The excess hay supplies were mostly reported for lower-quality hay. Many areas reported little dairy-quality hay offered for sale during the last week of July.

In the Upper Midwest, wet weather was hampering harvest and quality in Iowa, pushing some hay growers into experimenting with anaerobic wrapping. Lower-quality hay was plentiful in southwestern Minnesota, but no dairy-quality hay was offered at auction in late July. With excess supplies, there were reports some Wisconsin hay lots did not receive bids at auction, regardless of quality.

Drought pressure in western South Dakota and northeastern Wyoming was improving hay market prices there. Consigned hay from eastern Wyoming and western Nebraska at a monthly internet auction was headed to drought-stricken areas of northern Wyoming, with some dairy-quality hay going to dairies in Iowa, Illinois and Indiana.

In South Dakota’s East River region, third-cutting harvest tonnage was lighter due to hot and dry conditions.

Dairy and feedlot demand was extremely limited in Oklahoma. Fourth-cutting alfalfa yields are fairly low for most producers, but quality is mostly good. Spotty rainfall over parts of central and western Oklahoma improved pasture conditions, but some hay received rain damage.

In New Mexico, where fourth cuttings were well underway, prices were steady, trade was slow and demand was light.

Drought areas stretch a little farther

While many corn- and soybean-producing areas benefited from rain, USDA’s latest World Agricultural Outlook Board report indicates drought conditions increased in major hay-producing states. As of July 26, about 17 percent of U.S. hay acreage was located in areas experiencing drought.

West of the Mississippi River, drought areas include California, southern Arizona, western Nevada, eastern Oregon, western South Dakota, along with pockets in Montana and Wyoming. In the eastern half of the country, drought areas are expanding in the Southeast and Mideast, stretching from Michigan to New York and Pennsylvania.

Check out the hay areas under drought conditions.

June hay prices lower

Summer alfalfa and other hay prices continued to drop, according to the USDA National Ag Statistics Service’s (NASS) monthly ag prices report, released July 29.

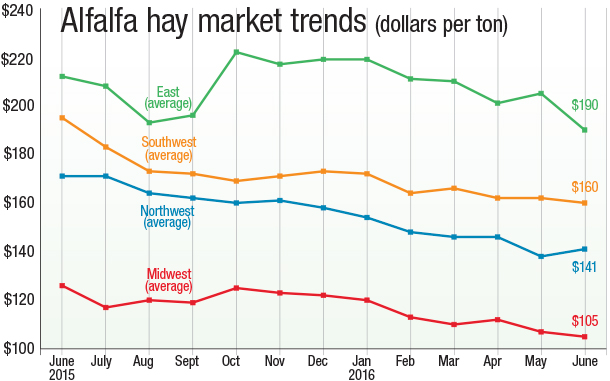

Alfalfa

The June 2016 U.S. average price paid to alfalfa hay producers at the farm level was $142 per ton, down $5 from May and $36 less than a year earlier. Based on USDA records, U.S. average alfalfa prices are the lowest since March 2011.

Compared with a month earlier, average prices were up $13 in Oklahoma, but $15 to $30 per ton lower in Arizona, Ohio and Pennsylvania. The eastern region saw the largest overall month-to-month decline (Figure 1).

Several states saw average prices down $40 to $60 per ton compared to June 2015, including California, Idaho, Michigan, Minnesota, New Mexico, Oregon, Texas, Utah and Washington. Pennsylvania led all decliners, down $76 per ton. Only Kentucky and Montana reported average prices higher than a year earlier.

Lowest reported alfalfa hay prices in June were in North Dakota ($74 per ton), Nebraska ($82 per ton) and Minnesota ($84 per ton). Highest average prices were in Kentucky ($220 per ton) and New York ($200 per ton).

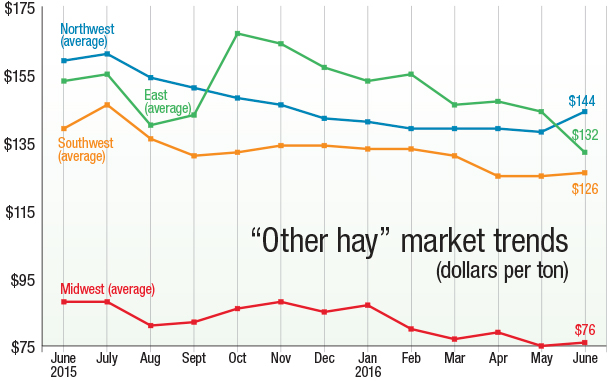

Other hay

The June U.S. average price for other hay was $116 per ton, down $6 from May and dipping to lows last seen in December 2014.

