Based on the USDA’s Crop Production report released Oct. 9, production of alfalfa and alfalfa mixture dry hay for 2020 was forecast at 52.6 million tons, down 4% from 2019. As of Oct. 1, yields were expected to average 3.22 tons per acre, down 0.06 ton from last year. Harvested area was forecast at 16.4 million acres, down 2% from 2019 and the smallest alfalfa and alfalfa mixture hay area since 1948.

Production of other hay for 2020 was forecast at 75.1 million tons, up 1% from 2019. Based on conditions as of Oct. 1, the U.S. yield was expected to average 2.08 tons per acre, the second-highest yield on record (behind only 2017). Harvested area is forecast at 36 million acres, up 1% from 2019.

For additional information on USDA’s 2020 hay acreage, yield and production estimates, read: 2020 dry hay harvest a mixed bag.

Drought areas worrisome

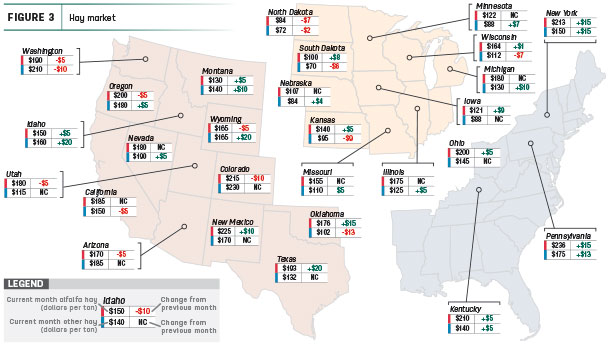

Meanwhile, moisture conditions in major hay-producing areas continue to worsen. Based on USDA Drought Monitor maps as of Oct. 6, about 31% of U.S. hay-producing acreage (Figure 1) was considered under drought conditions, a 7% increase from the first week in September and equaling levels seen in the fall of 2018.

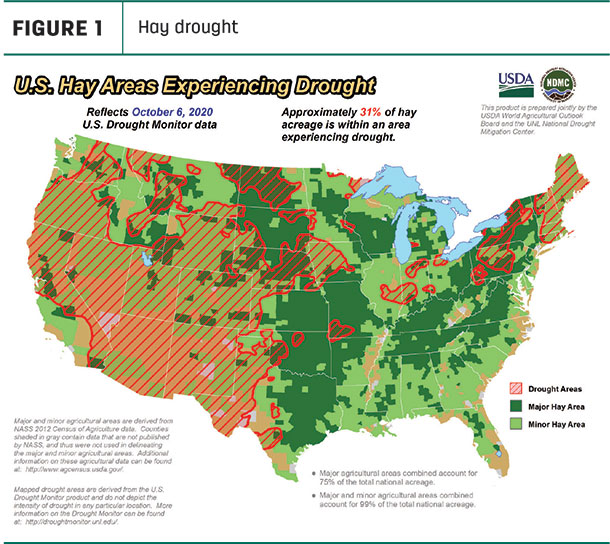

The news was worse for alfalfa: At 47%, alfalfa-producing areas affected by drought increased 12% from early September (Figure 2) and are the highest since the first quarter of 2013.

Hay prices mapped

The USDA’s Ag Prices report indicates the national average price for all alfalfa hay fell to a nine-month low in August. At $172 per ton, it was down $2 from July. The U.S. average for other hay was unchanged; at $137 per ton, it equaled a 12-month high set last November.

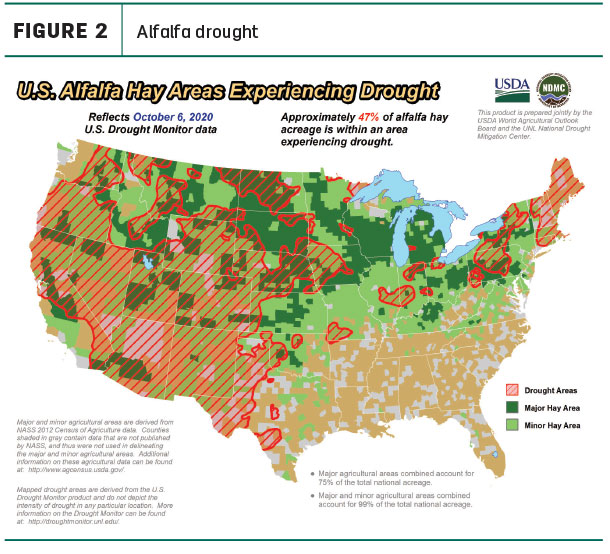

The price data for 27 major hay-producing states is mapped in Figure 3, illustrating the most recent monthly average price and one-month change. The lag in USDA price reports and price averaging across several quality grades of hay may not always capture current markets, so check individual market reports elsewhere in Progressive Forage.

