Spring is off to a fast start, with the planting pace of most crops well ahead of the five-year average in many parts of the country. Climbing corn and soybean futures prices are still impacting final planting decisions. Perhaps the brightest news concerned exports.

March exports surged

According to Christy Mastin, sales representative with Eckenberg Farms, Mattawa, Washington, foreign hay buyers and U.S. exporters remain focused on ongoing logistical challenges that hamper deliveries. Struggles continue regarding availability of shipping containers, port congestion and getting vessel space for bookings. Recently, some bookings have been split because of overweight vessels, forcing full containers to be left behind.

Despite ongoing challenges, hay export activity picked up substantially in March, and Mastin said she believes April sales, when counted, will be similar to those in March.

March 2021 alfalfa hay exports totaled 282,496 metric tons (MT), the highest monthly total since April 2020. Based on USDA reports tracked by Progressive Forage, March 2021 sales to China at 143,532 MT are likely a record high for any month to any country on record, surpassing previous the peak of about 128,582 MT to China in October 2019.

March is historically the busiest month for exports of other hay, and March 2021 was no exception. At 148,915 MT, exports of other hay were the highest since March-April 2015. About two-thirds (98,156 MT) of the month’s sales went to Japan, the largest volume for any month dating back to early 2013. Shipments to another major customer, South Korea, hit a 10-month high at nearly 34,000 MT.

Looking ahead, Mastin said she expects customer travel to remain limited due to COVID-19, forcing exporters to get creative when marketing hay, sending photos and samples to potential buyers. That may slow confirmation of purchases.

On the demand side, South Korea’s domestic harvest season is underway, and favorable weather is improving the outlook for both quality and quantity. This will reduce the demand for U.S. ryegrass and fescue, and may even impact U.S. timothy sales, depending on new crop pricing and quality.

Trade tensions between China and Australia could affect the oaten hay market, with some of that hay diverted to South Korea. Rains during harvest in Australia have hampered quality, which means large volumes of lower-quality, lower-priced oaten hay could put downward price pressure on other commodities, including straw and timothy.

Alfalfa demand remains steady, and although delivery delays have reduced volume in the market, this shouldn’t cause much change in pricing or requested volume, Mastin said. Reports from the Pacific Southwest indicate new crop harvest is short on Supreme and Premium alfalfa hay, so prices are increasing.

In the Northwest, there is some carryover of alfalfa and timothy inventories due to shipping issues, and the early outlook for new crop harvest is good.

Dry conditions: Alfalfa acreage under more stress

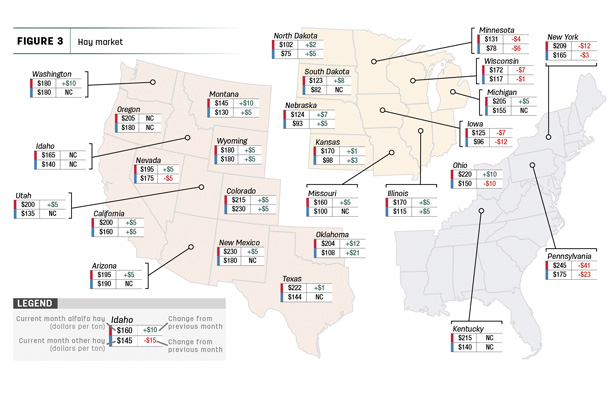

Back home, moisture conditions remain a concern across many major hay-producing areas, although U.S. Drought Monitor maps indicate some regional changes.

