One ripple is the drought in the Northern Plains, according to Katelyn McCullock, economist with the American Farm Bureau Federation’s Market Intelligence.

Because of the region’s short growing season and lower cuttings per acre, the implications are likely to affect stocks going into the next winter and over a much larger geographical footprint as supplies are drawn from outside the area. The High Plains corridor is typically the highest producer of “other” hay in the country, McCullock said.

We’ll get a first look at 2017 hay yield and production estimates in the survey-based USDA Crop Production report to be released Aug. 10.

The agency previously estimated U.S. hay producers intended to harvest 53.5 million acres of all hay in 2017, up less than 1 percent from 2016, according to the USDA’s Acreage report. However, production will take a big hit in drought areas, and quality could be hampered by widespread rain damage elsewhere.

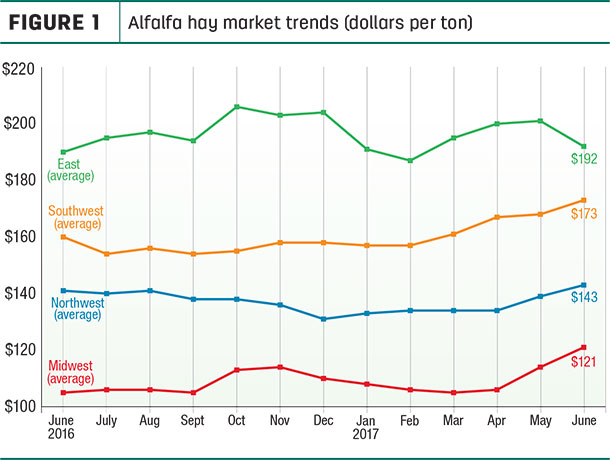

Alfalfa hay prices

The latest available USDA monthly ag prices report was released July 31, summarizing June 2017 prices.

Alfalfa

The June 2017 U.S. average price paid to alfalfa hay producers at the farm level was $152 per ton, down $3 from May 2017 but still $10 more than a year earlier.

Localized moisture conditions had the biggest impact on price changes. On a regional basis (Figure 1), June prices were lower than month-earlier levels in the East, largely based on declines in New York (-$28 per ton) and Pennsylvania (-$15 per ton).

Elsewhere, large increases in North Dakota (+45 per ton), Washington (+$30 per ton), South Dakota ($15 per ton) and Arizona and Nevada (both +$10 per ton) pushed regional averages higher across the Midwest, Northwest and Southwest.

Compared to a year earlier, prices were $20 to $50 higher in California, Michigan, Nevada, New Mexico, New York, North Dakota, South Dakota and Wisconsin but $10 to $31 per ton lower in Illinois, Kentucky, Oklahoma, Oregon and Pennsylvania.

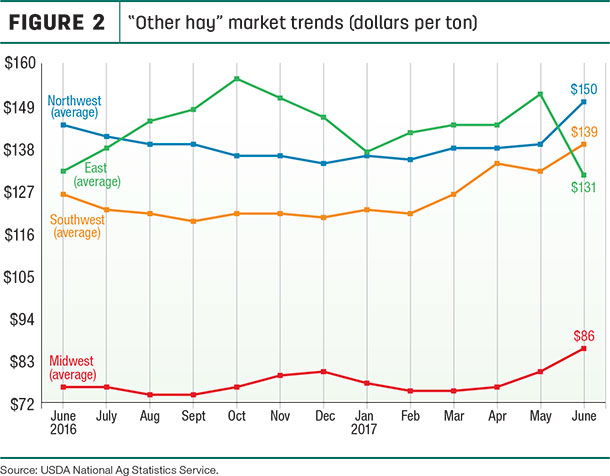

Other hay

The June 2017 U.S. average price for other hay was estimated at $124 per ton, also $3 per ton less than May’s average. As with alfalfa hay, price declines in New York (-$60 per ton) and Pennsylvania (-$19) skewed the national average. As a result, prices for other hay were down in the East but somewhat higher in other regions (Figure 2).

North Dakota, South Dakota and Washington posted the largest month-over-month increases. Compared to a year earlier, prices changes for other hay were also diverse: up $40 per ton in Washington and $37 per ton in North Dakota but $50 per ton lower in Oregon.

Figures and charts

The prices and information in Figure 1 (alfalfa hay market trends) and Figure 2 (“other hay” market trends) are provided by NASS and reflect general price trends and movements.

Hay quality, however, was not provided in the NASS reports. For purposes of this report, states that provided data to NASS were divided into the following regions:

- Southwest – Arizona, California, Nevada, New Mexico, Oklahoma, Texas

- East – Kentucky, New York, Ohio, Pennsylvania

- Northwest – Colorado, Idaho, Montana, Oregon, Utah, Washington, Wyoming

- Midwest – Illinois, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, South Dakota, Wisconsin

Organic hay

The USDA’s organic hay report, released Aug. 2, reported grower FOB farm gate organic alfalfa prices for large square bales as follows:

- Supreme – $310 per ton

- Premium-Supreme – $250 per ton

- Premium – $263 per ton

USDA National organic grain and feedstuffs report

Hay exports

While domestic demand has increased across the country this year, export markets are still adjusting to the new crop situation, said Christy Mastin, international sales manager with Eckenberg Farms, Mattawa, Washington.