Click here or on the map above to view it at full size in a new window.

Alfalfa

Among the 27 states reporting alfalfa prices, 13 saw price increases in August, while seven posted small declines. Biggest increases from the previous month were in Texas, New York, Oklahoma and Pennsylvania. Prices averaged more than $200 per ton in Pennsylvania, New Mexico, Colorado, New York, Kentucky, Ohio and Oregon, but $100 per ton or less in North Dakota and South Dakota.

Other hay

Prior to the previous month, August prices rose in 13 states, led by Idaho and Wyoming, and declined in seven, led by Kansas, Washington and Oregon. Average prices were $175 per ton or higher in Colorado, Washington, Nevada, Arizona, Oregon and Pennsylvania.

Dairy hay

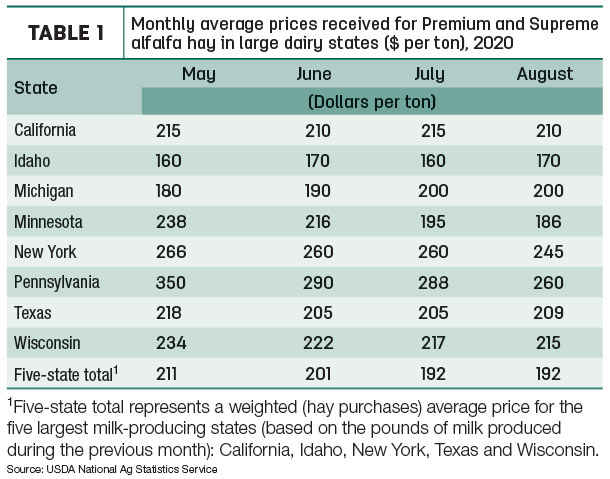

The average price for Premium and Supreme alfalfa hay in the top milk-producing states averaged $192 per ton in August, unchanged from July (Table 1) and equaling lowest since the USDA began compiling “dairy hay” price data to start 2019.

Organic hay

The USDA’s Organic Hay price report summarized f.o.b. farm gate prices for the two-week period ending Oct. 7. All averages are for large square bales. High-testing Supreme alfalfa topped the market at $350 per ton, while other Supreme alfalfa sold in a range of $250-$290 per ton, averaging $262 per ton. Premium alfalfa sold in a range of $203-$235, averaging $215 per ton, and Good alfalfa sold in a wider range, $125-$238, averaging $182 per ton. Finally, Premium sudan averaged $150 per ton.

Exports of U.S. hay continued lower

As the 2020 harvest seasons winds down, U.S. exports of hay continue to be hampered by several factors, noted Christy Mastin, sales representative with Eckenberg Farms, Mattawa, Washington.

Due to expectations of travel restrictions to view new-crop hay and anticipated shipping challenges, many buyers bought earlier in year to the point of being overstocked.

Vessel schedules still have issues with delays, but the reason has changed from a lack of ships to one of port overcrowding. As those supply chain conditions improve, September-October exports should increase to more normal levels, Mastin said.

Foreign competition is also factor. Based on supply and price, European alfalfa, Canadian timothy and Australian oaten hay are appealing alternatives.

On a positive note, the exemption of a tariff on alfalfa and alfalfa-related products shipped to China has been extended for another year, through mid-September of 2021.

Looking at the numbers, August 2020 U.S. exports of other hay fell to 93,063 metric tons (MT), dipping below 100,000 MT for the first time since August 2007 and the lowest total for any month since July 2006. Sales to four of the five leading markets – Japan, South Korea, Taiwan and China – were down from July, with only the United Arab Emirates (UAE) posting a small increase.

Meanwhile, at 212,474 MT, August exports of alfalfa hay hit a six-month low and were down about 78,000 MT from April’s peak. China remained the biggest alfalfa customer purchasing 109,844 MT in August, about 52% of all alfalfa hay exports for the month. Sales to South Korea and the UAE were steady with July, but sales to Saudi Arabia and Taiwan were lower.