Regionally, monthly declines averaged $14 to $21 per ton across the country (Figure 2). Compared with a month earlier, Colorado, Nevada, Oregon and Washington posted increases of $10 per ton, while Pennsylvania (-$24 per ton), Ohio (-$15) and New Mexico (-$10), led decliners.

Compared with a year earlier, other hay prices were down $25 to $40 per ton in California, Colorado, Minnesota, Nevada, New Mexico, Utah and Washington. Pennsylvania led all decliners, down $61 per ton compared to a year earlier. Only Kentucky, Oregon and Texas reported other hay prices higher than a year earlier.

May U.S. alfalfa hay exports grow

U.S. alfalfa hay exports remain a brighter spot in what is turning into a deficit ag trade picture, according to latest estimates from USDA’s Foreign Ag Service.

May alfalfa hay exports topped 212,200 metric tons, about 20,000 metric tons more than April, and 40,000 metric tons more than May 2015.

Chinese alfalfa hay shipments were down slightly, but increased shipments to the Middle East and Japan offset that decline.

The increases to the United Arab Emirates (UAE) and Saudi Arabia come with a bit of an asterisk, according to Christy Mastin, international sales manager with Eckenberg Farms Inc., Mattawa, Washington.

“This is the alfalfa production from farm ground that was purchased earlier this year, mostly in the southwest U.S., by companies from these countries for the purpose of exporting the hay,” she said.

Read: More U.S. alfalfa hay moving abroad

Dairy: Milk price outlook improves, but near-term is tough

The 2016 dairy outlook has improved somewhat, with higher milk prices and reduced feed costs forecast. USDA’s July World Ag Supply and Demand Estimates (WASDE) report cut the 2016 U.S. milk production estimate, helping boost the annual price outlook by about 50 to 65 cents per hundredweight compared to a month ago.

Based on USDA’s monthly milk production report, June 2016 milk production was estimated at 17.77 billion pounds, up 1.5 percent from June 2015 and the strongest monthly year-over-year gain since March. Milk cow numbers were estimated at 9.328 million head, 5,000 head more than June 2015, and up 1,000 head from May 2016.

Although USDA projects 2016 milk production will still rise about 1.8 percent from 2015, University of Wisconsin – Madison professor emeritus Bob Cropp expects the increase to be closer to 1.6 percent.

“Much of the dairy country is currently experiencing some extreme temperatures, which could reduce milk per cow, especially if these temperatures persist into August,” he said.

While the outlook is better, dairy farmers have to make it through summer first. Based on June calculations, USDA announced the smallest income margins to-date under the Margin Protection Program for Dairy (MPP-Dairy).

At $14.80 per hundredweight, the June U.S. average milk price was up slightly from May, halting a six-month decline. However, with the exception of hay, higher feed prices took a bigger bite of June’s milk income.

When combined with May milk and feed prices, the two-month MPP-Dairy margin was calculated at $5.76 per hundredweight, down $1.39 from the March-April pay period and the lowest in the program’s short history.

Beef outlook: Supplies grow, margins don’t

The beef outlook is marked by increasing cattle numbers and beef production throughout the supply chain. Monthly cattle on feed, feedlot placements and marketings were all higher than the year before. As a result, June beef production was up 10 percent compared to a year earlier, and beef inventories in cold storage were up from the month before.

With supplies pressuring prices lower, July income margins contracted, and the farm-to-retail price spread widened as producers saw their share of the retail beef dollar shrink.

Figures and charts

The prices and information in Figure 1 (alfalfa hay market trends) and Figure 2 (“other hay” market trends) are provided by NASS and reflect general price trends and movements. Hay quality, however, was not provided in the NASS reports.

For purposes of this report, states that provided data to NASS were divided into the following regions:

Southwest – Arizona, California, Nevada, New Mexico, Oklahoma, Texas

East – Kentucky, New York, Ohio, Pennsylvania

Northwest – Colorado, Idaho, Montana, Oregon, Utah, Washington, Wyoming

Midwest – Illinois, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, South Dakota, Wisconsin ![]()

-

Dave Natzke

- Editor

- Progressive Forage

- Email Dave Natzke