June exports of alfalfa hay fell off slightly in June, but year-to-date sales remained at a record-high pace. U.S. alfalfa hay exports topped 237,000 metric tons (MT) for the month, the lowest total since February, but the fifth consecutive month sales volumes topped 200,000 MT in 2017.

China was the leading foreign market for alfalfa hay during the month, at about 109,210 MT. However, low milk prices in China are limiting that country’s ability to buy premium hay at premium prices, according to Mastin.

June 2017 sales of other hay remained average relative to recent history. Monthly sales totaled 118,115 MT, with reduced sales to Japan offset by gains to South Korea, which suffered heavy rain damage to its domestic crop, Mastin said. Demand for U.S. hay is expected to remain strong there into fall.

June exports of alfalfa cubes and meal were little changed from May.

Washington producers had some rain damage during first-cutting alfalfa and timothy. This caused prices to rise above levels export customers were expecting, so many have waited to see the condition of Canada’s harvest, which has resulted in little no rain damage.

The Middle East and Saudi Arabia, specifically, as well as China are increasing their purchases of alfalfa hay. However, the low milk price in China is limiting purchases of high-quality hay at premium prices. Instead, China is looking for large volumes of the best-quality hay it can get at lower prices.

“Currently, we don’t see new-crop purchase prices being reflected in our new-crop sales prices to these countries,” Mastin said.

South Korea suffered heavy rain damage on their domestic hay harvest last year. The next harvest is not expected to be until fall, so demand from South Korea could remain strong until their harvest and maybe into next year, especially if the harvest is challenged by weather again in 2017, Mastin said.

Also the reduced supply and increased price of straws (ryegrass, fescue) and timothy has this market looking for more alfalfa at better prices.

See more on hay exports: International demand changing U.S. hay market

USDA 2017 dry hay crop forecast and acreage report

Additional alfalfa/alfalfa mixture hay acreage will be offset by lower yields, leaving the 2017 U.S. harvest of dry hay about the same as last year, according to USDA’s first survey-based estimate of the growing season.

Acreage and expected yields of all other dry hay are similar to 2016, also resulting in little change in the 2017 harvest outlook.

Alfalfa and alfalfa mixture

Production of alfalfa and alfalfa mixture dry hay for 2017 (click to see Table 1) is forecast at 56.2 million tons, down 4 percent from 2016. Based on Aug. 1 conditions, yields are expected to average 3.28 tons per acre, down 0.17 ton from last year. Harvested area is forecast at 17.1 million acres, unchanged from the June forecast but up 1 percent from 2016.

Montana, North Dakota and South Dakota, the top three states in area of alfalfa and alfalfa mixtures in 2017, have experienced severe drought conditions this year. As a result, hay producers in those states are expecting lower yields than in 2016. Record high yields are expected in Arizona, Idaho and Oregon in 2017.

Other Hay

Production of other hay (click to see Table 2) is forecast at 76.4 million tons, down less than 1 percent from 2016. Based on Aug. 1 conditions, yields are expected to average 2.10 tons per acre, up 0.01 ton from last year. If realized, the 2017 U.S. average yield will be a record high. Harvested area is forecast at 36.4 million acres, unchanged from the June forecast but down less than 1 percent from 2016.

Outside of the drought-stricken states of Montana, North Dakota and South Dakota, limited hay acres have experienced drought conditions this year. As a result, Idaho, Missouri, North Carolina and Texas are expecting record-high yields.

Information for the USDA August Crop Production report, released Aug. 10, was compiled from telephone, mail, email and personal interviews of about 21,700 producers of all crops. Find the full report here.

Auction and market summaries

Here’s a peek at early August auction market summaries:

-

East: Alabama hay prices were steady with light supply and good demand. In Pennsylvania’s Lancaster area, a lighter supply of hay and straw sold mostly steady with some firmness noted in large bales of alfalfa/grass mixed hay. Supply was light to moderate. Buyer attendance and demand were moderate.

-

Southwest: All classes of California hay traded steady with moderate demand. Alfalfa fields were being irrigated, cut and baled. In Oklahoma, alfalfa trade was mostly slow and movement light to moderate; prices were steady as supplies of Supreme- and Premium-quality alfalfa are becoming harder to find.

Dairy demand for alfalfa was moderate; grinding alfalfa and grass hay demand was very light. In the Texas Panhandle, hay traded steady to $5 higher except for top-end-quality hay, which sold instances of $15 higher.

Movement was slow to moderate as some buyers are waiting in hopes of lower prices as barns fill up with new-crop hay. Coastal bermuda producers in the north and east have been baling between rains and report plenty of hay available.

