With the recent resurgence of cover crops being sown on crop fields with corn stover, the idea of grazing a cover crop has been considered by producers and researchers alike, especially for economic reasons. The general consensus is: Cover crop grazing is a positive practice, but is grazing the cover crop worth the cost?

Putting cows and calves out on a field of corn stover and an established cover crop can provide many benefits for both the cattle producer and grain farmer. Grazing cattle can effectively manage the higher mass of residue created by today’s higher-yielding corn varieties.

Cattle trample many cornstalks as they forage, and this places more of the stalks’ surface area in contact with the soil. Once the stalks are in contact with the soil, soil-decomposing organisms can more effectively break the stalks down. Grazing corn stover with a cover crop established is a win-win for grain farmers from a yield point of view.

The question is: Is grazing crop residue with or without a cover crop an economically viable practice? Depending on how you manage input costs and animal marketing, it may or may not provide positive net returns.

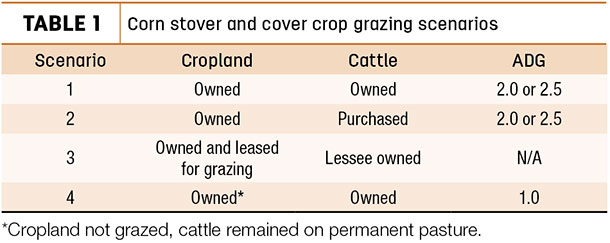

We conducted an economic evaluation of grazing 100 acres of corn stover and cover crops under four scenarios. Each scenario is explained in the following subparagraphs.

Scenario 1: Integrated enterprise with owned livestock and cover crops on crop fields

The operator owned both the cropland and cattle. Moving cattle to graze crop fields made use of corn stover and cover crop for winter grazing while resting permanent pastures. Steers were assumed to be either 400 or 500 pounds at the start of grazing. They grazed the corn stover and cover crops for either 90 or 120 days.

Scenario 2: Cropping enterprise with cover crops on crop fields with livestock purchased

The operator owned the cropland, but had no integrated livestock enterprise. Cattle were purchased specifically to graze corn stover and cover crops and were sold at 90 or 120 days. Steers were purchased 100 miles away and shipped to the farm. Cattle were purchased at weights of either 400 or 500 pounds.

Scenario 3: Cropping enterprise with cover crops on crop fields with grazing lease

The crop operator sowed the cover crop, fenced the field and provided livestock services to a lessee granted grazing rights. Grazing period was Nov. 15 to either Feb. 15 or March 15. The landowner was paid a management fee of 87.5 cents per head per day.

Scenario 4: Integrated enterprise with or without cover crops, hay fed to supplement available permanent pasture

In this scenario, no cover crop was grazed. The operator maintained a 50-cow cow-calf operation on permanent pasture and cropped 100 acres of corn. Pasture was supplemented with good-quality hay and grain for 90 or 120 days. All 50 offspring were fall-weaned steers and were either 400 or 500 pounds at the start of the feeding period in November or December.

Costs of carrying cows through the winter on pasture and supplemental good-quality hay and concentrate were not considered in the analysis. The average daily gain (ADG) used in the analysis for this group of animals was fixed at 1 pound per day regardless of the ADG used in the analysis of the other scenario groups.

Outcomes

Table 1 gives a brief description of the scenarios with ADG.

Scenario 1

The net returns for a 90-day grazing period were positive for 75 and 100 400-pound steers with a November start month. Net returns from 500-pound steers starting at the same time were positive at an ADG of 2 with 75 animals and stayed positive at both rates of gain with 100 animals.

Net returns from the 120-day grazing period were more sensitive to ADG effects on sale prices. The 400-pound steers showed net negative returns except for the 100 animals starting in November and gaining 2.5 pounds per day, whereas the 500-pound steer group showed positive net returns in all but one situation, 75 animals gaining 2 pounds per day. The December 90-day group of animals only produced positive net returns when 100 steers were gaining 2 pounds per day.