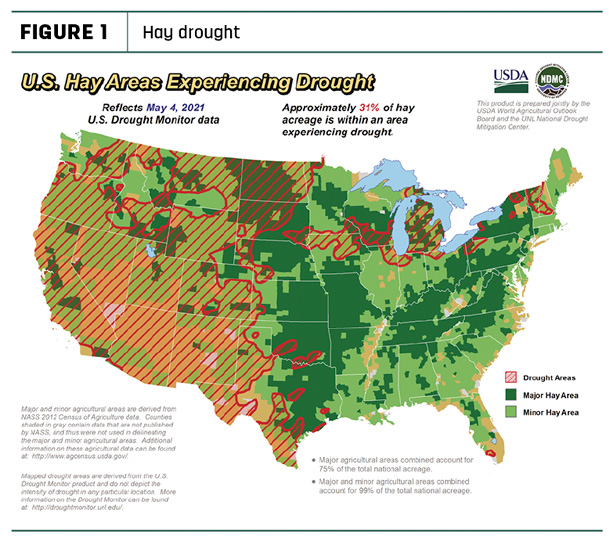

As of May 4, about 31% of U.S. hay-producing acreage (Figure 1) was considered under drought conditions, a 1% improvement from a month earlier. The arrival of precipitation in portions of Washington, Oregon, Idaho and Montana were offset by worsening conditions in southern Minnesota, northern Iowa, southern Wisconsin and all of Michigan. With the Midwest’s reliance on alfalfa, the area of drought-impacted alfalfa acreage (Figure 2) increased 9% during the month to 55%.

Price movement mixed

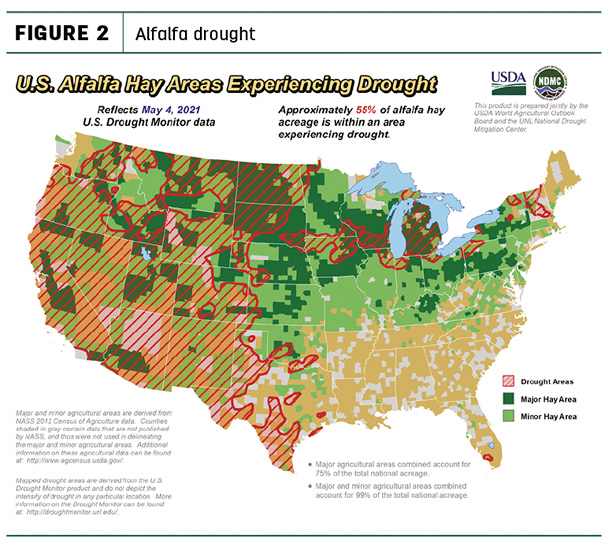

Price data for 27 major hay-producing states is mapped in Figure 3, illustrating the most recent monthly average price and one-month change. The lag in USDA price reports and price averaging across several quality grades of hay may not always capture current markets, so check individual market reports elsewhere in Progressive Forage.

Click here or on the map above to view it at full size in a new window.

Dairy hay

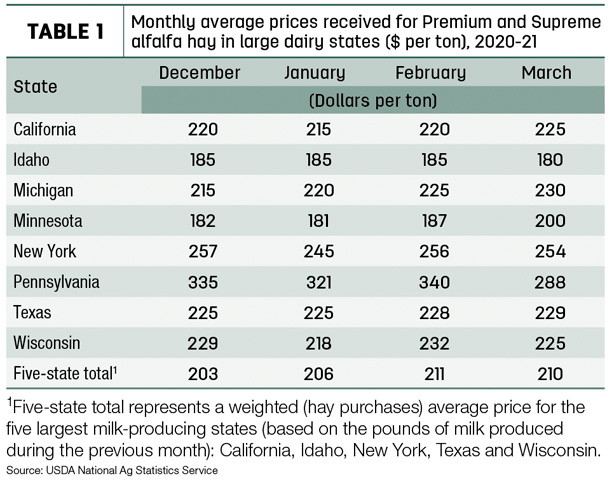

The average price for Premium and Supreme alfalfa hay in the top milk-producing states averaged $210 per ton in March, down $1 from February (Table 1) but still a 20-month high. Compared to a month earlier, dairy-quality hay prices were higher in California, Michigan and Minnesota, lower in Idaho, Pennsylvania and Wisconsin, and mostly steady in New York and Texas.

Alfalfa

The national average price for all alfalfa hay rose again, up $6 in March 2021 to $181 per ton, equaling a 12-month high. Compared to a month earlier, average alfalfa hay prices increased in 19 of 27 major forage states, led by Montana, Ohio, Oklahoma and Washington. Most of the other states saw only modest increases. March prices declined in just five states, although the decline in Pennsylvania (-$41 per ton) was substantial. Even with that price drop, Pennsylvania alfalfa hay prices remained the highest in the country at $245 per ton.

