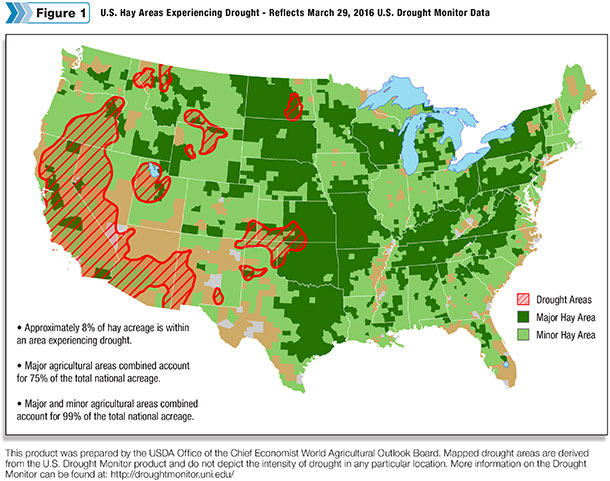

USDA’s latest World Agricultural Outlook Board report provided an update on soil moisture conditions in major and minor hay-producing areas of the United States. As of March 29, about 8 percent of U.S. hay acreage are in areas experiencing drought. Those areas included most of California and portions of Oregon, Utah, Arizona, New Mexico, with pockets in Montana, Wyoming, Kansas, Oklahoma, Texas and Colorado.

Check out the hay areas under drought conditions.

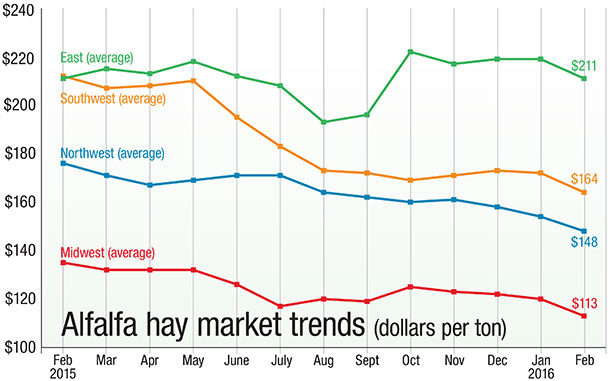

Alfalfa

With few exceptions, alfalfa hay prices continued to trend lower in most major states, according to the USDA National Ag Statistics Service’s monthly Ag Prices report, released March 30.

The February 2016 U.S. average price paid to alfalfa hay producers at the farm level was $142 per ton, down $5 from January and $25 less than a year earlier. Sharpest year-to-year declines were seen in Nevada, down $80 per ton, and Michigan, down $55 per ton. Only Kentucky, Ohio and Missouri reported somewhat higher prices than a year ago.

Some areas still recorded average prices above $200 per ton in February, topped by Kentucky, New York, Pennsylvania and Texas. Lowest reported alfalfa hay prices in February were in North Dakota, Nebraska, Minnesota and Wisconsin.

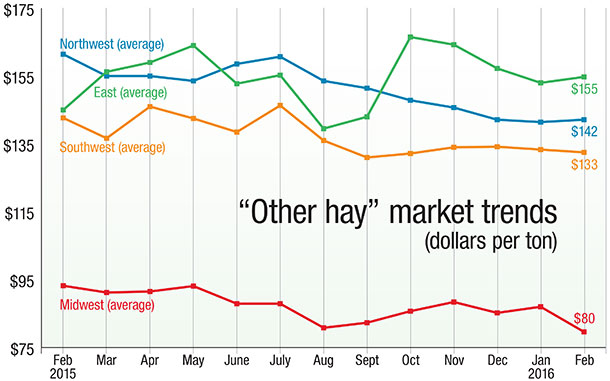

Other hay

In contrast, the U.S. average price for other hay was up $4 per ton, to $125 per ton in February. While Midwest prices were pressured lower, prices in the East were steady to higher.

2016 acreage

U.S. hay producers intend to harvest 54.3 million acres of all hay in 2016, according to the USDA’s annual Prospective Plantings report released March 31. Record-low area harvested for all hay is expected in several major dairy states, including California, Illinois, Indiana, Michigan, New York, Pennsylvania, Vermont and Wisconsin in 2016.

