutting is generally in most demand and highest priced, Mastin said.

Regional markets

Early July hay auction activity may have been impacted by the July 4 holiday. Here’s a snapshot of regional markets:

- Southwest: In Texas, hay prices remained mostly firm to $10 higher in all regions. Hotter-than-average temperatures accompanied by high winds and limited moisture have hurt hay yields in all regions. Stockpiles of last year’s hay were dwindling, and pasture conditions across much of the state were rated in fair to very poor condition. As a result, livestock producers were feeding supplemental hay and beginning to cull deeper into their cow herds and sell off calves earlier than normal. If the weather pattern continues, hay supplies will be very tight come fall and into winter. Hay from outside the state will continue to move in, but continually increasing freight rates are going to have an impact on the cost to producers.

In Oklahoma, hay trade was slow to steady. There was still no true new-crop market trend for all types of hay. Parts of the state need moisture again to help with production and make up for shortages.

In New Mexico, hay prices were steady, and demand was very good for high-testing dairy-quality hay. Southern and eastern parts of the state were finishing third cutting. Monsoon rain had provided relief across the southwest after months of extremely dry conditions.

In California, trade activity and demand were good. Retail hay prices were steady; dairy and export hay prices were steady with good demand.

- Northwest: In Montana, hay sold generally steady with light-to-moderate demand. Due to rains, regional hay quality varies widely. While hay costs are lower than last fall and winter, freight costs have ballooned over the last six months, making transportation much more expensive. Several producers quoted the cost of a train load from $8.50-$10 per loaded mile. Many ranchers were waiting to see how the market develops. Demand from western states remained good, as local first cutting was rained on and buyers in Idaho and Washington were looking to Montana to find high-quality hay.

In Idaho, all grades of alfalfa hay sold steady. Trade remained active with good demand from dairies and exporters.

In Colorado, baled hay sold mostly steady to slightly firm. Trade activity was moderate on good to very good demand for horse hay, feedlot and ranch hay. Restrictions in irrigation water, yield and overall supply around the state continue to influence hay market prices. Recent precipitation likely helped many producers in the southeast and northeast who were approaching the second cutting of alfalfa. However, the early monsoon storms continued to damage cut and windrowed first-cutting alfalfa in the San Luis Valley.

In the Columbia Basin, all grades of alfalfa sold steady to firm with prices supported by exporters. Markets have noted some price resistance from dairies. Supplies of Premium timothy for horse markets remain limited. Past thunderstorms and continuing rain are making haying a challenge.

In Wyoming, sun-cured alfalfa pellets sold $5 higher, with bales of hay trading fully steady. Demand was good from both in-state and out-of-state buyers looking for hay. First-cutting tonnage was reported good in the central and western areas. Lighter first-cutting tonnage was reported in the east, but second cutting appeared to be much better.

- Midwest: In Nebraska, hay prices were fully steady on moderate-to-good demand.

Best demand for hay came from buyers in Colorado and the Texas Panhandle. Harvest tonnage for alfalfa and grass hay has varied widely, with most reporting lighter tonnage than a year ago.

In Kansas, prices remained steady to firm on a limited test, but the true market price had not seemed to find its feet yet. Supply and demand were moderate, while hay movement was moderate to good as most producers reported lower yields.

In South Dakota, prices for alfalfa and grass hay remained firm. Demand for high-testing dairy-quality hay was very good as spring weather did not support high relative feed values. Second cutting had been delayed because of storms.

In Missouri, the far northern third of the state received significant moisture, giving crops and pasture a well-needed drink. Areas in the southern two-thirds were very hit or miss. There were reports of several farmers starting to cull cows. Quite a bit of hay was being baled, but quality was very questionable. Hay prices were steady to firm; supply and demand were moderate.

In Wisconsin, prices for dairy-quality hay were steady to strong with lower-quality hay discounted.

- East: In Pennsylvania, alfalfa and alfalfa-grass blends sold weaker on light tests. Buyer attendance, demand and supply were all moderate.

In Alabama, hay prices were higher to end June, with moderate supply and demand.

Other things we’re seeing

-

Dairy: Record-high milk prices again offset higher feed costs in May, improving monthly dairy producer milk income over feed cost (IOFC) margins calculated under the Dairy Margin Coverage (DMC) program. Despite that, monthly U.S. milk production was below year-ago levels for a fifth consecutive month.

-

Fuel: There was some good news regarding fuel costs to start July, with prices for both gasoline and diesel fuel down about 10 cents per gallon compared to the week before. Nonetheless, the U.S. regular gasoline retail price averaged $4.77 per gallon, about $1.65 more than a year earlier. The U.S. average on-highway diesel fuel price was $5.76 per gallon, up $2.34 from a year ago.

-

Trucking: Flatbed prices were slightly lower in early July, according to DAT Trendlines. The national average price was $3.36 per mile. Regionally, average prices per mile were: Southeast – $3.72, Midwest – $3.55, South – $3.45, Northeast – $3.32 and West – $2.92.

- Port negotiations: The prior agreement expired July 1, and negotiations between the International Longshore Warehouse Union and Pacific Maritime Association on a new agreement continue, with both sides tentatively agreeing to normal operations without risk of strike or lockout, according to Daniel Munch, economist with the American Farm Bureau Federation.