Other hay

After hitting a 17-month high in February, the U.S. average price for other hay dipped $1 in March to $142 per ton. March prices moved higher in nine states, led by a $21 jump in Oklahoma. Price declines were reported in seven states, led by a $23 drop in Pennsylvania. Colorado again had the top monthly average of $230 per ton; average prices were under $90 per ton in Minnesota, North Dakota and South Dakota.

Organic hay

The USDA’s latest organic hay price report did not provide price summaries for hay.

Regional markets

Here’s a look at local markets during the first week of May:

- Southwest: In Texas, hay prices were firm to higher, indicative of shortening supplies before first cutting and poor pasture, causing producers to offer supplemental feeding.

In Oklahoma, hay trade remained very slow as several weeks of below-average temperatures and heavy rainfall had producers eager to start first cutting. Alfalfa remained in rough condition, and first cutting could be mostly grinder hay.

In New Mexico, alfalfa hay prices were steady on good demand.

The southern part of the state was almost finished with first cutting.

In California, prices for all regions were steady with moderate demand. In the Central Valley, the first cutting of alfalfa neared completion, and some producers began their second cutting.

- Northwest: In Montana, hay sold generally steady; demand was mostly good to very good. Most producers are completely sold out. Many producers are being asked to contract hay but most are passing. Rain was desperately needed in both far eastern and western parts of the state.

In Idaho, some harvesting of new crop hay was underway in the south-central trade area. Some feedlots were getting Utility/Fair alfalfa old crop out of the Columbia Basin in Washington.

In Colorado, trade activity was light to moderate on good demand for farm/ranch hay and stable hay. Dairy and feedlot hay trades were minimal; prices were steady on horse hay in the northeast.

In the Washington-Oregon Columbia Basin, hay harvest occurred in the southern part of the basin and producers were bullish on new crop supplies. Trade was slow with light-to-moderate demand as buyers wait for the new crop.

In Wyoming, hay sold steady on a very thin test. The bulk of the old crop was sold, and hay barns are cleaned out. Most producers started to irrigate as dry weather continues across the reporting region.

- East: In Pennsylvania, markets were weaker as weather affected auction attendance.

In Alabama, hay prices were steady with moderate supply and demand.

- Midwest: In Missouri, there were several reports of farmers cutting and wrapping hay. There was a lot of talk about pricing new crop hay given the extremely high grain costs and increased prices of fuel and fertilizer. States to the west are in serious drought conditions, driving up prices in those areas.

In Nebraska, forages sold steady on a thin test. Demand remained good for this time of year for all baled products. Some alfalfa acreage was being diverted to corn. Drought lingered in the western half of the state, raising questions about the availability of summer grass. Cattle producers searched for baled hay just in case they to supplement their herd.

In Kansas, alfalfa hay price was steady in the southwest region and steady to $10 higher in the south-central region, as availability of alfalfa hay became more limited. Grass hay prices remained mostly steady, and demand for all hay was light to moderate as cattle return to pastures.

In Iowa, the quality of hay offerings was average to good, with demand steady and prices steady.

In South Dakota, alfalfa hay prices were steady to firm with good demand for all classes. Buyer interest has increased dramatically as drought continues persist. The cold overnight and cooler than average daytime temperatures continue to hamper alfalfa growth.

In Wisconsin, prices are steady for dairy-quality hay.

In Minnesota, alfalfa stands appear to be looking nice heading into May.

Other things we’re seeing

- Dairy: U.S. milk production marched into the spring flush with the highest number of cows passing through milking parlors and robots in more than three decades. Since bottoming out in June 2020, the nine-month growth spurt has added 120,000 cows in the 24 major dairy states and about 113,000 cows to the U.S. herd.

Meanwhile, milk income margins remain slim. The USDA set the March 2021 Dairy Margin Coverage (DMC) program milk price over feed cost margin at $6.46 per hundredweight (cwt), the fourth time the monthly margin has been below $7 per cwt in the past 12 months, when the onset of the COVID-19 pandemic sent milk prices plummeting.