Read Prospective plantings: 2016 hay acreage expected to remain steady.

Dairy outlook

USDA’s March World Ag Supply & Demand Estimates (WASDE) report reduced 2016 U.S. milk production estimates slightly, but projected further milk price erosion, too. The lower milk production forecast is the result of a small decline in cow numbers and slower growth in milk production per cow.

USDA’s latest dairy outlook report forecasts cow numbers will peak in the second quarter of 2016 before starting a slow decline. For the year, cow numbers are projected at 9.305 million head, up 10,000 from the previous forecast, but about 12,000 fewer than 2015.

Milk production per cow is forecast at 22,745 pounds, up about 350 pounds (1.6 percent) from 2015.

At 211.6 billion pounds, 2016 production would be up about 1.4 percent from 2015 revised production estimates.

The projected 2016 all-milk price is $15.25 per hundredweight at the mid-point, down $1.83 from 2015 and down about $8.70 from 2014’s record high of $23.97 per hundredweight.

February average milk income over feed cost margin levels were squeezed to the lowest level since late last summer, but not enough to trigger indemnity payments under the Margin Protection Program for Dairy (MPP-Dairy). Based on current projections by the Program on Dairy Markets and Policy, MPP-Dairy margins could dip below $7.00 per hundredweight in April-May 2016, before trending higher later in the year.

Read: February dairy producer margins tighten, but not enough to trigger MPP-Dairy payment

Foreign impacts

A healthy appetite for alfalfa hay in the Middle East helped boost U.S. exports in January, according to latest estimates from USDA’s Foreign Agriculture Service. However, while up sharply from a year earlier, monthly alfalfa hay exports were still the lowest since September 2015.

January 2016 alfalfa hay exports totaled 151,603 metric tons (MT), up 38 percent from January 2015. Other issues, including the end of West Coast port worker slowdowns resolved in early 2015, likely also factored into the year-over-year export improvement.

China was the top foreign alfalfa hay market for the month, importing 46,260 MT, followed by Japan, at 40,758 MT.

The United Arab Emirates (UAE) and Saudi Arabia posted the largest year-to-year gains.

With the jump in export volume, total value of alfalfa hay exports was also higher, despite lower hay prices. Total alfalfa hay exports were valued at $47.3 million in January 2016, compared to $38.5 million a year ago.

January 2016 U.S. exports of other hay, at 125,048 MT, were up from 111,999 MT in January 2015. Despite the higher volume, lower prices dampened total value. Other hay exports were estimated at $37.1 million in January 2016, compared to $37.8 million in January 2015. Leading markets were Japan and South Korea.

January 2016 exports of alfalfa cubes also posted gains compared to a year earlier.

Two of the largest foreign buyers of U.S. hay, Saudia Arabia and UAE are ramping up hay ground purchases in the U.S., according to multiple published reports.

Saudi Arabia's largest dairy company, Almarai Co., has purchased more than 14,000 acres of cropland in California and Arizona, with plans to grow alfalfa hay for its 170,000 dairy cows back home. In an effort to protect its own water supplies, Saudi Arabia has already banned wheat production, and will phase out all forage production for livestock feed over the next three years.

California-based hay exporter Al Dahra ACX Global Inc., owned by Al Dahra Agriculture Co. of UAE, plans to add 7,500 acres in the U.S. for alfalfa and other crops.

Figures and charts

The prices and information in Alfalfa hay and Other hay market trends are provided by NASS and reflect general price trends and movements. Hay quality, however, was not provided in the NASS reports.

For purposes of this report, states that provided data to NASS were divided into the following regions:

Southwest – Arizona, California, Nevada, New Mexico, Oklahoma, Texas

East – Kentucky, New York, Ohio, Pennsylvania

Northwest – Colorado, Idaho, Montana, Oregon, Utah, Washington, Wyoming

Midwest – Illinois, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, South Dakota, Wisconsin. FG

-

Dave Natzke

- Editor

- Progressive Forage Grower

- Email Dave Natzke