Scenario 2

The net returns for the 90-day group started in November were negative when only 50 animals were in the group. With 75 animals, the 400-pound steers produced a positive net return at both ADG rates, whereas the 500-pound steers only showed a positive net return at 2 pounds per day ADG.

Increasing the stocking rate to 100 animals resulted in positive net returns for both weight groups at each of the ADG rates. For the animals started in December, only the 100 animals with an ADG rate of 2 pounds per day produced a positive net return.

Discussion of scenarios 1 and 2

The results of the effects of increasing stocking rates show there is an interaction among stocking rate, rate of ADG and start month. Increasing stocking rate generally led to higher net returns. When looking at the net returns, it becomes evident controlling cost factors may lead to more positive net returns for the enterprise.

There is also an interaction among grazing duration, rate of ADG and sale price. Having a fixed grazing duration can work against net returns at higher ADG rates. As an animal moves into the next higher weight price category, the risk of a lower net return increases.

Periodic weighing of animals when moving between paddocks might reduce the price risk by allowing producers to market animals before they move into the next weight price category. Weighing is a practice that can help producers determine the ADG rate at a particular time and allow them to set target dates for marketing animals.

Scenario 3

Increasing stocking rates increased the income generated for Scenario 3, but net returns remained significantly negative. The greatest income occurred with 100 animals grazing for 120 days but still resulted in a negative net return ($6,230.28). Therefore, if the landlord provides fencing, watering and management services to a lessee, the daily management fee must be greater than the 87.5-cent-per-head per-day value used in this analysis to provide a net positive return to the landlord.

Researchers in 2016 reported stover grazing management fees ranged from 50 cents to $1.25 per head per day. The variability in fee prices suggests there is variability in the management services provided for the fee. In this study, the services provided included fencing, watering and general oversight of herd well-being.

Based on the costs for the services provided, a breakeven management fee was determined for each stocking density and grazing duration. The breakeven management fee was determined using the costs determined for the grazing period less the $900 land lease divided by the number of grazing days (number of head x the number of days).

As stocking density and grazing duration increase, the per-head cost of the management fee decreases. The management fees reported in the 2016 study suggest landlords may not be capturing all the costs associated with providing management services to fellow producers leasing their cropland to graze cattle on stover and cover crops.

Maximizing stocking rates based on forage availability provides tangible benefits to both the landlord and the lessee. The lessee benefits from a reduction in per-head cost, and the landlord benefits from a lower per-head cost that ensures a positive net return to the enterprise.

Scenario 4

Net returns were negative for all possible outcomes. The negative net returns ranged from $967 for the Nov. 500-pound steers fed 90 days to $2,498 for the Nov. 400-pound steers fed 120 days. Reducing supplement fed might have resulted in some positive net returns, but it is likely the ADG without supplementation would fall below 1 pound per day.

Summary

The economic evaluation demonstrates grazing steers on corn stover with a cover crop established requires careful management to produce a positive net return. Controlling costs can increase net returns, but careful management of cattle weights may be more influential on net returns. Allowing steers to gain weight into the next higher price category can potentially lower net returns.

Using a portable livestock scale and weighing animals periodically can assist producers to determine ADG and project weight-based marketing dates. The cost of weighing animals periodically is likely to be more than paid for through increased net returns.

When compared to the Scenario 4 results, grazing corn stover and cover crops is more likely to produce a positive net return than feeding hay and supplement when the animals’ weight is carefully managed.

Leasing cropland for grazing (Scenario 3) has no cattle price volatility risk but is not without risk. It requires the owner to find a lessee who is willing to pay a management fee sufficiently high to return a positive net return to the owner.

Another benefit to grazing crop fields with cover crops is resting permanent pastures. Removing grazing pressure for several months may allow the permanent pasture to recover and may improve grazing tolerance in the next year. ![]()

PHOTO: Research takes a look at the economics of grazing corn stover and cover crops, incorporating cattle ownership and weight management in four scenarios. Photo by David Cooper.

Todd Higgins, Ph.D., is an agronomist and owner of Cover Crop Consulting, Jefferson City, Missouri. Jason Bergtold, Ph.D., is a professor of agribusiness at Kansas State University. Email Todd Higgins.