Almost all forage production can be traced back to one crucial input, one necessary ingredient: rainfall. In the farming and ranching community, the health of our operations is heavily dependent upon this one crucial variable. But what if rain does not come? Do you have a plan to protect your operation?

The USDA and the crop insurance industry introduced Pasture, Rangeland and Forage Insurance (PRF) in 2007 as a pilot program to help livestock producers financially endure drought situations. In 2016, it expanded to the lower 48 contiguous states.

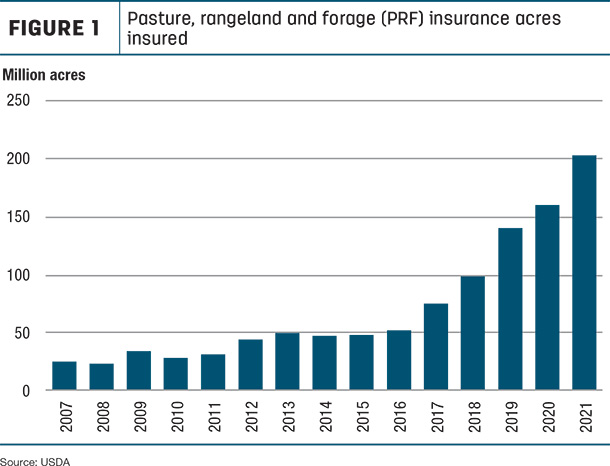

As seen in Figure 1, participation has increased dramatically, rising by an average of 26% year-over-year between 2016 and 2021.

According to the 2017 USDA Census, there are more than 400.77 million permanent pasture and rangeland acres across the U.S. As of 2021, 51% of that acreage was insured through PRF.

Why are farmers and ranchers so quickly embracing PRF? Corn and soybean growers don’t operate without crop insurance. It’s an essential tool to keep farms financially viable from year to year. But in the past, ranchers and forage growers didn’t have similar options. PRF changed this. Now growers have the option to purchase insurance and protect their operation financially in case the rain doesn’t fall.

How does it work?

PRF allows producers to insure grazing and haying acreage from a lack of precipitation. The program allows users to cover a percentage of average rainfall during a set period. If it rains less than the average level chosen, the insured receives a payment.

But the rainfall isn’t measured for a specific field or property. No government inspector is coming to check your rain gauge. Instead, the USDA estimates rainfall received in roughly a 17-mile square the grower’s land is located within, the grid area. So if rainfall for your grid is less, a payment is triggered.

The five decisions

Growers work with a licensed insurance agent, not the USDA, to select and manage their insurance. Each grower will need to make five decisions when selecting their coverage levels:

- Intended use: Producers can select whether their operations are intended for grazing or haying. Irrigated haying ground can be insured as well. (Note that irrigation water doesn’t count as rainfall.)

- Coverage level: Producers can insure themselves from rainfall lower than 70% to 90% of average yearly precipitation for their grid.

- Productivity factor: Growers specify an expected yield when selecting policy protection per acre level. It can be as low as 60% of historical production to keep the premium low or up to 150% for maximum protection.

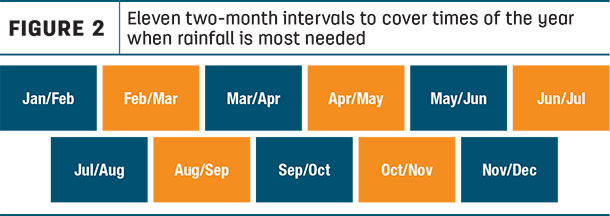

- Index interval: Forage producers can choose from 11 two-month index intervals to cover times of the year when that rainfall is most needed. A minimum of two and maximum of six intervals can be chosen.

- Allocation of acreage: Growers allocate a percentage of total acreage within the selected intervals. Though coverage varies by county, producers can insure a minimum of 10% and a maximum of 70% of acreage.

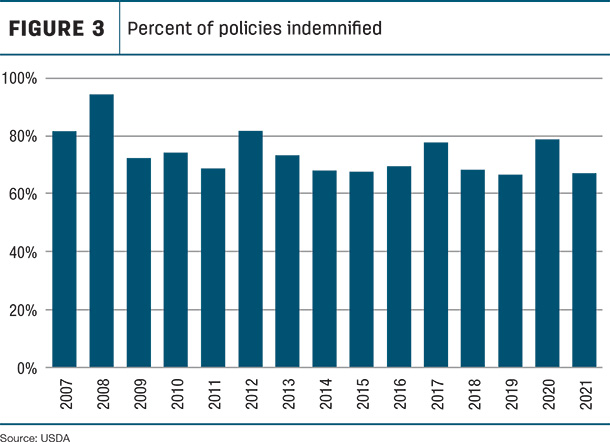

Like most federal crop insurance tools available, this program is subsidized, making it an affordable option for ranchers and forage growers. Historical performance for many parts of the country also suggests it is effective in compensating producers for lack of rainfall. On average, 74% of the policies written in every year between 2017 and 2021 received indemnity payments.

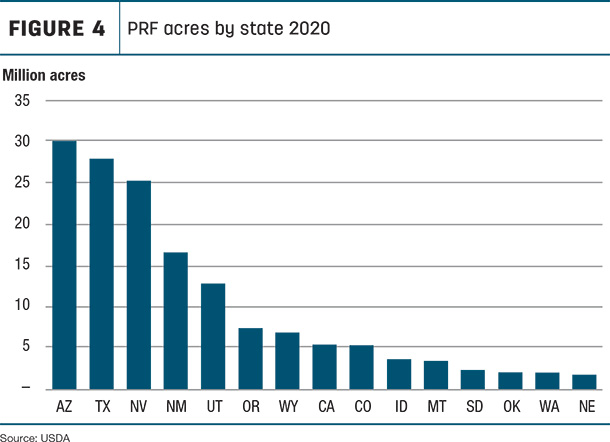

The western U.S. sees the most PRF use, with Arizona, Texas and New Mexico accounting for over 80 million acres of land insured. But growers in all 48 states should consider if PRF is right for their operation. With the many choices in coverage, PRF can be tailored to a specific operation’s needs.

Don’t spend another year worrying about little or no precipitation and if your farm is going to make it. Use PRF to alleviate some of that risk.