For the content of this article, let’s use the little bit of skill part: Many factors affect the market price; most important are simple supply-and-demand economics.

I know we suggested this article is about export market outlook, but first and foremost we have to analyze the domestic dairy situation.

Dairy farmers are in the business of making money again. A dairy must buy feed, whether they are profitable or not. The key is: A profitable dairy farmer normally will buy better quality hay at higher prices.

Higher prices from domestic buyers tend to push the price up for export buyers. The other side of the coin is: With corn prices on the slide, dairymen will feed more corn. The real tale to be told is what the hay quality will be like this season.

A few more domestic factors to consider are: Is acreage up or down, due to pressure from other crops? What is water supply outlook?

Currently, it appears that West Coast alfalfa acreage should remain pretty flat. We see small increases in some states and decreases in others. We have seen a decrease of pressure from other crops like wheat and corn.

There is some pressure in certain areas for vegetables and other human consumption-type crops. All in all, it is doubtful we will see an oversupply of material on the market in 2014.

Water is a precious natural resource that can make or break a growing area. Often we take water for granted, as we are blessed to live in an area with abundant irrigation projects and what seems to be an ample supply of water.

However, many have heard the rumblings of tight water supply in states experiencing drought conditions. This is a huge concern as winter ticks days off the calendar yet precipitation is well behind normal for most of the West Coast.

As mentioned earlier, if you look at this as a supply-and-demand game, a water shortage in any hay-growing state could have the potential to tighten the supply.

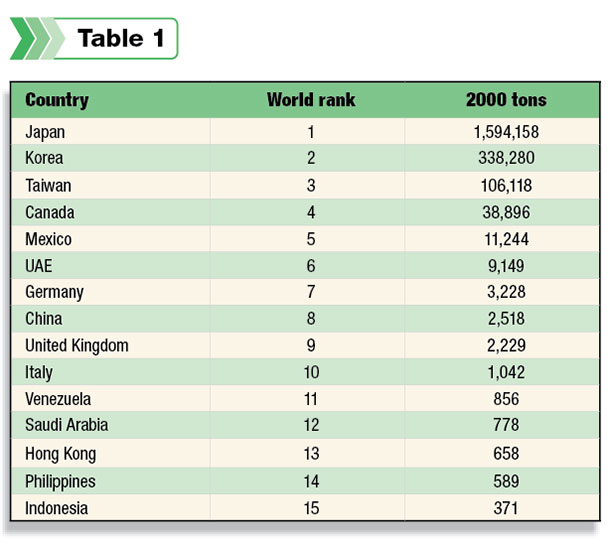

So, back to the subject of this article, 2014 export market outlook – I prefer to take a look at each major market for hay off the West Coast.

Japan

This is the most mature market we deal with. The U.S. has been exporting forage to Japan for over 40 years. This market is stable. The truth of the matter is: This market is shrinking slightly each year as aging farmers retire and no family members wish to continue the business.

Because the market is fully developed, Japan will continue to have demand for grass hay, alfalfa and grass straw. Horse, beef and dairy markets are users of imported forages.

It’s a quality-driven market that wants better-quality hay. The fluctuation of the yen to the U.S. dollar exchange has made things a little volatile, and many importers are buying “hand to mouth” rather than stockpiling inventory.

The other factor most people in the U.S. don’t hear about is the government subsidy being paid due to the Fukushima nuclear reactor problem. In mid-2012 to mid-2013 there was high radiation fallout in some areas, and the Japanese government deemed the domestic grass and straw unsafe for feed. They, in turn, paid certain farmers a subsidy to feed imported grass hay and not use domestically grown forage.

We saw the subsidy increase demand of grass hay by more than 100,000 tons to the affected area. Most of the area is now deemed safe, and the subsidy has been drastically reduced, bringing demand back to normal levels. The 2014 outlook is steady-as-she-goes in Japan.

Korea

Korea is another mature market. Demand appears to remain solid into 2014. This market tends to be more price-sensitive and will accept lower-grade hay at a slightly lower price. However, as the dairy market there has expanded, they have seen the need to buy higher-quality hay as well.

There is a very limited racehorse market in Korea. Most of the forage is sold to beef and dairy customers. Korean government monitors the amount of forage imported into the country using a quota system with import companies. The 2014 outlook is strong with this valuable trading partner.

Middle East

The Middle East is an extremely interesting market. Currently, the largest country in the Middle East by import volume is the United Arab Emirates. A handful of smaller countries are importing as well.

The sleeping giant in this region may be Saudi Arabia. You recall we talked earlier about water and how precious it is? Many countries in the Middle East have seen thousands-of-years-old aquifers run dry.

Some countries have, and others soon will, stop growing forage crops to save water. Most countries are doing this over time, therefore drastically increasing the demand for imported forage.

Currently, this is mainly an alfalfa market with a dab of grass hay. Market is currently driven by fair price and not top quality. That could change as the market develops.

The number of animals in the region is astonishing. Dairy cattle, beef cattle, camels, sheep and goats are all looking for forage to consume. This Middle East market seems to have upside potential and more demand as time goes on.

China

China is simply the largest developing market for U.S. alfalfa. China has gotten a taste of dairy products and has invested large sums of money in dairy cattle.

They have figured out the hard way that they have difficulty producing high-test hay and distributing it throughout the country due to poor infrastructure.

High-quality hay imported from the U.S. is being imported to increase milk production on a per-head basis. The government has mandated rapid growth in the dairy sector within China.

This has caused the imports of hay into China to literally go off the charts. China and the U.S. are currently in negotiations to allow grass hay into the country as well.

Grass hay will be extremely important to China’s racehorse industry – an industry that is on the rise. This market is on a sharp upward trend, and demand should increase again in 2014.

Of course, there are other countries importing hay from the U.S. The ones listed here are the ones that we see as the main markets at this point. There is work being done to open other areas as well, like India and Vietnam. More countries buying from the U.S. mean more demand.

All this being said, good harvest coupled with good demand is exactly what we all, in the domestic market and export market, are looking for.

As growers and customers, do the best you can with what you have to work with. In my humble opinion, the 2014 outlook is excellent based on the factors we can analyze with skill. Now let’s just hope Mother Nature will do her part and give us all a little luck at harvest. FG

Mike Hajny

Vice-President

Wesco International, Inc.