Good managers can control machinery costs per acre by making smart decisions about how to acquire machinery, when to trade and how much capacity to invest in. All of these decisions require accurate estimates of the costs of owning and operating farm machinery.

Costs such as depreciation, interest, insurance and housing are incurred simply by owning machinery. Because these costs are mostly independent of how much the machine is used, they are often called “fixed” costs.

On the other hand, costs for repairs, fuel, lubrication and labor are called operating or “variable” costs because they depend on how many acres a machine is used over each year.

Machinery costs can be estimated for the current year or over a longer period of time. Operators who want to know their costs so they can set a reasonable custom rate or estimate their total costs of production will want to know their current costs.

Those considering buying or trading for a new machine will want to estimate their future costs over the years they expect to own it.

Before fixed costs can be calculated, the current value of the machine must be estimated. The current value of a newly acquired machine is simply its purchase cost, including the value of any items traded in as part of the transaction

. For machines owned for several years, the current value can be estimated from “blue book” manuals, auctions or values found in sale ads in newspapers or on used-machinery websites.

Depreciation

For illustration, let’s assume we own a self-propelled windrower with a 15-foot header. It is 3 years old and has been used 600 hours so far on about 2,000 acres per year.

Its original list price was $100,000, but a check of some used-machinery sites shows machines of similar type and age selling for about $75,000 now.

Various depreciation rates can be used, but a common practice for farm machinery is to multiply its current value by 10 percent to estimate depreciation for this year.

In this case, depreciation cost would be 10 percent of $75,000, or $7,500. Note that depreciation costs calculated for income-tax deductions should not be used because they overestimate true depreciation costs in the early years of ownership.

Interest

If you borrow money to buy a machine, the lender will determine the interest rate to charge. But if you use your own capital, the rate to charge will depend on the opportunity cost for that capital elsewhere in your farm business.

If only part of the money is borrowed, an average of the two rates should be used. For the example, we can assume an average interest rate of 5 percent, so the interest cost for the current year would be $75,000 x 5 percent, or $3,750.

Insurance and housing

Insurance is carried on farm machinery to allow for replacement in case of a disaster such as fire or tornado. Current rates for farm machinery insurance are roughly 0.5 percent of value.

Another 0.5 percent of the current value is often added for the cost of housing the machinery. To simplify, insurance and housing costs can be lumped together as 1 percent of the current machine value, or $750 per year for our windrower example.

The estimated costs of depreciation, interest, insurance and housing are added together to find the total ownership cost. For our example windrower, this adds up to $12,000 per year. If the windrower is used over 2,000 acres per year, the total ownership per acre is $6.

Repairs and maintenance

Repair costs occur because of routine maintenance, wear and tear, and accidents. Repair costs for a particular type of machine can vary widely because of soil type, rocks, terrain, climate and operator skill.

The best data for estimating repair costs are records of past repair expenses. Good records indicate whether a machine has had above-average or below-average repair costs and when major overhauls may be needed. Without such data, though, repair costs must be estimated from average experience.

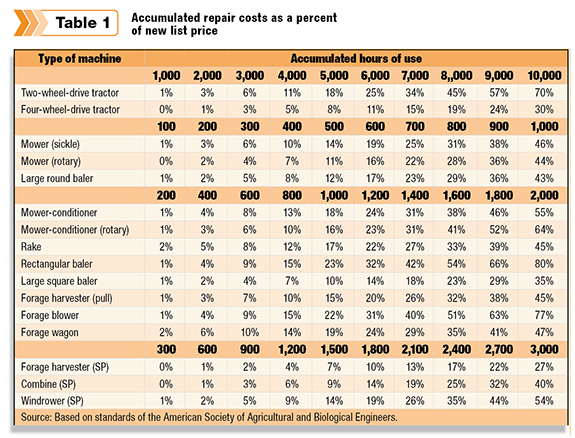

The values in Table 1 show the relationship between accumulated repair costs for a machine and the total hours of use during its lifetime, based on historical repair data.

The total accumulated repair costs are calculated as a percent of the current list price of the machine, since repair and maintenance costs can be expected to change at about the same rate as new list prices.

According to Table 1, total accumulated repair costs will be equal to about 2 percent of its new list price after 600 hours ($2,000) and 5 percent after 900 hours ($5,000), for an expected cost of $3,000 over the next 300 hours. This calculates to $10 per hour or $1 per acre.

Fuel and lubrication

Fuel costs can be estimated in two ways. An Iowa State University Ag Decision Maker publication A3-27, “Fuel Required for Field Operations” lists average fuel use in gallons per acre for many field operations.

Those figures can be multiplied by the expected fuel cost per gallon to calculate the fuel cost per acre. For example, if the average amount of diesel fuel required for windrowing is .45 gallons at an expected price of $3.40 per gallon, the estimated fuel cost per acre is $1.53.

Lubrication costs are often estimated at 10 percent to 15 percent of fuel costs. For our example, expected lubrication cost would be $1.53 x 15 percent, or $0.23 per acre.

Labor

Because different-sized machines require different quantities of labor to accomplish such tasks as planting or harvesting, it is important to consider labor costs in machinery analysis. Labor cost is also an important consideration when comparing owning a machine to custom-hiring the same service.

Actual hours of labor usually exceed field machine time by 10 to 20 percent because of the time required to transport and maintain the machine. Using a wage rate of $14 per hour, labor cost for our example can be estimated at $14 x 1.15 = $16.10 per hour of field time, or $1.61 per acre. Different wage rates can be used for operations requiring different levels of operator skill.

Repair, fuel, lubrication and labor costs are summed to calculate total operating cost. For the windrower example, total operating cost is $1 + $1.53 + $0.23 + $1.61 = $4.37 per acre.

Total cost

After all costs have been estimated, the total ownership cost can be added to the operating cost to calculate total cost per acre for the machine. For our windrower example, the total cost is $6 + $4.37 = $10.37 per acre.

Costs for operations that involve an implement pulled by a tractor can be estimated by finding the total costs per acre for the tractor, then estimating the fixed costs and repair costs for the implement and summing them.

More detailed examples of machinery cost estimates can be found in information file A3-29, “Estimating Farm Machinery Costs,” on the Ag Decision Maker website.

To estimate average costs over the entire ownership period, the average expected value of the machine during this time period should be used.

This can be found by averaging its current value and its anticipated salvage value when it is traded, sold or retired. Future salvage values can also be estimated from used-machinery auctions or websites.

Machinery cost calculators

Several universities offer online programs for estimating farm machinery costs. They provide more detail and precision than the approach outlined in this article. Here are several such calculators:

- Machinery Cost Calculator (Ag Decision Maker, Iowa State University)

- Machinery Economics (FAST Tools, University of Illinois)

- Machcost (Center for Dairy Profitability, University of Wisconsin)

- Agmach$ (Oklahoma State University)

- MACHDATA (University of Minnesota)

- Machinery Cost Calculator (Ontario Ministry of Agriculture and Food) FG

William Edwards

Economist Emeritus

Iowa State University Extension