Regional markets

Here’s a snapshot of conditions and markets during the first week of October:

- Midwest: In Missouri, hay movement was limited, demand was light, supplies were heavy and prices were steady to firm.

In Iowa, fieldwork limited sales activity. There was interest in medium- to better-quality alfalfa. Grass quality was good overall and the lower-end grass also sold well.

In Kansas, hay movement increased slightly but remained sluggish; prices remained steady for all hay types in all regions.

In Nebraska, central grass hay and western large squares of alfalfa sold steady on good demand. Hay was moving out of state. Cattle producers, backgrounders and feedlots started to buy some loads as they prepare for winter feeding needs. Most local customers have an easy time finding trucks to haul hay.

In Michigan, late-season alfalfa is reportedly high quality and yielding well.

In South Dakota, quality of fourth cutting of alfalfa was aided by good drying weather, although yield was lower. Alfalfa hay sold mostly steady on few reported transactions. Demand for high-quality dairy hay remained good.

In Wisconsin, dairy-quality hay remained in demand and prices were steady, with pressure to reduce prices. Lower-quality hay prices and demand were declining.

- Southwest: In Texas, hay prices were mostly steady to firm. Supplies were tightening, especially in the Panhandle, north and western regions where precipitation and the influx of hay from drought-stricken states were shortening.

In California, wildfires continued to hamper air quality and hay drying conditions. Demand and prices were steady.

In Oklahoma, hay trade activity was light as beef producers hoped for an extended grazing season. Many producers are looking for alternative feedstuffs.

In New Mexico, alfalfa hay prices were steady to $10 higher; demand was moderate to good.

- Northwest: In Wyoming, hay and sun-cured alfalfa pellets sold steady; demand was good.

In Montana, hay and sun-cured alfalfa pellets sold steady. Demand was good.

In Idaho, trade remained slow as the haying season came to an end. Demand remains good as remaining supplies are in firm hands. Stimulus checks have been going out to help businesses.

In Colorado, trade activity and demand was moderate to good for most types of hay.

In the Washington-Oregon Columbia Basin, export, domestic and retail feed store alfalfa sold steady in a light test. Trade remained slow with light-to-moderate demand as major exporters were reportedly dumping product in order to secure market share. Quality is also affecting movement as most hay supplies suffer from smoke or range damage. Quality supplies remained hard to secure.

The Northwest Farm Credit Services’ quarterly Hay Market Snapshot offered a varied 12-month outlook for regional hay producers. Individual producer profitability will be heavily dependent on the quality of hay harvested. Depending on location, the haying season was a bit of a roller coaster, with first-crop hay harvest negatively affected by wet conditions, followed by more favorable conditions during subsequent cuttings. Then, wildfire smoke slowed hay drying conditions in mid-September. As mentioned above, widespread Western drought hampered dryland hay production.

- East: In Lancaster, Pennsylvania, alfalfa and alfalfa-grass mixes sold higher. Buyer demand was moderate with a moderate supply. In Leola, alfalfa sold weaker but orchardgrass sold stronger on a light comparison.

In Alabama, early October hay prices were steady with moderate supply and demand.

Other things we’re seeing

- Dairy. The government-fueled roller coaster ride continues. Boosting dairy farmer gross income, a second Coronavirus Food Assistance Program (CFAP 2) will pay dairy farmers $1.20 per hundredweight (cwt) on all milk produced during the final nine months of the year.

The USDA also announced the third round of Farmers to Families Food Box Program contracts in mid-September, sending block cheddar cheese prices and Class III milk future prices higher. That creates another Class I base-Class III price inversion in October and widens the gap between Class III-Class IV prices. As a result, the incentive for Federal Milk Marketing Order depooling increases, and negative producer price differentials will impact milk checks for some dairy producers.

-

Alfalfa and CFAP 2. As part of CFAP 2, alfalfa growers are eligible for direct payments equal to $15 per acre. All other hay, including crops intended for grazing, are not eligible for payments. Producers must apply for CFAP 2 payments at USDA Farm Service Agency offices by Dec. 11, 2020.

-

Dave Natzke

- Editor

- Progressive Forage

- Email Dave Natzke