Some are running out of room to store hay and may drop prices to get some moving before first frost. New Mexico alfalfa hay prices were unchanged with trade slow and demand moderate. Rain showers have slowed harvest in Southern and Southwestern regions. As of Aug. 4, Southern and Southwestern areas were 40 to 50 percent into fourth cutting; southeastern areas were between 40 to 50 percent into fourth cuttings.

-

Northwest: In Idaho, prices for domestic and export alfalfa and timothy were steady. Trade was slow with moderate to good demand, especially for export-quality timothy. Trends were similar in the Washington-Oregon Columbia Basin. Utah hay prices were mostly firm with trading slow on all qualities. Lower-quality hay demand is light with good supplies. In Montana, hay prices sold mostly $10 to $15 higher as drought conditions continued to worsen.

Demand was good to very good on mostly light to moderate supplies and active market activity. Compared to the previous week, prices were mostly steady with demand good to very good across Wyoming. Colorado prices were steady with activity and demand good in all classes.

Growers are reporting a decrease in yields compared to last year. Precipitation in certain areas of the state has hindered the process of putting up hay and may cause a shortage in grass hay for the year.

-

Midwest: In Iowa, alfalfa sold mostly $5 lower on varying quality; grass hay sold $5 to $10 lower. In Missouri, hay movement was light, supplies are moderate, demand was light, and prices were steady. Hay market activity slowed in southwest/south-central Kansas with prices mostly steady to slightly higher. In Nebraska, round bale hay sold stronger with all other hay packages on a steady trend. Demand was good for all classes of hay.

In South Dakota, alfalfa and grass hay sold steady to $10 higher. Demand was good for higher-quality alfalfa, with better demand noted for lower-quality cow hay and high-quality grass hay suitable for starting feeder calves. Interest has picked up especially from end-users in the hard-hit drought areas of the state.

Many areas of the state have received varying amounts of rain over the past week; however, for most cattle producers it is too late to save pastures. In Wisconsin, large supplies of lower-quality hay are available. While there is adequate quantity of hay, there is a lack of quality hay in the state. Prices are steady to weaker with lower-quality hay discounted at the market.

Drought area increases

The USDA’s World Agricultural Outlook Board estimated 17 percent of U.S. hay-producing acreage was located in areas experiencing drought as of Aug. 1. Eastern Montana, North Dakota and South Dakota are hardest hit, but the drought area is stretching into major areas of Nebraska and Iowa with additional pockets in north-central Kansas, southeastern Missouri, western Oklahoma and south-central Texas.

Check out the hay areas under drought conditions: U.S. drought monitor

Fuel prices inch upward

Fuel prices moved slightly higher to end July, according to the U.S. Energy Information Administration (EIA). As of July 31, U.S. on-highway diesel fuel prices averaged about $2.53 per gallon, up 2 cents per gallon from a week earlier and up about 18 cents per gallon compared to a year ago. California diesel prices averaged nearly 37 cents per gallon higher than the national average.

The EIA estimated U.S. retail prices for regular gasoline averaged about $2.35 per gallon as of July 31, up about 4 cents from the week before and about 19 cents per gallon more than a year ago.

The EIA’s latest short-term energy outlook projects total U.S. crude oil production to average 9.3 million barrels per day in 2017, up 0.5 million barrels per day from 2016. In 2018, the EIA expects crude oil production to reach an average of 9.9 million barrels per day, which would surpass the previous record of 9.6 million barrels per day set in 1970.

Dairy outlook: Milk production growth slowing

The USDA made further cuts to its 2017-2018 milk production forecasts, even though the number of cows continues to grow. And, while the growth in overall milk production has slowed, there’s been limited impact on pressuring prices higher.

The USDA released its June 2017 Milk Production report on July 20, estimating total U.S. milk production up about 1.6 percent compared to June 2016. It’s the smallest year-over-year increase since July 2016.

Nationally, milk cow numbers increased for nine consecutive months, dating back to last October. However, minimal year-over-year gains in monthly milk output per cow are becoming a recurring theme. Reasons for the declines differ regionally, linked to lower feed quality, heat stress, the lingering effects of a harsh winter, too much or too little rain, or the loss of recombinant bovine somatotropin.

Dairy income margins strengthened over the last half of July due to a combination of higher milk prices and lower feed costs, according to Commodity & Ingredient Hedging LLC. Market analysts were waiting on the USDA’s Crop Production report, Aug. 10, for further price direction. Most traders are expecting declines in yield and production estimates from July for both corn and soybeans.

Beef cattle outlook

The USDA revised beef production estimates for 2017 upward slightly, forecasting higher commercial slaughter in the third and fourth quarters.

CIH said beef margins deteriorated over the second half of July as weaker cattle prices more than offset a decline in corn feed costs. With the exception of the spot August marketing period, cattle finishing margins were back below breakeven through the first half of 2018.

Cattle prices succumbed to pressure after the USDA’s latest monthly Cattle on Feed report, which indicated June feedlot placements well above increases expected by market analysts. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke