Weather

Drought in the West persists, while rain soaked much of the Upper Midwest, Plains and South. The rain arrived too late to benefit some summer crops in the South, but topsoil moisture was improved and helped to revive pastures.

Current wildfires are the real weather story. By Aug. 24, the Okanogan Complex fire (a conglomeration of five fires near Omak, Washington) had become the largest wildfire in state history. Sparked by lightening, the fire surpassed 260,000 acres and claimed the lives of several firefighting crewmen. Full containment is not expected until fall rains bring relief.

Change in alfalfa forecast in the West

The USDA National Agricultural Statistics Service (NASS) forecasted California alfalfa yield down 15 percent in 2015, but drought is only part of the story. An overabundance of fair-quality alfalfa hay supplies has depressed the market, along with light demand by dairies.

Other western states’ yield predictions bounce around, with Washington (down 2 percent) and New Mexico (down 2 percent) headed downward and other states rising slightly – Idaho (up 5 percent), Nevada (up 12 percent), Oregon (up 2 percent), Utah (up 8 percent) and Arizona (up 6 percent). Quality, however, is the challenge this year in the West. Feeder hay seems to glut the current market, rather than dairy quality hay.

Equipment and fertilizer

Low grain prices have resulted in a 17.7-percent decline in high horsepower tractors, and combine sales fell 41.7 percent. Original equipment manufacturers have responded by reducing inventory levels, laying off employees and reducing overhead costs. It’s a buyer’s market for equipment.

Green Markets Weekly Index indicated the fertilizer index on Aug. 15 closed at 402, which is close to the March 30, 2015, close price.

International issues

An explosion at a chemical warehouse on Aug. 12 rocked the Port of Tianjin, China (over 100 killed), where most West Coast alfalfa hay is shipped. This will undoubtedly delay shipments and put into question whether containers sitting on the dock will be condemned because of chemical fumes. This, coupled with the fact that China’s currency was devalued in mid-August (making U.S. hay more expensive to China), has made Western export buyers cautious. In June, hay exports to China topped 84,500 metric tons, eclipsing exports to Japan by 3,000 metric tons.

Other commodities

It may be true that not much triticale hay is sold in large square or small square bales, but some areas of the West market it a bit. The USDA Agricultural Marketing Service reports that from June through August 2015, 4,725 tons of triticale were sold (mostly in Oregon) at an average price of $141 per ton.

Dairy market demand

Rabo AgriFinance released the August report, stating, “While U.S. dairy farmers have mostly been profitable in 2015, New Zealand producers are now facing a season worse than 2009 with farm gate prices currently sitting at $3.85 kgms (less than $10 per hundredweight), which is well below local costs of production.”

Why has the U.S. continued to perform well? U.S. dairymen have access to overseas markets and a large domestic market. However, while helpful, this does not fully protect the U.S. from global market conditions. The report states, “The months ahead will likely bring more downside than upside to commodity prices.” Lower farm gate prices are expected through the rest of 2015.

Dairy Management Inc. in their August 2015 newsletter says, “Milk prices in many major milk-producing countries have plummeted to levels that are producing severe financial stress for their farmers. However, on the back of stable domestic consumption, the milk price outlook in this country is generally more positive. Domestic consumption of dairy products has been strong throughout 2015 and has helped to offset both increased milk production and declining U.S. exports.”

NASS reported actual prices received for “all milk” in July 2015 was averaged across states at $16.60 per hundredweight (cwt), which was down from June’s prices of $16.90 per cwt.

Beef market demand

Cow-calf producers are coming out ahead this year, with an estimated $500 per head profit, according to the Rabo AgriFinance August report. Beef cow slaughter is 17 percent below levels of 2014, with heifer retention growing. Cattle feeders and beef processors are experiencing a difficult year as market-ready cattle numbers tighten. The report states, “Reduced cow slaughter and heifer retention will start to make a measured increase in available cattle supplies that will gradually increase in 2016 and expected to show a sizable recovery in 2017.”

And did you know?

Rabobank cited the USDA Economic Research Service and reported that about half of every dollar spent on food in the U.S. is prepared away from home (restaurants or other food service places). It doesn’t affect hay prices, to be sure, but now you know.

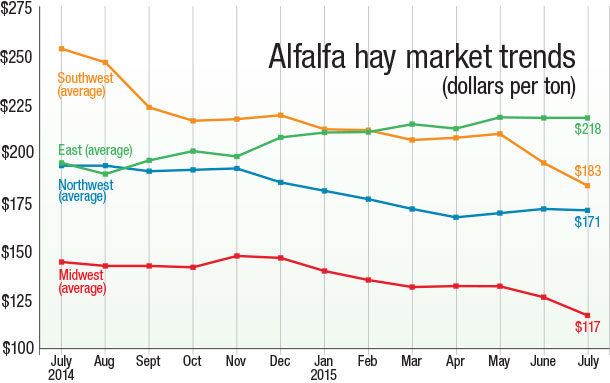

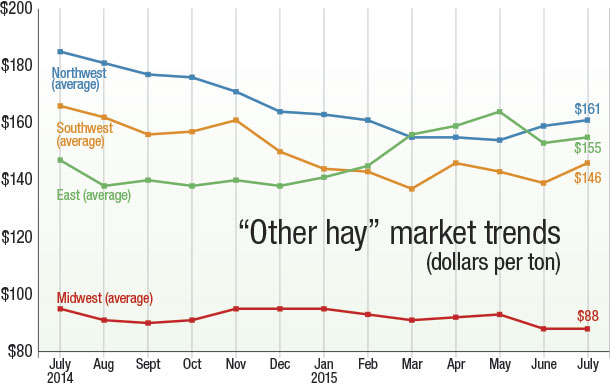

Hay charts

Hay markets vary widely by region and by product – alfalfa hay versus “other hay.” The prices and information in Figure 1 (alfalfa hay market trends) and Figure 2 (“other hay” market trends) are provided by NASS and reflect general price trends and movements. Hay quality, however, was not provided in the NASS reports.

For purposes of this report, states that provided data to NASS were divided into the following regions:

Southwest – Arizona, California, Nevada, New Mexico, Oklahoma, Texas

East – Kentucky, New York, Ohio, Pennsylvania

Northwest – Colorado, Idaho, Montana, Oregon, Utah, Washington, Wyoming

Midwest – Illinois, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, South Dakota, Wisconsin FG